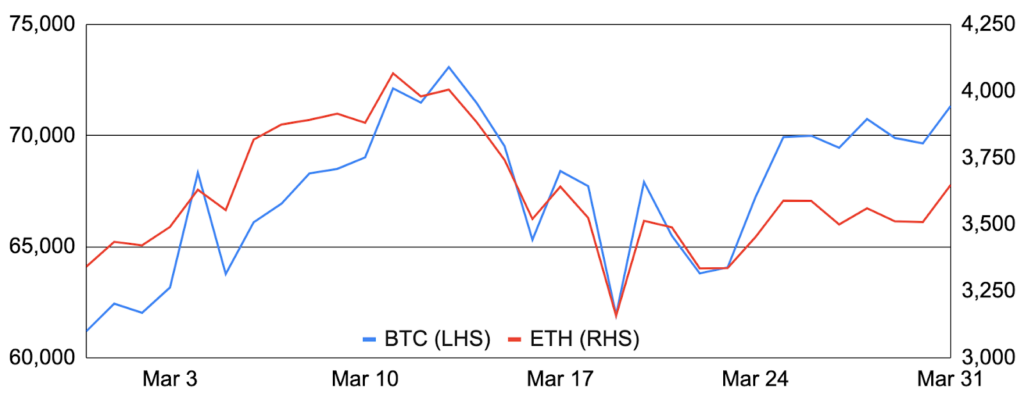

Bitcoin entered March around $61,200 and ended the month at ~$71,300, increasing 17%. While intraday activity was volatile and with heightened liquidations, Bitcoin spent the first two weeks of the month moving higher amidst particularly strong spot Bitcoin ETF inflows that included March 12th’s $1b inflow day. However, prices started moving down mid-month after higher-than-expected inflation readings pushed out Fed rate cut expectations and ETF inflows started to stall, which included March 18th’s net outflow, the first in some time. Bitcoin then spent the rest of the month reacting to macro news, most notably to the Fed maintaining its expectation for three rate cuts this year, and to the spot Bitcoin ETF flows, which improved towards the end of the month. Outside of market activity, there were many notable items during the month. Bitcoin’s hash rate hit a record high, as did Bitcoin futures open interest and Lightning Network’s US dollar capacity. Additionally, the UK’s FCA stated it will permit Bitcoin and Ethereum ETNs, while Japan’s GPIF, the world’s largest pension fund, revealed it was considering investing in Bitcoin. And, a judge ruled that Craig Wright is not Satoshi. Finally, Bitcoin developers united to draft guidelines for BRC-20 tokens, while there were a flurry of L2 developments from many companies including BVM, Velar, Polyhedra, Stacks, and Sovryn.

Ethereum entered February around $3,350 and rose 9% throughout the month to finish around $3,650. While Ethereum largely tracked Bitcoin, the middle part of the month featured a successful Dencun upgrade amidst falling expectations for a near-term approval of the US spot Ethereum ETF applications as well as the reporting of an alleged SEC investigation examining whether ETH is a security, all detailed more below. Notably during the month, the number of validators surpassed 1m, the number of ETH staked surpassed 32m (26% of supply), and restaking continued to gather steam with 4m ETH now restaked. It was also an important month for network security, as Lido’s dominance fell to 30% and Coinbase successfully moved half of its validators from the Geth to Nethermind execution client, helping Geth to move below the critical 66% threshold. There was also news on the core development front, as core devs agreed to include max effective balance in the forthcoming Pectra upgrade, others campaigned to raise the gas limit from 30m to 40m, and talk of changing Ethereum’s emissions model sparked significant debate. Additionally, BlackRock launched its first tokenized fund, BUIDL, on Ethereum, offering US dollar yields to qualified investors. Finally, there were many L2 developments, including Polygon shipping its Napoli upgrade, StarkNet revealing plans for parallel execution, Base seeing surging activity amidst the memecoin frenzy, and Optimism deploying fault proofs on testnet.

BTC and ETH

Source: Santiment, GSR.

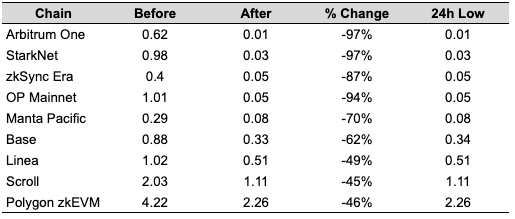

Dencun

Ethereum successfully implemented its Dencun upgrade on March 13th, which featured EIP-4844 (proto-danksharding) and other key EIPs including 1153, 4788, 5656, and 6780. The idea behind 4844 is to materially expand Ethereum’s data availability throughput to make rollups easier/cheaper to use and increase the usage of the Ethereum ecosystem as a whole. To do so, 4844 introduced a new blob-carrying transaction type that allows rollups, which enhance execution throughput while inheriting many underlying security properties by executing transactions off of mainnet and posting data back to optimistically or mathematically prove valid execution, to post such data to Ethereum via data blobs rather than the previously-used call data that persists in history forever. Moreover, data blobs have their own 1559-style fee market for orderly and efficient pricing, and are pruned after 18 days to allow anyone to recreate a rollup’s state while keeping disk use manageable. These factors combine to drastically increase Ethereum’s data availability throughput and lower L2 costs, the majority of which historically were from fees paid for call data. In fact, while some L2s have yet to implement 4844 and items like blobscriptions may distort Dencun’s ultimate impact, many L2s are seeing transaction fees fall by 90% or more since Dencun went live.

Importantly, lower L2 fees is not the only benefit of 4844, as it implemented most of the logic and scaffolding behind full danksharding, Ethereum’s long-term approach to scaling. Thus, 4844 sets the stage for further scaling, whether from increasing the number of blobs per block, PeerDAS, or full danksharding. All in, the Dencun upgrade was the most complex fork since The Merge and was a resounding success. For more information, see here for our Ethereum Roadmap report, here for a 4844 explainer video, here for a blob explorer, and here for more info about individual L2 data availability layers.

L2 Daily Average Fees – Before and After Dencun

Source: OKLink, GSR. Note: The pre-upgrade fees reflect the average transaction fee on Mar 13, 2024. Post-upgrade fees reflect the average transaction fee in the last 24 hours. Changes are influenced by the respective chain’s support for EIP-4844 and the blob fee mechanism. Data as of April 3.

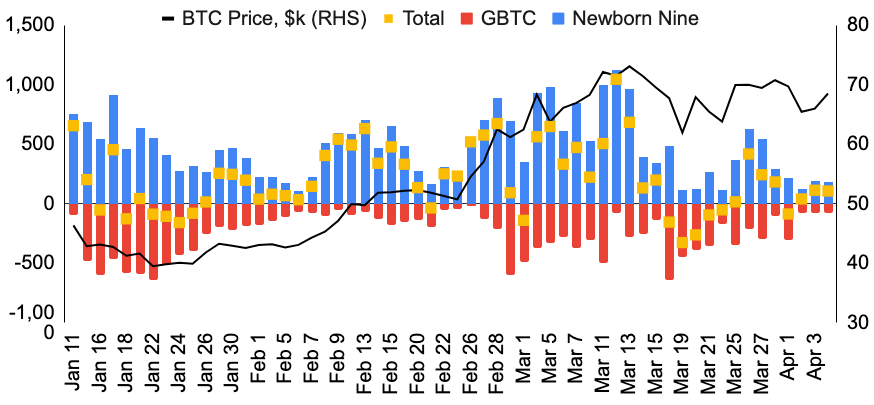

ETF Updates

ETF activity continues to dominate price action, especially for Bitcoin where flows have proven more volatile of late. In fact, the spot Bitcoin ETFs had negative daily flows every day two weeks ago due to both subdued Newborn Nine inflows (there are actually ten now given Hashdex’s conversion to a spot ETF) as well as elevated GBTC outflows. On the former, whether from IBIT’s small $13,000 average purchase size or from anecdotal evidence from wealth managers, inflows into the Newborn Nine now appear to be more retail-driven, suggesting they may be more volatile and impacted by price than their prior, more consistent flow performance would suggest. However, it seems as if the market has a greater appreciation of this with a lower correlation between flows and price, and the long-term wealth management opportunity is just as strong as ever. And regarding GBTC outflows, many believe the elevated outflows of the last month were due to Genesis that may now be done, and there is further hope outflows will ebb from Grayscale’s eventual “mini” Bitcoin ETF spinout, the potential for lower GBTC fees, and simply getting through all potential sellers at some point.

Meanwhile, there has been little movement related to the spot Ethereum ETF applications. Specifically, there has reportedly been little engagement by the SEC with the issuers thus far, particularly compared to the amount we had seen at this point with the spot Bitcoin ETFs. In addition, there is at least some political pressure to deny the applications, exemplified by a recent letter sent to SEC Chair Gensler by two Senators asking him not to approve any additional digital asset ETFs. Lastly, there are reports that the SEC is investigating whether Ethereum is a security, which many have speculated the mere presence of the investigation could enable the SEC to deny the ETFs while avoiding a correlation-based argument that would prove temporary as well as the collateral damage that outright naming ETH as a security would likely cause. At any rate, odds of a near-term approval continue to fall, whether from Polymarket, which assigns just a 19% chance of approval, or from the Grayscale Ethereum Trust’s discount to NAV, which widened from 10% at the beginning of March to 23% by the end.

US Spot Bitcoin ETF Inflows

Source: BitMEX Research, Santiment, GSR.

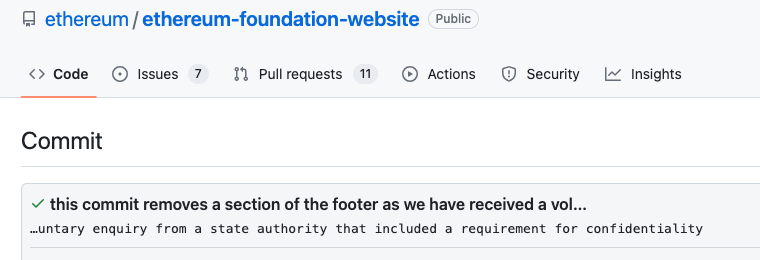

US Regulators Remain Active

It was a busy month for US regulators who remain active on the crypto front. Most notably, several media outlets reported that various crypto firms received subpoenas from the SEC related to Ethereum, indicating the SEC has launched an official investigation, though details remain murky. Nevertheless, according to Fortune, the SEC is waging a “legal campaign to classify Ethereum…as a security” and began investigating the Ethereum Foundation in September 2022 after Ethereum switched to proof-of-stake, “providing the SEC with a new pretext to attempt to define Ethereum as a security.” While many have shared myriad reasons why ETH is not a security and others have suggested the SEC may be looking into whether sales of ETH constituted an investment contract, a small but important difference, it would clearly have far-reaching implications on the spot and futures markets as well as for other tokens’ status as securities should the SEC be successful in its alleged quest.

Elsewhere, we got an update in the SEC’s case against Coinbase, where Judge Katherine Polk Failla denied most of Coinbase’s efforts to dismiss the SEC’s lawsuit against the exchange. While some believed that the SEC’s case would be dismissed, Judge Failla ruled that the SEC sufficiently pleaded that Coinbase operates as a clearing agency, broker, and exchange under federal law. In a partial win for Coinbase, however, the judge granted the exchange’s claims that it does not act as an unregistered broker when offering its wallet service – a move being seen as a big win for DeFi. Both sides will now prepare a proposed case management plan as the bulk of the SEC’s case heads to discovery.

Also notable during the month, the SEC asked a New York judge to impose a ~$2b fine against Ripple Labs for unregistered XRP sales over the past three years. In addition, the SEC settled with ShapeShift regarding allegations the exchange sold unregistered securities, and it settled with Genesis Global for charges relating to Gemini Earn. And lastly, the SEC was sanctioned by a court for “gross abuse of power” and “bad faith conduct” in its action against Debt Box.

Finally, the US Department of Justice charged KuCoin and two of its founders for conspiring to operate an unlicensed money-transmitting business and conspiring to violate the Bank Secrecy Act, while the CFTC sued KuCoin for operating as an illegal digital asset derivatives exchange. Perhaps most notably, however, the CFTC reiterated in its suit that Bitcoin, Ethereum, and Litecoin are commodities, a statement potentially partially at odds with the SEC’s position.

Ethereum Foundation GitHub Commit Disclosing an Enquiry from a State Authority

Source: github.com, GSR.

Memecoins and AI, Oh My!

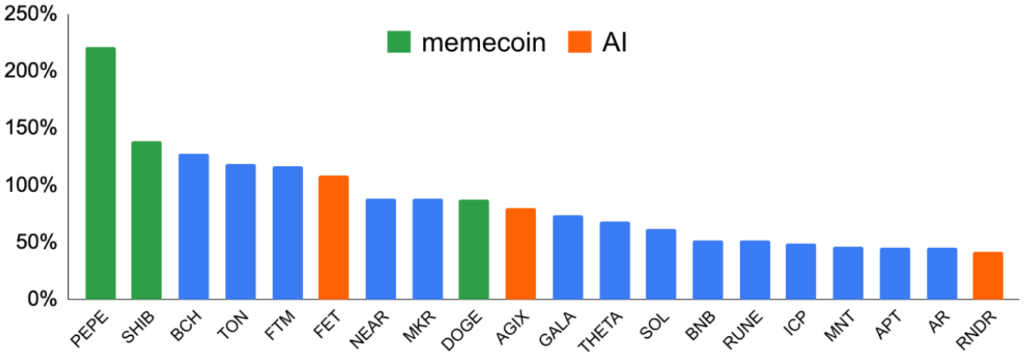

Arguably the most important development in the history of blockchain technology – nay, mankind – or at the very least, one of the most fun has been the acceleration of the memecoin frenzy. Indeed, mainstays like Dogecoin, Shiba Inu, and Pepe each returned ~90%+ in March, while several popular, smaller memecoins increased many times over, including Brett (79x), Degen (52x), BOOK OF MEME (8x), dogwifhat (6x), Jeo Boden (5x), and cat in a dogs world (4x). While there was certainly “fundamental” news during the month, such as dogwifhat’s Binance listing and Vegas Sphere fundraise, Floki’s token burn and plans for regulated bank accounts, Elon Musk’s pondering of Dogecoin-enabled Tesla purchases and investor hopes for a Dogecoin ETF, the pump has undoubtedly been due to speculation, exemplified by traders pouring over $100m into Solana-based memecoins over a single weekend. So active has the craze been that Solana and Base, the two high-throughput blockchains seeing the majority of the action, saw higher fees and network congestion because of it.

AI related tokens also performed particularly well during the month, likely helped by Nvidia’s 14% rise, the general solid crypto backdrop, and several notable web3 AI news items. Chief among these was a proposal to merge from Fetch.ai, SingularityNET, and Ocean Protocol into a vertically integrated Superintelligence Alliance. The Alliance, if approved, will take advantage of Fetch.ai’s autonomous AI agents and blockchain infrastructure, SingularityNET’s AI development and integration capabilities, and Ocean’s data sharing and monetization capabilities to target Artificial Superintelligence where AI systems perform far beyond human capabilities and operate with the sum of all human knowledge. Outside of the merger announcement, Fetch.ai announced a $100m infrastructure investment, Bittensor subnet registration costs increased by 10,000% amidst the hype, USDT issuer Tether announced an AI push, and NEAR presented at Nvidia’s annual AI conference and is close to releasing NEAR Tasks. Lastly, protocols that can be leveraged for AI applications also got a boost, such as The Graph with its unique data and indexing capabilities and Arweave, which released its AO hyper-parallel computer on testnet in late February.

Top Performing Tokens, March 2024

Source: Santiment, GSR. Note: Shows top 20 performers for the month out of the top 100 tokens by market cap as of the beginning of the month.

GSR in the News

- Bloomberg – Singapore Licenses Crypto Market Maker GSR in Rare Step for Industry

- Businesswire – GSR Obtains Major Payment Institution Licence from Monetary Authority of Singapore

- CoinDesk – Crypto Market Maker GSR Recieves Singapore Crypto License

- Cointelegraph – Crypto liquidity firm GSR secures MPI license in Singapore

- The Block – GSR markets granted ‘major payment institution’ license in Singapore

- PYMNTS – Singapore Licenses Crypto Platform GSR Markets

- Business Insider – Crypto Market Maker GSR Recieves Singapore Crypto License

- CoinGape – Singapore Sets Precedent with Licensing of Crypto Market Maker GSR Markets

- Crypto News – GSR Markets secures license in Singapore to offer OTC services

- Blockhead – Singapore Grants License to Crypto Market Maker GSR, Signaling a Progressive Shift

- CryptoHead – Singapore Says Yes to GSR: A New Era for Crypto Market Making?

- Coinspeaker – GSR Markets Bags Major Payments License in Singapore

- Crypto Times – GSR Secures Major Payment Institution License in Singapore

- Coinjournal – GSR Markets gets Major Payment Institution license from the MAS

- CoinSpeaker – GSR Markets Bags Major Payments License In Singapore

- Washington Post – Bitcoin hits record, breaking pandemic-fueled 2021 mark

- The Block – Ether spot ETF’s chance of May approval dropped to 20% by GSR

- The Block – Spot bitcoin ETFs have been an ‘absurd’ success and blown away expectations

- The Block – D2X crypto derivatives trading platform raises $10 million in Series A fundraise

- Finextra – Institutional players back digital asset clearing house ClearToken

- Bloomberg – Bitcoin Faces ‘Sell-the-News’ Moment After Record High Set

- Crypto news – ClearToken Receives Over $10M Investment From Nomura’s Laser Digital, Flow Traders and GSR

- Coindesk – ClearToken Raises $10M From Institutional Investors Including Nomura’s Laser Digital

- The Block – Modular blockchain developer 0G Labs raises $35 million in pre-seed funding

- Blockworks – 0G Labs raises $35M for data availability

- Business Insider – Bitcoin’s halving is unlike others before it: A supply shock colliding with a demand tidal wave

- The Block – When it comes to bitcoin’s price, ETF inflows are only part of the picture

- The Block – Bloomberg analysts substantially lower likelihood of spot Ethereum ETF approval in May to 30%

- DL News – Surging dollar supply will teach bankers that Bitcoin isn’t just for speculation, say macro analysts

- DL News – As Bitcoin hits second all-time high in a week investors wonder when altcoins will follow suit

Author:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.