Bitcoin and Ethereum

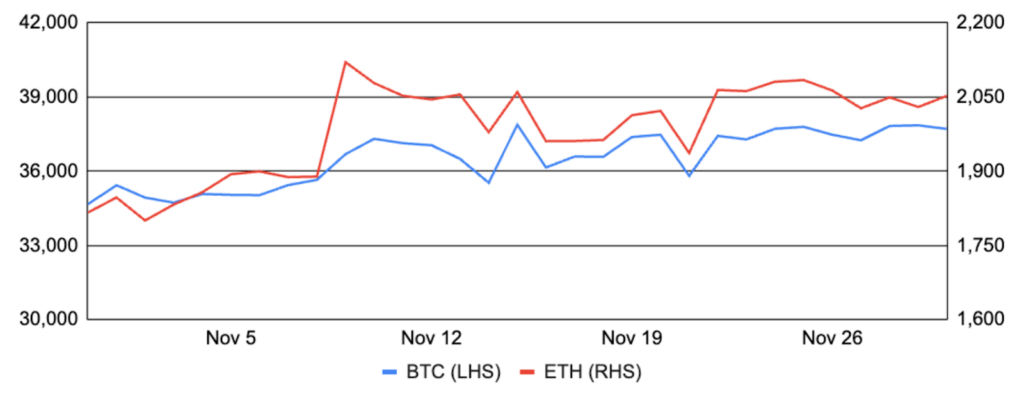

Bitcoin gained ~9% during November after entering the month around $34,700 and finishing at ~$37,700. Prices rallied during the first third of the month, with the local peak following BlackRock’s spot Ethereum ETF filing on the 9th. Bitcoin generally trended sideways during the middle-third of the month but resumed the uptrend after Binance settled with the US Department of Justice, discussed more below. Bitcoin dominance dipped during the month as investors moved out further on the risk spectrum and bolstered the altcoin market. Indeed, the demand for risk extended beyond crypto markets, and equities returned their best month of the year despite their correlation to crypto markets retracing into negative territory. The month featured a resurgence in Ordinals and BRC-20 activity after Binance listed ORDI, the first-ever BRC-20 token, which gained ~230% during the month and has since doubled again so far in early December. There were also several new mining pools, like DEMAND and OCEAN that came online during the month, discussed more below. Elsewhere, MicroStrategy acquired 16,130 bitcoin for ~$593m; Tether unveiled a ~$500m expansion into the Bitcoin mining industry; Mt. Gox’s trustee confirmed that creditor repayments will begin in 2023 and extend into next year; and, Javier Milei, a Bitcoin proponent and outspoken critic of Argentina’s central bank, was elected to serve as the country’s next President.

After lagging bitcoin routinely for several months, Ethereum reversed course and outperformed in November, gaining ~13% after entering the month around $1,820 and finishing at $2,050. The month’s outperformance stemmed from BlackRock’s spot ETH ETF filing and the ~12% one-day return that came alongside it. From a fundamental lens, ETH supply deviated from its recent inflationary trend and net supply fell by 32,000, its largest decline since May. November was packed with new staking announcements and project launches, headlined by the unveiling of the “layer 2” Blast that offers native yield and the much anticipated launch of StakeWise v3, covered more below. In the Layer 2 ecosystem, OKX revealed plans to launch its own zkEVM Layer 2 leveraging Polygon’s tech stack, joining the likes of Coinbase (Base), ConsenSys (Linea), and Bybit (Mantle) with affiliated L2s. Kraken is also reportedly searching for a tech partner to deploy an L2, and Celo proposed a framework for selecting amongst the L2 tech providers ahead of its migration. In other Ethereum news: Starknet confirmed an airdrop is coming but noted the eligibility snapshot was already taken; Polygon and NEAR are developing a zkWASM prover that’ll enable WASM-based blockchains (e.g., NEAR, Polkadot, Internet Computer) to better integrate with Ethereum; Coinbase rolled out onchain credential verification leveraging the Ethereum Attestation Service; a white hat security report disclosed a vulnerability at Lido node operator InfStones that could’ve been exploited for ~1.2% of all staked ETH; and, a mysterious address holding 250k ETH (~$560m) that’s been dormant since the 2014 presale was confirmed to have belonged to LHV Bank founder Rain Lohmus but has since been lost.

BTC and ETH

Source: Santiment, GSR.

Binance Settles with the US Department of Justice

The big news of the month was Binance’s settlement with the US Department of Justice, where the exchange admitted to anti-money laundering, unlicensed money transmitting, and sanctions violations. Binance also reached agreements with the CFTC, FinCEN, and OFAC. Under the terms of the agreement, Binance will pay $4.3b in penalties and forfeiture, completely exit the US, and retain an independent compliance monitor for three years. Further, CZ pled guilty to violating the Bank Secrecy Act and will be sentenced in February. He further stepped down from his position as CEO and is prohibited from having any involvement in Binance for three years. Richard Teng, who was Binance’s regional markets head and formerly an Abu Dhabi regulator, was appointed in CZ’s place. While the news was initially seen as negative, with BNB immediately falling 13% after the announcement, many commentators eventually proclaimed the settlement was a positive for crypto, as it removes one of the larger negative industry overhangs and additionally offers Binance a fresh start.

Binance Plea Agreement

Source: Department of Justice, GSR.

ETF Developments

While BlackRock’s filing for the iShares Ethereum Trust was the most notable market moving event, November also featured several other tidbits of information that suggest a spot Bitcoin ETF approval may come in January. The consensus view is that if approval comes, the SEC will promote free-market competition and approve several applications simultaneously as they did recently with the Ethereum Futures ETFs.1 Bearing this assumption in mind, the SEC delayed Hashdex and Franklin’s spot Bitcoin ETF applications last week, but its decision came uncharacteristically early, about one month ahead of the actual deadline. The most probable theory is that the SEC intentionally delayed these applications early to open a window from January 6th to January 10th where all outstanding applications will fall outside of the SEC’s comment window, presenting an opportunity for the SEC to approve each application simultaneously without granting one issuer a first-to-market advantage. Aligning such a window would be unnecessary for a denial as no implications of favoritism arise for denying one issuer first (i.e., if the SEC were to deny, they’d likely deny each ETF around their respective decision dates). Beyond this speculative reading of the tea leaves, multiple accounts demonstrate ongoing dialogue between the SEC and issuers about the operational mechanics (i.e., in-kind vs. cash creations), further inspiring confidence that a positive decision could be on the horizon. While this theory has gained acceptance amongst many prominent industry analysts, it’s important to reiterate that approval is by no means guaranteed. However, we’ll know with certainty by January 10th, and most likely on the 8th-10th as the decision will not come over a weekend.

SEC’s Early Delayal of Franklin’s Spot Bitcoin ETF

Source: Twitter, GSR.

Staking Ecosystem Developments

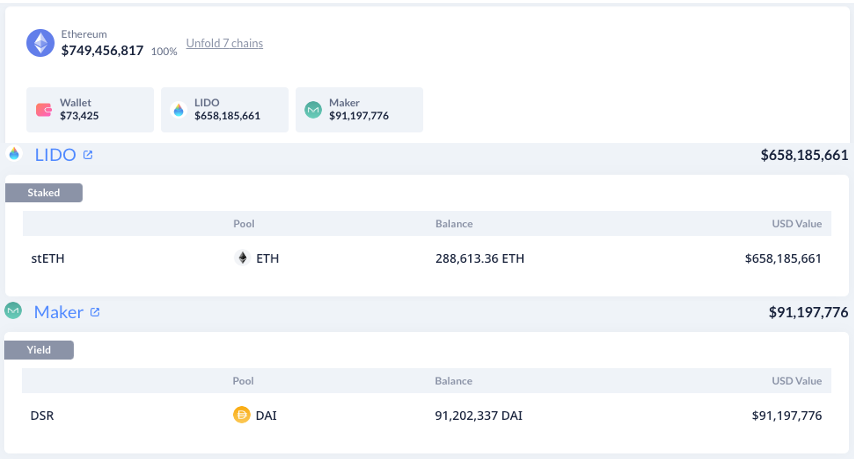

On November 20, the founder of the NFT marketplace Blur launched Blast, a new Ethereum “Layer 2” offering native yield on ETH and stablecoins. Blast’s simple idea is to stake assets bridged to the network on users’ behalf, predominantly through Lido’s stETH (~$658m) and Maker’s Dai Savings Rate (~$91m). However, the project has been criticized for a number of reasons. First, Blast does not exist as an L2 today, but rather as a one-way deposit vault secured by a 3-of-5 multisig with anonymous signers. In addition, Blast utilized an influencer-heavy marketing campaign offering ponzinomic referral incentives with promises of an airdrop to spur deposits. Lastly, Blast’s predominant use of Lido as its staking provider of choice has exacerbated stake concentration concerns. Speculation and yield, at least so far, have won out over these criticisms, as Blast has attracted $750m of deposits and single-handedly flipped all of Solana’s TVL. We’d encourage interested readers seeking a deeper dive to check out this thread.

The month also featured the launch of StakeWise V3, a potential counterbalancing force to Lido’s indirect stake accumulation via Blast. About two years in the making, StakeWise v3 joined Rocket Pool becoming the second decentralized staking protocol that’s entirely permissionless on Ethereum. StakeWise v3 introduces a modular staking marketplace that gives stakers optionality to selectively delegate their stake according to their individual preferences. More specifically, it allows anybody to permissionlessly create their own staking vault or pool that stakers can delegate to, and each vault is a unique smart contract with segregated deposits and rewards with bespoke terms uniquely configured by the vault’s deployer. Operators can deploy vaults with custom features, including the node operator(s) managing it, infrastructure details (e.g., geography, client mix, redundancy, DVT, MEV usage, etc.), insurance, fees, or even private vaults with negotiated terms for large stakers. Private vaults also enable solo stakers to mint liquidity against their otherwise illiquid operator stake in the form of StakeWise’s osETH liquid staking token, and this example can be extended to staking-as-a-service operations more generally. Put simply, StakeWise v3 provides an infrastructure layer simplifying the complexities of staking-as-a-service and liquid staking that enables anybody managing a node to seamlessly sell trustless, non-custodial liquid staking services. In fact, many Lido node operators have launched their own StakeWise vault on the side that allows stakers to delegate to them directly and without Lido’s cut of fees (examples here, here, here, and here).

Elsewhere in the staking ecosystem, ether.fi’s eETH LST went live on mainnet, Mantle unveiled its mETH LST, and Octant announced a collaboration with Diva Staking, committing up to 100k ETH to the protocol to bolster the staking ecosystem’s health while funding public goods.

Blast’s Deposit Contract Assets

Source: StakeWise, GSR.

Centralization Tradeoffs in Bitcoin Mining

To smooth out revenue and reduce the impact of luck, miners commonly opt-in to mining pools. Such pools enable miners to combine compute resources to mine blocks together as a group, sharing processing power over a network and splitting the rewards based on each miners’ contribution to the pool. Typically, the mining pool operator creates the block template that miners in the pool seek to find a valid proof-of-work for, and then block rewards and transaction fees accrue to the pool operator who distributes them to the pool constituents. Such an approach, however, introduces a custodial trust relationship between the miners and the pool operator, and it weakens Bitcoin’s censorship resistance by concentrating block creation with the pool operator instead of the individual miners (i.e., miners have no say on what transactions go into blocks). In fact, such concerns came to the fore this month after F2Pool acknowledged it was filtering out OFAC transactions from the block templates in its pool. To tackle these issues, several new pools went live during the month.

DEMAND launched the first Stratum v2 mining pool that empowers individual miners to build their own block templates, reducing centralization risks versus the current model controlled by pool operators. Notably, DEMAND is not a mining pool in the typical sense today, as it only allows solo miners and it isn’t smoothing out variance across them. However, it does offer a hashrate marketplace integration that enables miners to sell their hashrate that similarly mitigates variance implications, albeit in a different fashion. Moreover, DEMAND has plans to launch a more typical pooled mining service in the near future.

The non-custodial OCEAN mining pool also went live, touting its ability to pay block rewards directly to miners instead of being passed through from the pool operator. The OCEAN pool was built by the ‘maxi’ faction of the Bitcoin community, and unlike with DEMAND, the pool creates the block templates and applies an opinionated view in doing so, filtering out inscription transactions, which it deems as “spam.” However, filtering out lucrative inscription transactions from blocks led to about 5-10% lower fees over one observation window.

OCEAN’s Transaction Filtering

Source: Twitter, GSR.

Footnotes:

- When Bitcoin Futures ETFs were considered for approval in 2021, the SEC allowed applications to go effective automatically at their respective deadline dates under Rule 485(a). This allowed ProShares, who sat at the front of the review queue, to be the first to enter the Bitcoin Futures ETF market before any other competitors were approved to launch, which allowed them to raise ~$1b more AUM than anyone that was subsequently approved after them. This approach was generally viewed as a mistake in hindsight, and the SEC took steps to enable a more fair launch for Ethereum Futures ETFs this year, and we anticipate they’ll do the same for spot Bitcoin ETF.

GSR in the news

- Fortune – Bitcoin approaches $38,000 and Ethereum crosses $2,000 as ETF fever continues to buoy the crypto market

- Straits Times – Bitcoin’s ETF momentum is spurring the biggest monthly gains since January

- The Block – Crypto derivatives protocol MYX raises $5 million in seed round led by HongShan

- Yahoo! Fiance – Bitcoin approaches $38,000 and Ethereum crosses $2,000 as ETF fever continues to buoy the crypto market

- Bloomberg – DeFi Rates Signal Rising Leverage in Crypto as Ripple (XRP) Leads Alt-Coin Rally

- Forbes – Why SBF’s Favorite Crypto, Solana, Has Doubled Since September

- Blockworks – CeFi is making the DeFi jump. Will it work?

- CoinDesk TV – Fed Likely to Be Most Dovish Central Bank in 2024, Research Shows

- Forbes – Are DeFis High Yields on Stablecoins Worth the Risk?

Authors:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

View November 2023 Market Update

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.