The following dives into the growing discussion around Lido’s staking dominance and its implications for Ethereum. We’d recommend unfamiliar readers begin with our Guide to Ethereum Staking.

Overview of Ethereum Staking and Lido’s Role

Participants in Ethereum’s proof-of-stake consensus are known as validators, which must run full nodes and stake (i.e., lock) 32 ETH in the Beacon Chain, proposing a new block when chosen to do so or attesting to the validity of a proposed block when not selected. Validators receive staking rewards for performing this work in a timely fashion, and they may also be financially penalized if they perform their responsibilities poorly or even have their stake slashed and be removed from the network if they behave maliciously.

The distinction between a node operator and a validator is a common source of confusion. Node operators are the individuals managing servers and running their selection of Ethereum client software to track the chain and validate blocks, and anyone can run a full node without depositing the 32 ETH required to stake. Validators similarly require a full node to track the chain but also must deposit 32 ETH to activate a unique validator key pair that is used to sign block proposals and attestations on behalf of its stake (i.e., vote on its view of the chain).1 More precisely, a validator specifically refers to the key pair generated for a particular 32 ETH deposit, so large stakers need to activate many validators to effectively stake their ETH. But since a single node operator can manage many validator key pairs, the total number of validators in existence says little about the network’s decentralization properties as it could be a single operator managing them (i.e., Lido, a liquid staking solution for Ethereum, has ~275,000 validators divided across 37 node operators, while Coinbase has unilateral control over ~120,000 validators).

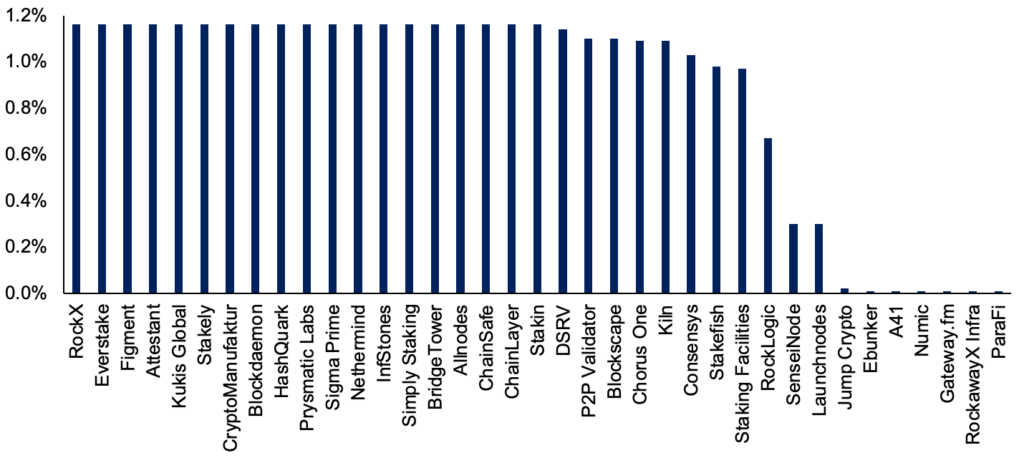

Lido’s Stake (~32%) Distribution Across Node Operators

Source: Rated, GSR. Data as of October 18, 2023. Note: Lido aims to equally distribute stake amongst its independent node operators. New Lido staking inflows accrue to the smallest node operator until stake parity is achieved, but there’s a wide dispersion of stake today as Lido just approved seven new node operators earlier in October. Lido’s largest node operators each manage ~1.15% of ETH’s stake, a small fraction of Coinbase (14%), Figment (5%), and Binance (4%).

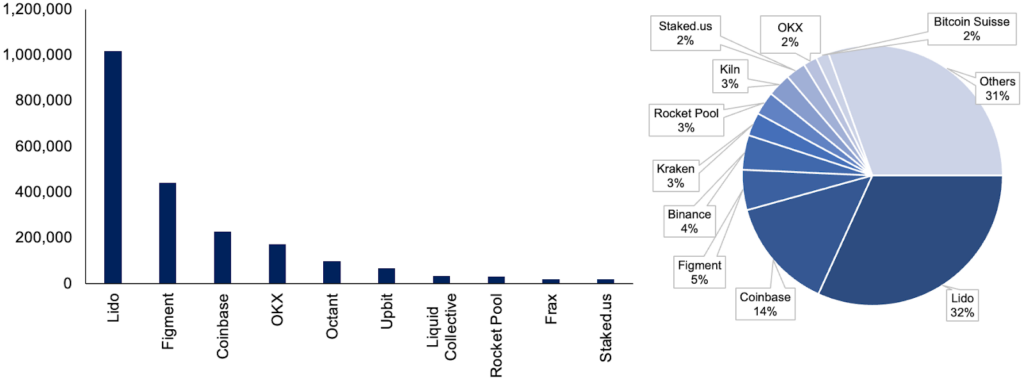

Lastly, unlike most competing proof-of-stake chains, Ethereum does not have a mechanism to delegate stake to node operators built into the protocol, so the only way to stake directly in-protocol requires the laborious work of maintaining a node and forgoing liquidity on 32 ETH. Projects such as Lido and others have emerged to meet this need by laying the infrastructure via smart contracts to facilitate the delegation of stake (i.e., the ability for ETH holders to give their ETH to a node operator to stake on their behalf in exchange for a small fee). Lido works by taking user deposits and pooling them together in 32 ETH batches, enabling individuals to stake any amount of ETH, and it outsources the burdensome node management responsibilities to a diversified set of third-party node operators whitelisted by Lido DAO. Lastly, Lido gives depositors its stETH liquid staking token (LST) that serves as a receipt of deposit and provides a fungible claim on the ETH staked through Lido. stETH accrues staking rewards daily, and unlike ETH staked natively on the Beacon Chain, it’s highly liquid and may be freely used for other purposes, such as for collateral to borrow funds or to provide liquidity to a decentralized exchange. In short, Lido abstracts away nearly every painful aspect of staking and enables staked ETH to be freely used while earning staking rewards in exchange for a 10% share of the rewards (5% to node operators and 5% to the Lido DAO). In fact, Lido has been so successful that it’s captured more than twice the market share of its nearest competitor and still attracts the lion’s share of new inflows today.

Net Staked ETH Inflows Last 3 Months (LHS) / Staked ETH Market Share (RHS)

Source: Hildobby, GSR. Data as of October 18, 2023. Note: Many of Lido’s closest competitors are centralized exchanges and institutional staking service providers that are even more centralized and opaque with their setup.

Lido’s Growth & Encroachment on Key Consensus Thresholds

Lido’s success has led it to capture 32% of all staked ETH, encroaching on Ethereum’s first major consensus threshold and causing consternation for some. The implications of a breach in Lido’s case are unclear, though. While Lido’s stake is distributed across a diversified set of third-party node operators, Lido governance maintains curation power over the approved operator list. In the more simple case of a monolithic staking entity, breaching such thresholds would grant the offending entity certain unilateral powers over Ethereum’s consensus:2

- >33% – A party controlling >1/3rd of stake could unilaterally inhibit Ethereum’s finality. The attack would be temporary and the length would depend on the amount of the attacker’s stake as Ethereum’s inactivity leak would eventually penalize the attacker enough for the chain to finalize again (i.e., the honest majority would reclaim 2/3rds stake as the attacker’s stake is penalized).

- >50% – A party controlling >1/2 of stake could censor transactions and perform short-term reorganizations of the chain (i.e., a 51% attack). This would be an attack on Ethereum’s fork choice rule, and it could be theoretically abused for harmful MEV extraction amongst other things.

- >67% – A party controlling >2/3rd of stake could finalize their preferred chain without any consideration for the votes of other stakers. They could also revert finalized blocks but would be slashed in doing so.

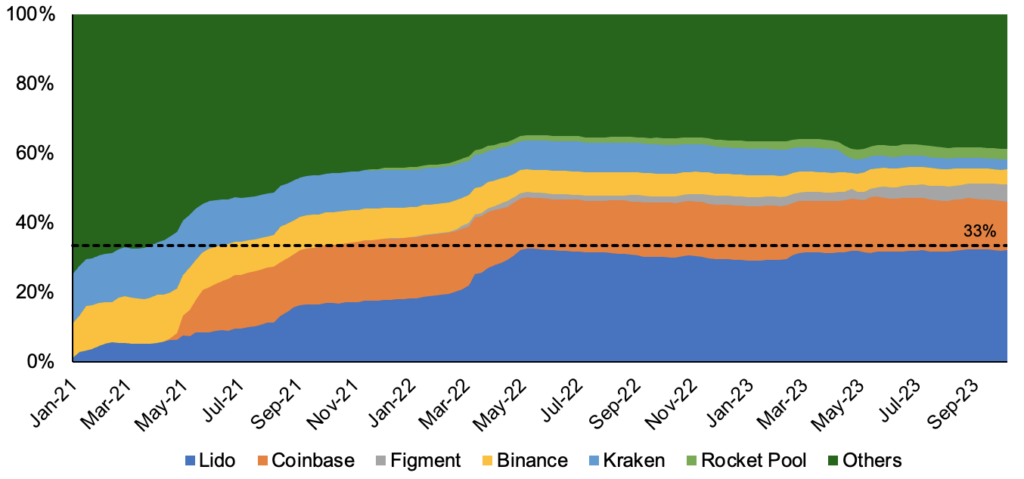

Staking Market Share Through Time

Source: Hildobby, GSR. Data as of October 18, 2023. Note: The ‘Others’ bucket is the sum of all other stakers (e.g., other liquid staking protocols, staking-as-a-service providers, solo stakers, etc.). While Lido continues to capture the greatest amount of new staking inflows on an absolute basis, its market share has remained nearly steady for the last ~18 months.

Lido has resultantly been chastised for approaching this important consensus threshold and neglecting to self-limit its growth in a display of protection for Ethereum, a move made by several competing providers.3 Additionally, core voices within Lido believe liquid staking is a winner-take-all or winner-take-most market, and Lido has been vocal about its ongoing growth plans to minimize the risk of being supplanted by a more centralized competitor, like a centralized exchange.

Indeed, Lido has many tailwinds in its favor that may help it maintain its rapid growth. As the most tenured LST, Lido’s stETH is highly trusted by users (i.e., a strong Lindy effect), and it also boasts the lowest fees, highest liquidity, and largest set of DeFi integrations. Additionally, Lido has benefited from other centralizing forces relative to more decentralized liquid staking providers, but further context is needed on this final point.

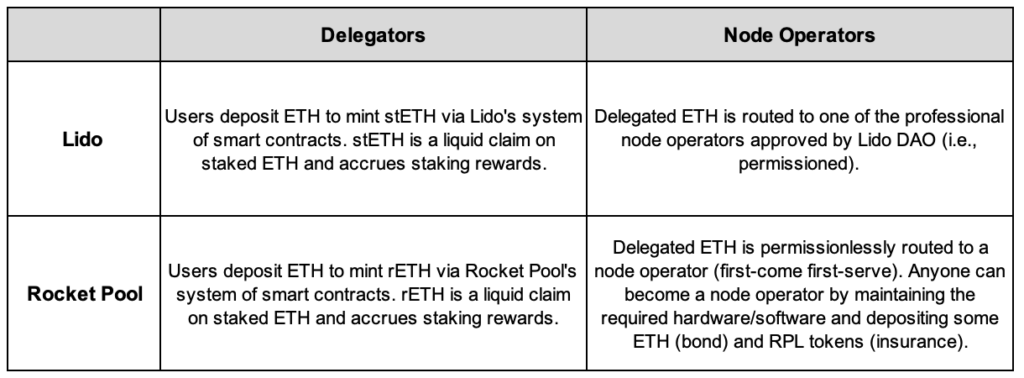

The liquid staking landscape can be simplified into two segments today, those with and without permissionless node operator participation. Take Lido and Rocket Pool, the two largest liquid staking providers, for example. Rocket Pool allows anyone to become a node operator and create a validator by depositing 8 ETH of their own to be paired with 24 ETH from staker deposits (i.e., rETH holders). But since Rocket Pool node operators are not trusted or permissioned professionals like Lido’s, they must also post an insurance bond equal to 10% of the borrowed ETH in RPL tokens (i.e., 2.4 ETH of RPL insurance + 8 ETH bond = 10.4 ETH per validator). This bond is a key point of distinction versus Lido node operators who are trusted to manage validators funded entirely from user deposits without risking any stake of their own. This poses a type of principal-agent problem as Lido node operators could intentionally slash the delegated stake without losing their own capital, although the loss of future Lido revenues alongside other potential legal implications incentivizes good behavior.4

The Liquid Staking Status Quo: Permissioned or Permissionless Node Operators

Source: GSR.

While Lido intends to improve its decentralization with distributed validator and permissionless node operator modules in the future, its more centralized starting point has been advantageous in achieving early scale versus peers as users can instantaneously mint an uncapped amount of stETH. In other words, growth is only constrained by demand for stETH. Conversely, Rocket Pool’s growth can be limited by either rETH demand or node operator supply, and historically there hasn’t been enough node operators to support the demand from stakers. Since Rocket Pool requires at least 10.4 ETH-equivalent of node operator capital for every 24 ETH of staker demand, its deposit pool is regularly filled to capacity and new rETH cannot be minted until more node operator deposits come in. This is a fundamental scaling challenge that arises when participation is permissionless and safety cannot be assumed based on a trust relationship.

Beyond those previously mentioned, there are several additional competitive advantages of operating at Lido’s scale, including compounding daily rewards into new validators and smoothing rare high MEV lottery blocks. Moreover, Lido had a temporary, yet meaningful advantage in optics for much of this year after withdrawals were enabled and the demand to stake ballooned the validator activation queue from days into months. Projects that were gaining momentum and briefly taking market share had a larger percentage of their stake waiting in the activation queue, which diluted their LST’s rewards versus stETH and may have hampered their growth.5

Overall, Lido has achieved tremendous growth fueled, in large part, by centralization tradeoffs it deemed necessary to scale, such as its permissioned node operators. Lido proponents argue the design choice was necessary to ensure the staking market wasn’t captured by even more centralized actors, like exchanges. But Lido still benefits from many of the centralizing forces of scale (e.g., lowest fees, highest liquidity, most DeFi integrations), and stETH remains in massive demand today and poses risks perhaps best categorized as a ‘tragedy of the commons’ problem. stETH is an excellent product, arguably the best LST from the lens of myopically profit-motivated users. Usage of stETH is individually rational for such users, but it becomes worse for the populace in aggregate as overreliance erodes Ethereum’s value proposition as a permissionless, censorship resistant, and neutral platform for applications.

The Lido Debate Further Contextualized

Ethereum Foundation researcher Danny Ryan is arguably the most notable Lido critic, authoring a prominent warning last year and reiterating his concerns more recently, calling Lido and its VC-controlled governance token a systemic threat to Ethereum. Conversely, others have argued that Lido’s emergent success is a failure of Ethereum’s incentives, and such incentives should be fixed rather than chastising a profit-maximizing actor’s response to those incentives. Ethereum Foundation researcher Dankrad Feist penned an elegant rebuttal, arguing perfect alignment is impossible “for the simple reason that centralized systems are more efficient than decentralized ones.” Ultimately, the debate reduces to a highly nuanced discussion around Ethereum community values and its social contract, which is not clearly defined with respect to stake centralization, particularly in multi-operator setup like Lido’s. Heading into the Merge it was clear that hard censorship (i.e., validators stop recognizing the validity of blocks with sanctioned transactions and preventing them from ever executing) was an obvious violation of Ethereum’s social contract (e.g., it’d even require running a client with modified validity rules) and drastic defense mechanisms, like social slashing, were prematurely raised to discourage potential offenders. No equivalent community understanding exists for stake centralization, however, and Ethereum would deservingly lose much of its credibility as a neutral platform if similarly severe social interventions were considered in response to Lido’s free-market success that followed in accordance with the protocol rules.6 Still, today’s state of affairs is precarious and several Ethereum researchers have been delving into the potential of enshrining delegation into the protocol in an effort to minimize centralization risks.7

While the renewed discussions have raised many valid Lido concerns, many critiques have also been overly dogmatic and fail to capture nuance. In our view, much of the real concern stems from Lido’s cavalier approach towards growth and capturing the liquid staking market entirely, but the 33% stake threshold largely just serves as a helpful line for the community to rally behind in opposition of this vision. More practically though, we don’t believe that Lido at 34% poses meaningfully different risks than Lido at 32%. For example, even if Lido were to breach the 33% stake threshold, it would require collusion amongst Lido’s 37 distinct node operators to temporarily inhibit Ethereum’s finality, and the attack would come at Lido’s own peril due to the inactivity leak. Moreover, even if a profitable attack vector did exist here, such an attack is not enforceable by Lido since the validator keys are divvied amongst node operators outside of its possession. Beyond that, such a vector isn’t unique to Lido either, and it’d be much easier for the largest individual operators (e.g., Coinbase, Figment, Binance, etc.) to collude and breach 33% than it would be for Lido operators, which are much smaller individually and would require more parties to maliciously coordinate.

While there are many theoretical attack vectors (see Mike Neuder’s report for a broad list), Lido’s underdeveloped governance structure is arguably the largest concern today, with its own self-assessed scorecard placing every governance metric in the “Needs Improvement” category. Lido governance today bestows significant power with “root” privileges to update the existing smart contracts, including stETH minting, the designated node withdrawal addresses, the permissioned set of node operators, and the protocol’s >$200m treasury, amongst other controls. Moreover, such decisions are controlled by a simple LDO token holder vote, and LDO’s token supply is heavily concentrated in a few VCs and individuals that essentially have full control over Lido’s governance today. Hence, concerns around Lido are mostly nuanced worries about such a large amount of power being controlled by an evolving governance layer, and less about an explicit attack vector that arises after gaining 33% of the stake. And while Lido intends to reduce the power of LDO holders in the future with proposals like dual governance (i.e., allowing stETH holders to veto LDO-driven governance proposals), they are not yet in place today.

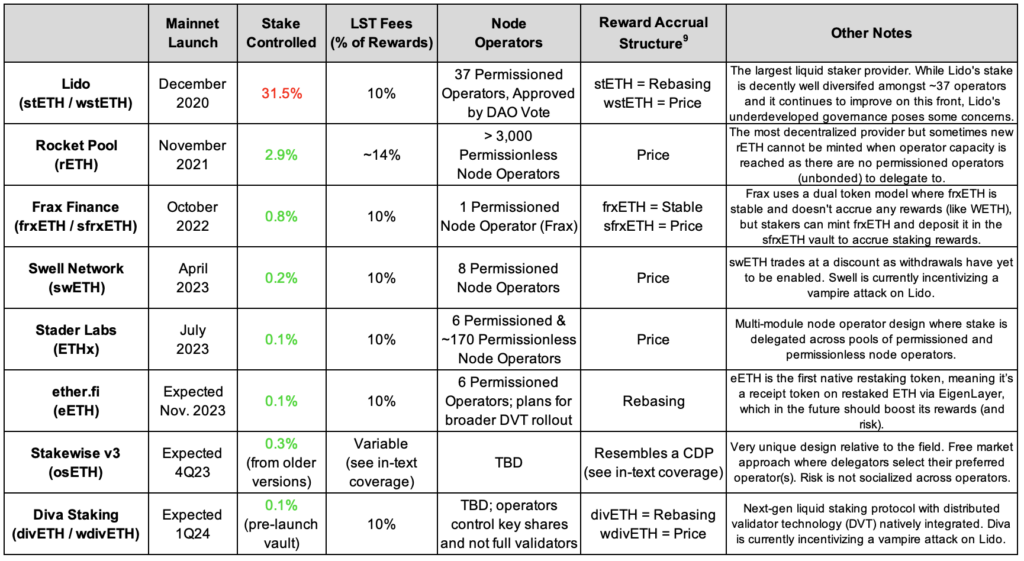

Minority LSTs Detailed

Regardless of one’s view on Lido, it’s clear that Ethereum’s value proposition as a credibly neutral base layer improves with the decentralization of its validator set. And as the number of liquid staking competitors have increased materially in the last twelve months, there are more alternatives to Lido’s stETH than ever before. These alternatives, detailed more below, should help mitigate the centralization concerns discussed herein. They vary meaningfully in their implementation and design, but each is at least one order of magnitude smaller than Lido today.

Summary of Liquid Staking Providers

Source: GSR. See footnote 9 for a discussion on the value accrual of LST rewards.

Rocket Pool (rETH)

Rocket Pool pioneered decentralized liquid staking by permitting open participation from non-whitelisted node operators. Rocket Pool stands out for its decentralization versus competitors, and its stake is divided across several thousand distinct node operators. Stakers (delegators) can mint rETH by depositing ETH into Rocket Pool or they can purchase it on the secondary market via a DEX.8 Since Rocket Pool node operators are required to post at least 10.4 ETH worth of collateral per validator, rETH arguably offers greater slashing protection versus peers since node operator collateral could subsidize losses. rETH also benefits from the best-in-class client diversity and may be relatively more insulated from tail events due to its diversified operator set. Rocket Pool’s rETH charges a ~14% staking fee that accrues in full to the node operator (i.e., the protocol does not take a cut), but it’s expected that this fee could be lowered as future upgrades improve capital efficiency (i.e., decreasing the operator’s bond and increasing LTV would improve node operator economics via leverage while simultaneously reducing rETH fees). Lastly, note that rETH is not a rebasing token and its rewards accrue into its price, so the price of rETH will grow continuously against ETH as it accrues rewards.9 This makes rETH more comparable to Lido’s wstETH than stETH, and this approach may offer tax benefits in certain jurisdictions versus rebasing tokens.

Diva Staking (divETH / wdivETH)

Diva Staking is a next-generation liquid staking protocol that natively incorporates Distributed Validator Technology (DVT) into its liquid staking tech and is expected to launch on mainnet in Q1 2024. In simple terms, DVT can be viewed as a multi-signature scheme for consensus votes, sharding validator keys under a threshold signature scheme to achieve superior fault tolerance. Unlike existing providers where each validator is controlled by a single trusted node operator, each Diva validator is split into 16 key shares and the validator is controlled by an 11/16 threshold signature scheme. The trusted operator can no longer individually slash the validator, intentionally or unintentionally, as slashing would now require collusion amongst 11 operators on a particular validator. DVT also enhances resiliency more generally as the validator can still deliver accurate and timely attestations despite 5 of the 16 key share operators failing to perform their responsibilities. Node operators will be able to participate permissionlessly, and operators will bond up to 1 ETH (or divETH) per key share, so there will still be collateral in place despite the usage of DVT. Diva’s divETH will charge a ~10% staking fee that accrues in full to the key share operators (i.e., the protocol does not take a cut). Finally note that divETH is a rebasing token like Lido’s stETH, so rewards grow one’s token balance instead of increasing the token’s price. However, divETH can be wrapped into wdivETH which more closely resembles the structure of Rocket Pool’s rETH and Lido’s wstETH.

While Diva’s mainnet has yet to launch, the project has gained early attention by airdropping its governance token to early ETH stakers, and the project is currently executing a vampire attack on Lido, where users are incentivized with DIVA tokens to lock ETH or stETH in a vault that will be swapped into divETH once its mainnet is launched. More than 16k stETH has already been deposited that will eventually be drained from Lido’s TVL and rolled into Diva.

StakeWise v3 (osETH)

While StakeWise does have a liquid staking offering on mainnet today (sETH2 & rETH2), our coverage prioritizes its forthcoming v3 iteration that will contribute meaningful progress to the existing liquid staking paradigm and is expected to go live by year-end. StakeWise v3 introduces a modular staking marketplace that provides stakers with greater flexibility to selectively delegate their stake according to their individual preferences. Unlike most existing staking solutions where stake is pooled and rewards are socialized across the whole protocol, StakeWise v3 decomposes stake into multiple heterogeneous vaults that stakers can choose to delegate amongst. Operators will be able to permissionlessly deploy new vaults with custom features, including the node operator(s), infrastructure details (e.g., geography, client mix, redundancy, DVT, MEV usage, etc.), insurance, operator fees, or even private vaults with wholly bespoke terms for large stakers. Private vaults could also meaningfully improve the UX for solo stakers, who could now spin up their own private vault to mint liquidity on their otherwise illiquid operator stake. StakeWise’s vault-based architecture necessarily requires a unique and thoughtful approach to its LST design, as fungibility of stake is lost between vaults (i.e., stake is only fungible on an intra-vault basis). Unlike competing LSTs, stakers do not receive the osETH LST by default after staking, but it can be optionally minted against one’s stake on an overcollateralized basis as needed for liquidity. As a result, osETH more closely resembles a collateralized debt position than most traditional LSTs. Finally, only the node operator(s) earn a fee at the vault level, and StakeWise’s revenue comes from a 5% fee levied on the rewards of those that minted osETH, making it a particularly compelling solution for fee-sensitive stakers with low liquidity needs (i.e., forgoing liquidity reduces staker expenses by 5%).

Stader (ETHx)

Stader is a multichain liquid staking project that facilitates staking on Ethereum and six other supported chains. Stader’s Ethereum staking program uses a multi-module operator design with stake delegated across permissioned and permissionless node operator pools. On an individual basis, these operator pools closely resemble the designs of Lido (permissioned) and Rocket Pool (permissionless), and Stader’s current form largely amounts to a hybrid of the two solutions. This hybrid design gives Stader the limitless scalability of Lido, where stake can be allocated to professional node operators without fronting any capital of their own (unbonded), while simultaneously enabling permissionless node operators (bonded) without constraining the protocol’s growth in the absence of supply from such node operators (which is a constraint with Rocket Pool today). ETHx is minted by depositing ETH into Stader, which is then routed across the operator pools based on DAO-set parameters (~90% permissionless / ~10% permissioned today). ETHx is a reward-bearing token (non-rebasing) with a 10% fee that’s split evenly between node operators and the DAO. Stader’s permissionless operator module resembles that of Rocket Pool but with decreased capital requirements, making it more capital efficient for operators; Stader node operators must stake 4 ETH and post 0.4 ETH in SD tokens to be paired with 28 ETH of deposits from ETHx minters. Lastly, Stader’s future roadmap intends to introduce a third staking module that leverages DVT, and the project is currently testing pilots with both Obol and SSV Network.

Swell (swETH)

Swell’s swETH launched on the back of the Shapella upgrade earlier this year and raised ~50k ETH in its first six months. Swell currently delegates its stake to eight trusted node operators, which it plans to increase before allowing permissionless operator participation further down the road. Indeed, Swell’s structure is very similar to Lido’s currently (i.e., it uses many of the same permissioned node operators and has the same 10% fee structure that’s split evenly between operators and the DAO) but does not present any of the same concentration risks. Swell is perhaps best described as a usability maxi, and the project has placed a heavy emphasis on DeFi integrations (40+) and making swETH as functional as possible with plans to introduce a Curve-esque vote escrow and gauge flywheel incentive model. Lastly, Swell has not yet enabled withdrawals, so liquidity is only available on the secondary market (i.e., via a DEX), and swETH cannot be redeemed for ETH on the Beacon Chain yet (expected 1Q24). As a result, Swell’s swETH trades at a ~3.5% discount and pricing dynamics resemble those exhibited by Lido’s stETH and other LSTs before withdrawals were enabled.

True to its DeFi roots, Swell has incentivized usage with its Voyage airdrop program where early users earn pearls that will become redeemable for SWELL after the token generation event occurs next year. Swell has also launched a vampire attack on Lido with incentives to get users to swap out of stETH. Users participate by depositing stETH into an Enzyme vault that’ll be redeemed from Lido and swapped into swETH. Participation is incentivized with pearls and boosted staking rewards as all of the DAO’s swETH revenues are redirected to vault depositors for the program’s 180-day life.

ether.fi (eETH)

Ether.fi is another upcoming liquid staking project that made waves earlier this year for its Operation Solo Staker (OSS) program that incentivized the geographic diversity of Ethereum stakers. The program provided selected applicants in underrepresented regions with the required ETH capital and hardware to run an Ethereum validator, leveraging Obol’s DVT technology to distribute signing responsibilities across multiple applicants for risk management. Stakers can support the OSS initiative today by minting a stake-backed NFT via ether.fan, which provides a gamified staking experience where staking rewards increase with their holding period in addition to earning loyalty points that can be used to win real-world prizes (ether.fan is really just a wrapped version of their forthcoming eETH token but the ERC-1155 wrapper pools the rewards and redistributes them based on holding period tiers). While ether.fi’s stake is primarily delegated to trusted node operators via an auction process today, the future vision is for stake to be delegated to geographically dispersed nodes running DVT once that tech stack matures. Moreover, they already have at least one DVT validator on mainnet today and plan to launch more in the weeks ahead.

Ether.fi’s eETH token (i.e., unwrapped ether.fan without the holding period tiers) will go live on mainnet over the coming weeks. Ether.fi’s staking model has three participants: stakers (eETH minters), bond holders, and node operators. New ether.fi validators are launched once 30 ETH of staker deposits is paired with 2 ETH of bond holder deposits. Bond holders generate validator keys and send encrypted copies to the node operator that won the auction for the mandate. Since the validator key is required to exit a validator, this process ensures that node operators cannot ignore an exit request, as now the bond holder and node operator both have the power to exit the validator (i.e., only the node operator typically has the power to exit in other LST setups).10 While many of the implementation details are outside of the scope of this report, the 30 ETH of staker deposits is represented by a transferable NFT (T-NFT) while the 2 ETH bond holder deposit is represented by a soulbound NFT (B-NFT) that’s permanently attached to the bond holder and serves as slashing insurance for the stakers. And ether.fi’s eETH token is backed by the pool of T-NFTs (i.e., the non-bond holder portion of each validator’s stake).

Lastly, eETH is leveraging EigenLayer and expected to become the first native liquid restaking token (LRT) on mainnet. This means the validators backing eETH will have their withdrawal credentials pointing to EigenLayer’s contracts, allowing the stake to opt in to additional slashing conditions to secure extra services beyond Ethereum’s consensus (i.e., restaked). Such services are called actively validated services (AVS) and could include bridges, oracles, data layers, multiparty compute, etc.11 In short, eETH is a liquid receipt token on restaked ETH as opposed to the typical receipt token on staked ETH. With that said, no AVS exist yet, so an LRT is functionally similar to an LST for the time being. Once a set of AVS are live, one would expect an LRT to generate relatively higher rewards, albeit with increased risk from the extra slashing conditions.

Frax (frxETH / sfrxETH)

Frax uses a dual token model that’s quite unique versus previously covered liquid staking providers. Frax’s frxETH is best described as an ETH-pegged stablecoin, more akin to WETH, and users only earn staking rewards after depositing frxETH into its staking vault in exchange for sfrxETH. While Frax’s setup is fully centralized today, with Frax serving as the sole node operator, the team has teased its permissionless vision for frxETH v2 in the months ahead. The idea starts from the premise that all LST protocols are simply lending markets where LST holders lend ETH to node operators to run validators, and the design has many similarities to familiar peer-to-pool lending systems. Unlike most LST designs though, where operators charge a fixed percentage of the staking rewards earned, frxETH v2 plans to allow any operator to permissionlessly borrow a validator from the lending pool, with borrow rates set dynamically based on the pool’s utilization, similar to Aave. While many details remain to be seen, frxETH v2 plans to allow operators to participate permissionlessly, with borrow rates determined based on free-market competition. Overall, the model presents an interesting alternative to today’s fixed percentage lending market but may incentivize validator churn as profitability dynamics change.

Considerations Ahead

As a final parting note, we’d encourage all delegators to ask the important questions raised throughout this report when deciding where to route their stake. Ask questions that go beyond just fees and liquidity, including, but not limited to:

- How much stake does the entity control?

- Is it a single node operator setup?

- How many node operators manage the stake and how is stake allocated amongst them?

- Are they geographically dispersed?

- Are they running minority or majority clients?

- Are they using non-censoring MEV relays?

- Are the node operators permissioned or can anyone become a node operator?

- How much power does governance have?

- Is governance sufficiently advanced and decentralized or is it controlled by a few?

As is always the case, the world is nuanced and none of these questions independently provide the answer but should be considered holistically and in accordance with one’s individual views and values. Moreover, ecosystem dynamics are non-stationary and subject to change. While Lido is often viewed as the largest staking-related concern today, the next concerning entity may be on the horizon. It could be single operator setups like Coinbase and other centralized exchanges. Or perhaps, its institutional staking providers that have been gobbling up share as of late, like Figment. Or maybe it will be a Lido-like delegation layer for institutional clients, such as Liquid Collective (LsETH), that allocates stake to already-large operators like Coinbase and Figment. Whatever the future holds, the Ethereum community must stay vigilant to maintain the network’s core principles of decentralization and censorship resistance.

Footnotes:

- The validator also pre-specifies a withdrawal address that’s beneficial for several reasons. First, having withdrawal credentials that are distinct from the signing credentials enables safer delegation of stake (i.e., the staking service provider can’t steal your funds with the validator keys they are using to participate in consensus). Additionally, validator key pairs must remain “hot” as they are required to attest every few minutes, but it’s this same key pair that is used to signal an exit and withdraw the validator’s balance when needed. If the “hot” validator keys were to be stolen, the attacker can only trigger a withdrawal but they cannot change the withdrawal address (i.e., the address that funds are withdrawn to), so the attacker wouldn’t be able to steal the funds unless they simultaneously compromised the withdrawal address that should’ve been kept in cold storage. While this is helpful, there are still other attack vectors available, like intentionally slashing the validator.

- Liquid staking providers notably sit in a unique application-layer position with their outsized impact on the base layer’s consensus, and we believe the argument generally holds that staking providers pose a greater systemic risk than the average application layer project (i.e., DEXs, borrow/lend protocols, NFT marketplaces, etc.). This isn’t always the case, however, and centralized stablecoins may perhaps be the best counter example. Consider what happens if the majority of the community wants to fork while Circle does not endorse that view of the chain? Circle controls the bank accounts with the actual dollars backing USDC.

- In Lido’s defense, arguments could be made that the self-limiting movement is virtue signaling from smaller providers displaying their “alignment” with Ethereum knowing full-well that they’ll never reach the stake thresholds where they’d be limited. It’s impossible to know how these smaller providers would act in Lido’s shoes.

- See footnote 1.

- Tokens like rETH and stETH are minted as users deposit ETH into the respective staking protocols. In normal times, the deposited ETH can be staked quickly to begin earning rewards, so this doesn’t normally create a big timing issue. However, Ethereum does have an activation queue that limits how much ETH can be staked over short periods of time, and a long queue formed after the Shapella upgrade and it began taking months from the time of the deposit until one began earning rewards on their stake. During this time, new LST minters were sharing rewards with existing LST holders despite their deposited ETH not actually generating rewards for the LST until several weeks or months later. This was better obfuscated by large projects like Lido that already had so much stake active, but it meaningfully dragged down the rewards on smaller projects like Rocket Pool and Swell that were gaining share and had a larger percentage of their stake inactive and thus diluting their LST’s rewards. This is no longer an issue as the queue has normalized by October, however, it was inflated for nearly six months and hampered the rewards on growing projects throughout much of the year.

- Many prominent voices have raised differing levels of stake acceptability, and there is little consensus here in terms of what level is too much. However, most of the ecosystem seemingly agrees that >30% is suboptimal. There are quoted examples of 15%, 22%, and 33% from Vitalik, Superphiz, and Danny Ryan.

- Vitalik, Dankrad, and Mike Neuder have all written on the potential for enshrined liquid staking in recent months.

- For reasons previously covered, rETH can only be minted when there is excess node operator capacity ready to spin up a new validator. rETH can alternatively be acquired via a DEX when Rocket Pool’s deposit pool is at capacity (although it may trade at a slight premium for that reason).

- There are two primary LST designs, each with different mechanisms for accruing the value earned from staking rewards. One approach is for validator rewards to accrue directly into the LST, causing the price of the LST to grow faster than the price of ETH, resulting in the redemption value in terms of ETH increasing through time (i.e., it will not be one-to-one). Another approach is for validator rewards to bypass price but come in the form of new token issuance, increasing the LST’s outstanding supply by the amount of validator rewards through a mechanism analogous to a stock dividend in traditional finance. This rebasing approach is cleaner from a mental accounting perspective, as one’s quantity of the rebasing LST will grow in alignment with the growth of their staked ETH, resulting in an LST that is redeemable on a one-to-one basis consistently through time. Rebasing tokens may have worse tax implications in certain jurisdictions, though, but most rebasing tokens offer functionality so they can be wrapped into a token where rewards accrue into price (e.g., stETH -> wstETH ; divETH -> wdivETH). Rebasing tokens and reward-bearing tokens (price) are also commonly called aTokens and cTokens, respectively. This naming comes from the different receipt token models used on deposits at Aave and Compound.

- Prior to ether.fi, this approach was foreign to the LST ecosystem but more common amongst the non-LST staking-as-a-service (SaaS) providers, like Allnodes. This setup is common amongst SaaS providers because it allows users to outsource their stake in a non-custodial fashion (i.e., at any point in time the user can signal an exit or migrate to another provider; however, this does present additional slashing risk if there is a miscommunication and two parties use the key simultaneously). This setup prohibits the operator from griefing the staker and ignoring exit requests as the staker can now force an exit independently. Specifically, this doesn’t offer any extra protection against slashing as the operator could still intentionally slash the validator, but this does protect against a node operator effectively freezing the stakers funds. Currently, if a node operator just stops participating in consensus without committing a slashable offense or signing an exit message, then they will remain “active” but will continuously receive small ETH penalties. However, validators aren’t kicked out of the active set until their balance dips below ~16 ETH, so if a validator key is lost (or intentionally not used) in the current environment, funds would be stuck for years and years until the validator’s balance slowly bleeds down to ~16 ETH. This is a problem solved by ether.fi’s design, but this problem is expected to be remediated more generally in 2024 after Ethereum implements the upgrade enabling exits to be triggered from the execution layer.

- Readers unfamiliar with restaking may find the intro section of the EigenLayer white paper helpful.

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Sources:

The Risks of LSD – Danny Ryan, Should Ethereum be okay with enshrining more things in the protocol – Vitalik Buterin, Magnitude and direction of Lido attack vectors – Mike Neuder, Lido on Ethereum Scorecard, Hasu’s GOOSE Submission

Also see hyperlinks throughout the text as well as the application docs of referenced protocols.

Disclaimers

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.