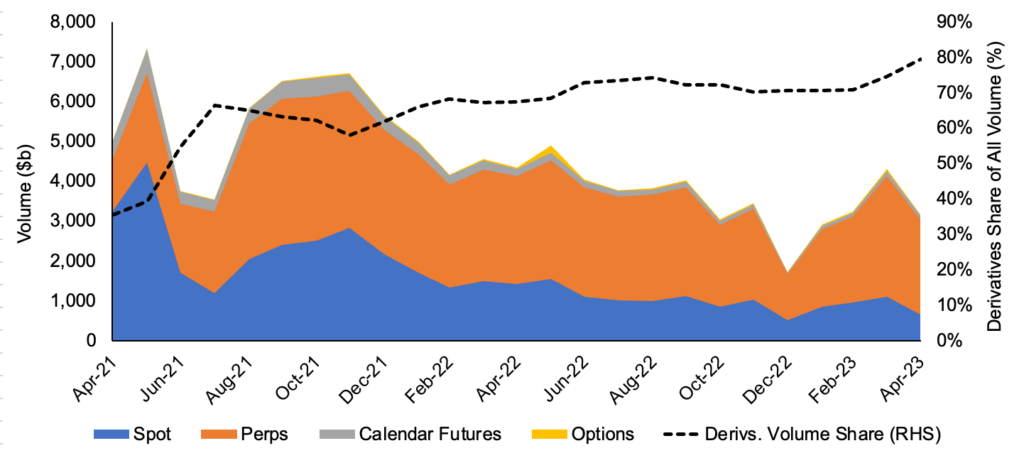

With crypto derivatives comprising a record ~79% share of crypto trading volume globally, we provide an overview of common derivatives and their use cases before diving into the landscape of crypto futures, options, and structured products.

We begin with an overview of derivatives and their use in traditional finance before diving into the crypto derivatives ecosystem. Familiar readers may skip the Derivatives 101 section.

Derivatives 101

Derivatives are financial contracts between two or more parties that derive their value from the price of an underlying asset or index (“the underlying”). Derivatives may reference various underlying assets like stocks, interest rates, commodities, currencies, crypto, and/or others. Derivatives date back thousands of years and are often used by commodity producers and consumers to hedge their revenues and expenses, respectively. For example, an oil rig operator may want to hedge its revenue by locking in a price at which it sells barrels of oil in the future. Conversely, an airline operator may want to hedge its input costs by locking in the future price it pays for oil. Beyond the naturally offsetting positions between commodity producers and consumers, derivatives are also used as an efficient medium for speculation, allowing for leverage and enabling users to gain long or short exposure without physically acquiring the underlying.

The two most common types of exchange-traded derivatives are futures and options:

- Futures contracts obligate the buyer (seller) to buy (sell) the underlying asset at a predetermined price on a future date (expiration). The purchase obligation embedded in a futures contract gives the future a roughly one-to-one (linear) exposure to the underlying asset’s price, meaning the price of the future and the underlying generally move in tandem. The price of a futures contract is based on the price of the underlying asset, interest rates, time to expiration, and cash flows or other utility derived from holding the underlying directly. Any short-term deviations between the price of a future and the underlying spot asset will dissipate as expiration approaches as the price of the future will converge to the spot price1. Futures are an efficient way to access leverage as they typically only require posting margin (i.e., collateral) in an amount that’s a small fraction of the contract’s notional exposure. Importantly, since traditional futures contracts expire, traders need to frequently roll contracts to maintain their exposure (i.e., sell expiring contracts to purchase longer-dated contracts). Lastly, most futures contracts are cash-settled at expiration, but terms vary, and certain contracts require physical delivery of the underlying asset2.

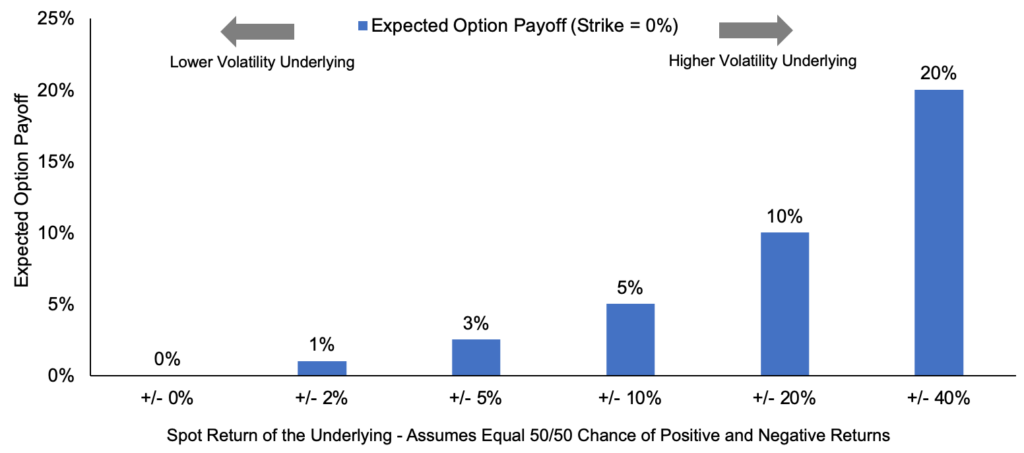

- Call (put) options grant the buyer the right, but not the obligation, to buy (sell) the underlying asset at a predetermined price and date, known as the strike price and the expiration date. Option buyers will only exercise their option at expiration if profitable to do so (these options are referred to as in-the-money; ITM), otherwise, the option will simply expire worthless (known as out-of-the-money; OTM). As the name implies, option contracts provide optionality instead of an obligation, which creates positively asymmetric/nonlinear exposure to the price of the underlying asset and necessitates buyers to pay an upfront premium to the seller for assuming this risk. Additionally, options referencing more volatile assets are more expensive, as the expected value of an option’s payoff increases with the volatility of the underlying (i.e., option payoffs are always greater than or equal to zero, so the average payoff is greater when volatility is higher). More precisely, options are positively exposed to implied volatility, which is a measure of the underlying’s expected volatility over the option’s life. Implied volatility uniquely impacts option prices due to their asymmetry, making it a distinguishing factor that does not impact the price of linear derivatives like futures. Options are also uniquely impacted by the passage of time for this same reason, as time is inherently valuable when the distribution of payoffs is positively asymmetric3. All told, option prices are impacted by the price of the underlying asset and its corresponding cash flows (if any), implied volatility, interest rates, and time to expiration. Similar to futures, options provide an efficient way to access leverage, need to be rolled to maintain exposure, and are typically cash-settled at expiration (though some contracts require physical delivery). Lastly, most options contracts are only exercisable at expiration (European), but traits vary, and some contracts can be exercised prior to expiration (American).

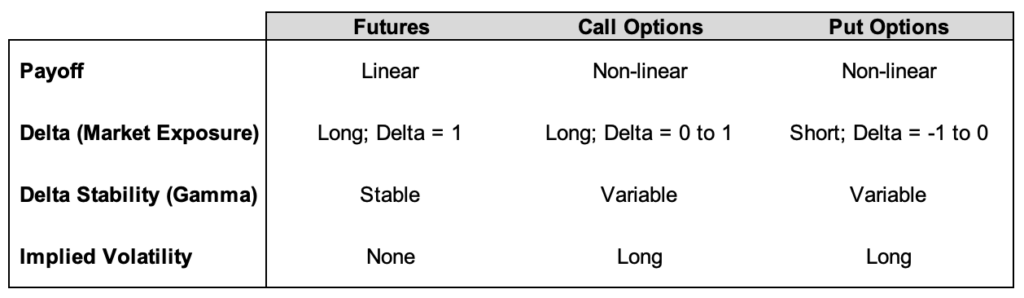

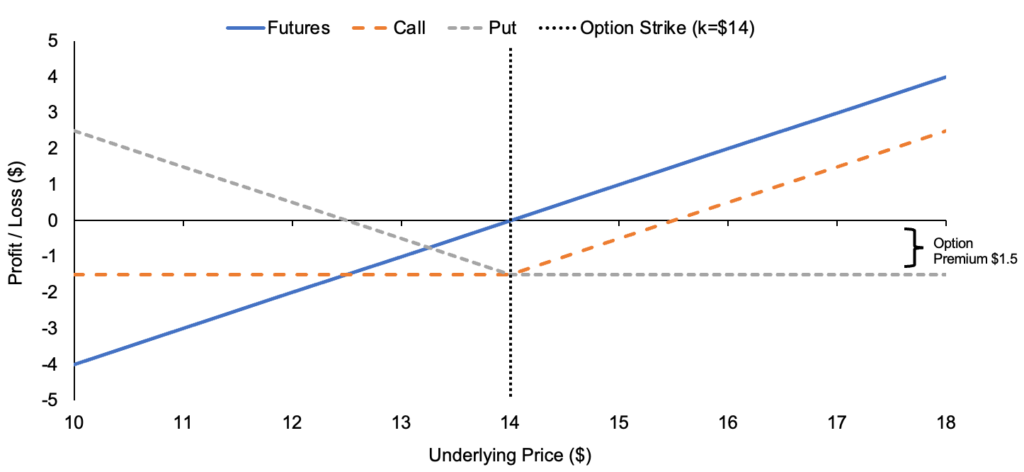

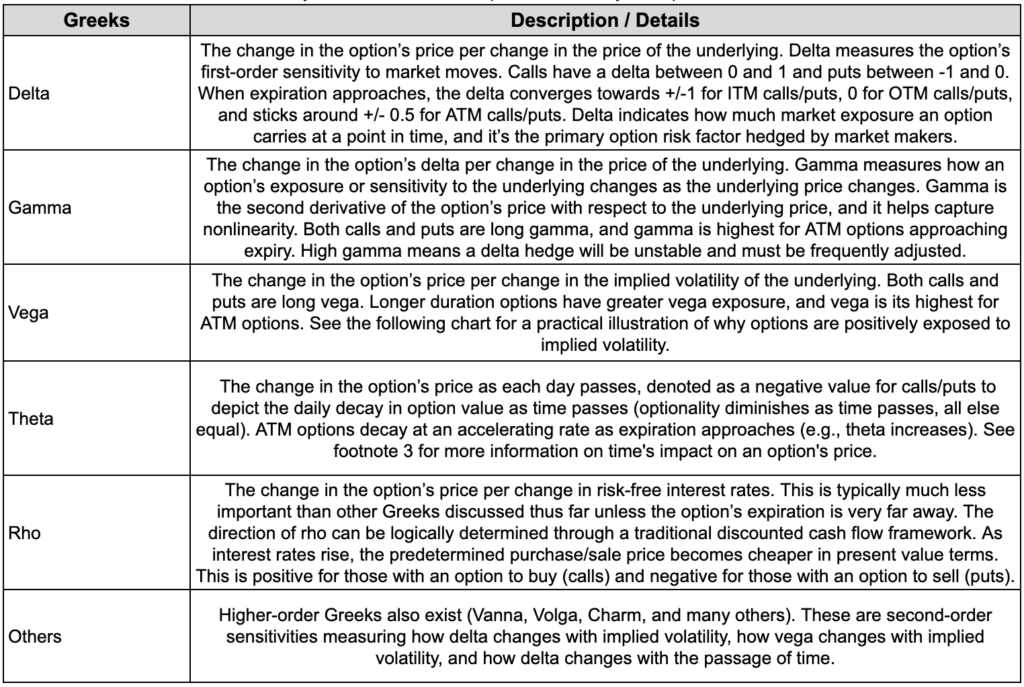

To summarize, futures are an obligation to transact at an agreed-upon future date and price, while options are more flexible and give the buyer the right but not the obligation to transact at the agreed-upon future date and price. The distinction between an obligation and an option is paramount as the two instruments possess vastly different sensitivities to various factors, with the degree of market exposure or sensitivity to the price of the underlying (delta) being one prominent example. Futures are known as delta-one instruments, as their prices move virtually one-to-one with the price of the underlying. On the other hand, options have variable exposure to the price of the underlying that changes depending on several factors, such as the price of the underlying itself (e.g., option deltas fluctuate between 0 and +/- 1). The nonlinear payoffs enabled by options additionally offer unique exposure to volatility and other factors that don’t exist in delta-one instruments like futures, making options highly desirable for advanced investment and risk management strategies. Option risk exposures are measured via a set of factors collectively known as the Greeks, covered in Appendix A. Interested readers may also refer to the ‘Option Values and Changing Market Conditions’ chapter of Option Volatility & Pricing for a deeper review.

Simplified Risk Exposures by Instrument

Source: GSR. Note: Exposures are based on the perspective of the derivative purchaser. Risk factors shown are simplified and not exhaustive. See footnote 3 and Appendix A for a deeper overview of option risk sensitivities.

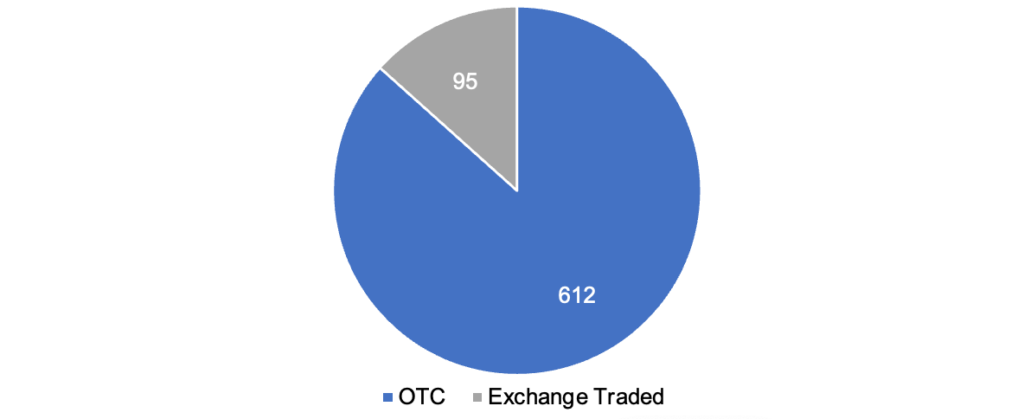

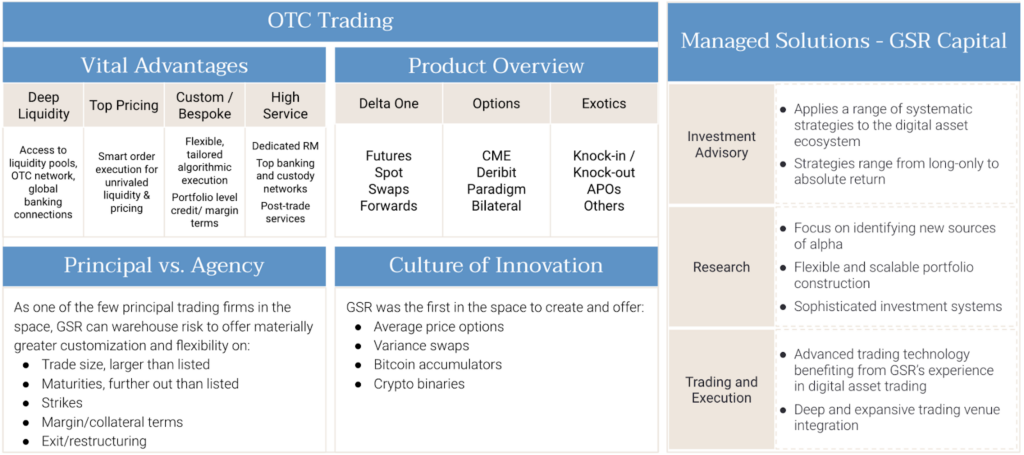

Many derivatives contracts are centrally cleared on regulated exchanges and trade with standardized contract terms, but a much larger segment of the market trades over-the-counter (OTC) on a bilateral basis with bespoke terms under a master agreement such as an ISDA4. OTC derivatives provide increased flexibility on terms and allow users to customize components of their trade like the notional size, tenor, strike, and settlement. OTC markets also offer a wider suite of derivative instruments like variance swaps, average price options, and other exotic derivatives that can be advantageous for hedging specific exposures. For example, a producer of a commodity, like an oil rig operator or a bitcoin miner, may be interested in hedging with average price options to align the pricing of the hedge with daily production. In order to trade OTC derivatives, investors contract with banks such as J.P. Morgan in traditional finance or trading firms like GSR in crypto markets.

Trillions of Notional Outstanding by OTC & Exchange Traded Derivatives ($t)

Source: Bank of International Settlements as of June 30, 2022. Note: Data only includes FX and interest rate derivatives, which make up the lion’s share of the market. While the notional exposure of other exchange-traded derivatives is not tracked by the BIS globally, derivative contracts on equities, commodities, and credit default swaps comprise just ~3% of the OTC derivative market, or ~$20 trillion. For further context, S&P 500 futures are the most popular exchange-traded equity contract, and the total notional outstanding sits around ~$420b.

Crypto Derivatives: A TradFi Comparison

While most crypto derivatives trading activity occurs on centralized exchanges (CEXs) via central limit order books (CLOBs) that resemble those used by exchanges in traditional finance, the crypto derivatives ecosystem also has many unique points of contrast. For example, crypto markets trade 24/7/365 globally, and most activity is quoted/settled in stablecoins to mitigate the shortcomings of fiat rails that are only accessible during bank hours. Additionally, crypto derivatives commonly trade on multiple crypto exchanges, bifurcating liquidity across venues. For example, unlike S&P 500 futures that only trade on the Chicago Mercantile Exchange (CME), BTCUSDT futures trade on dozens of crypto exchanges, such as Binance, OKX, and Bybit. Moreover, a subset of crypto derivatives trading volume occurs directly on the blockchain (onchain) via permissionless smart contract-based decentralized exchanges (DEXs), which act as a source of liquidity wholly unique to crypto markets. Despite increased fragmentation, the crypto derivatives ecosystem is arguably more dependent on the largest derivative exchanges as they provide a broader suite of services that is split amongst brokers, exchanges, and clearinghouses in traditional finance.

In addition to the above differences in market structure between traditional finance and crypto, entirely new crypto derivative instruments have not only been introduced but also have flourished, with the dominance of perpetual futures the most striking example. Covered at length in the next section, perpetual futures are evergreen or non-expiring futures contracts that improve liquidity fragmentation and are now the most successful crypto trading instrument by volume.

One final major difference is the location of exchanges as an outcome of the regulatory landscape. Due to a global crypto regulatory environment that mostly ranges from unclear or underdeveloped to non-existent, the vast majority of global crypto derivatives volume occurs on offshore derivatives exchanges that operate with fewer regulatory constraints. Given wide regulatory disparities across jurisdictions, crypto exchanges selectively operate where allowed, and those with the largest suite of offerings often only operate in more lax jurisdictions. Exchanges have commonly launched separate entities with a more limited set of offerings to compete in markets with more stringent regulation, such as Binance with BinanceUS and Coinbase, which did it in reverse order with Coinbase International Exchange. As such, the ability to access the full suite of the ecosystem’s trading services is arguably more dependent on jurisdiction than in traditional markets, with U.S.-persons generally unable to access crypto derivatives exchanges, as one example.

Summarizing the crypto derivatives trading landscape today, ~98.5% of global futures and options volume occurs on centralized exchanges that are primarily domiciled offshore, and trading on derivative DEXs represents a minuscule ~1.5% share of derivatives volume. Evaluating volume by instrument, perpetual futures comprise the majority of all crypto trading volume (~68%), followed by spot (~28%), with much smaller contributions from other instruments like calendar futures (~3%) and options (~1%).

Monthly Crypto Volume Decomposed (LHS) vs. Derivatives Volume Share (RHS)

Source: Laevitas, The Block, GSR. Data as of April 30, 2023. Note: Spot CEX and DEX volume data from The Block, derivatives data from Laevitas. CME crypto futures and options data was manually added.

Crypto Futures Landscape

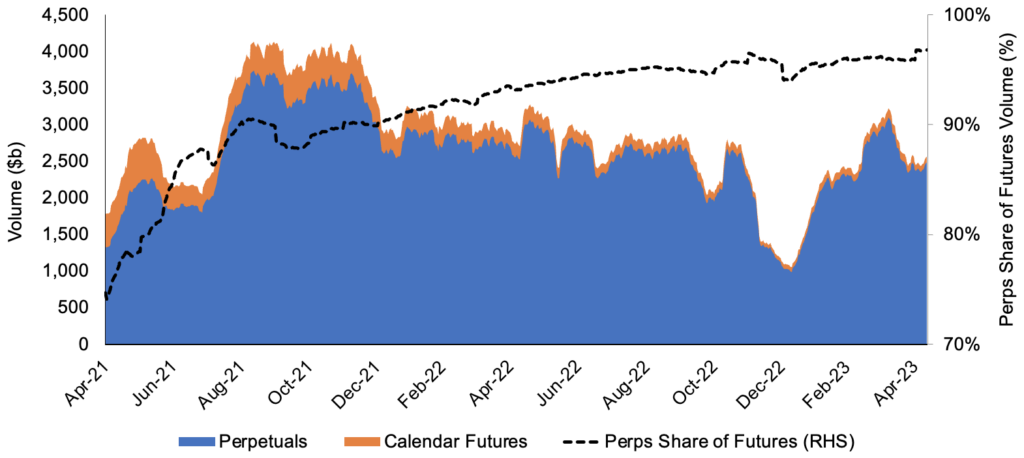

While traditional futures contracts with predetermined expiration dates do trade in crypto, most prominently for BTC and ETH on the CME5 and on offshore crypto derivative exchanges like OKX and Binance, they represent only a small fraction of crypto futures trading volume. The futures market in crypto is dominated by a crypto-native instrument known as a perpetual future, alternatively known as a perpetual swap or perp. Perpetual futures were first proposed by Nobel laureate economist Robert Shiller in a 1992 paper, but they were never implemented in traditional financial markets and were first introduced to crypto with BitMEX’s bitcoin perp in 2016.

Rolling 30-Day Crypto Futures Volume by Instrument, ($b)

Source: Laevitas, GSR. Data as of May 10, 2023. Note: Calendar Futures is adjusted to incorporate CME Bitcoin and Ether Futures volume.

As the name implies, perpetual futures are a unique variation of futures contracts without expiration dates. Unlike traditional calendar futures contracts, which converge to the underlying spot price at expiration, the price of a perpetual future is tethered around the spot price6 via a funding mechanism. When the price of the perpetual contract is higher than the spot price of the underlying, the contract has a positive funding rate (“funding”) and longs pay the funding to shorts. Conversely, when the price of the perp is beneath the underlying’s spot price, the funding rate is negative, and shorts pay the funding to longs7. Additionally, the funding rate is based on the magnitude of the dislocation between the perp and the underlying’s spot price during each funding interval, so it constantly adjusts to incentivize traders to balance demand and keep the perpetual’s price tethered near the underlying’s spot price8,9. As such, funding can be viewed as a measure of market sentiment as it represents the equilibrium cost longs must pay shorts, or vice versa, to incentivize a counterparty to assume (carry) the more contrarian side of the trade. We’d encourage readers to review our previous crypto derivatives report for more coverage of derivatives metrics and signals.

Illustrative BTCUSDT Perpetual Future Quote on Binance

Source: Binance, GSR. Illustrative example as of May 25. See footnotes 6 – 9 for more detail on the terms.

Similar to traditional futures, perps offer leverage and are capital-efficient instruments providing linear exposure to an underlying asset. Perps enable traders to take long or short positions without physically sourcing the underlying. Perps additionally improve market efficiency by concentrating liquidity in a single exchange-traded instrument, helping to mitigate the challenge of liquidity fragmentation inherent to traditional futures markets with numerous listed expiries. Position management is also simplified by the evergreen structure of perps. While traders still need to monitor their positions and maintain sufficient collateral to avoid liquidations, they no longer need to actively roll their contracts regularly to maintain exposure.

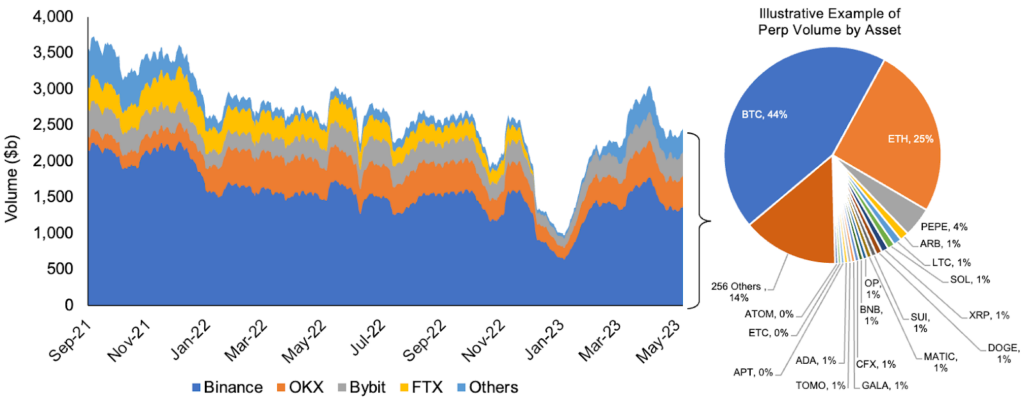

Perps now trade on hundreds of different crypto assets and dominate crypto trading volume and the price discovery process. The majority of perps volume is facilitated by offshore centralized exchanges and is primarily quoted/settled in stablecoins (e.g., BTCUSDT). Binance is the market leader, commanding a ~60% share of the centralized perps market, while OKX and Bybit follow at ~16% and ~12%, respectively. Together, these three exchanges comprise nearly 90% of the $2 to $3 trillion of perp volume that regularly trades each month.

Rolling 30-Day Perpetuals Volume by CEX ($b) / Illustrative Decomp of Listed Perps

Source: Laevitas, GSR. Data as of May 10, 2023. Note: The pie chart is an illustrative snapshot only meant to illustrate the number of assets that have listed perps.

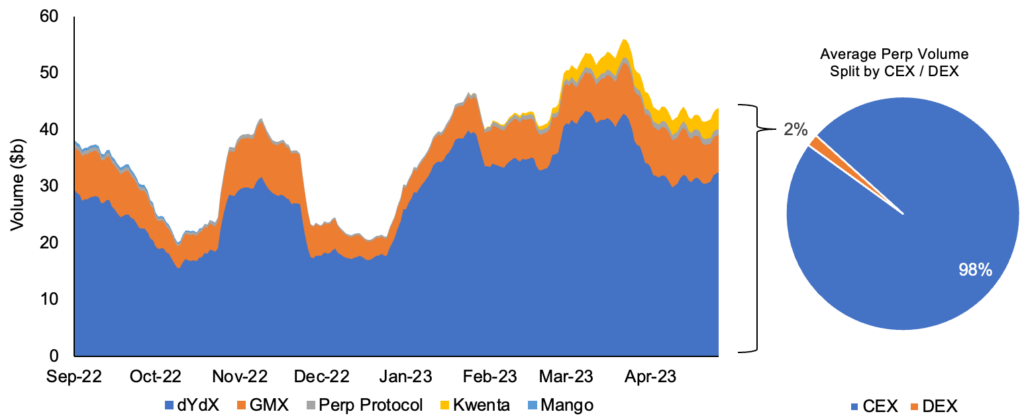

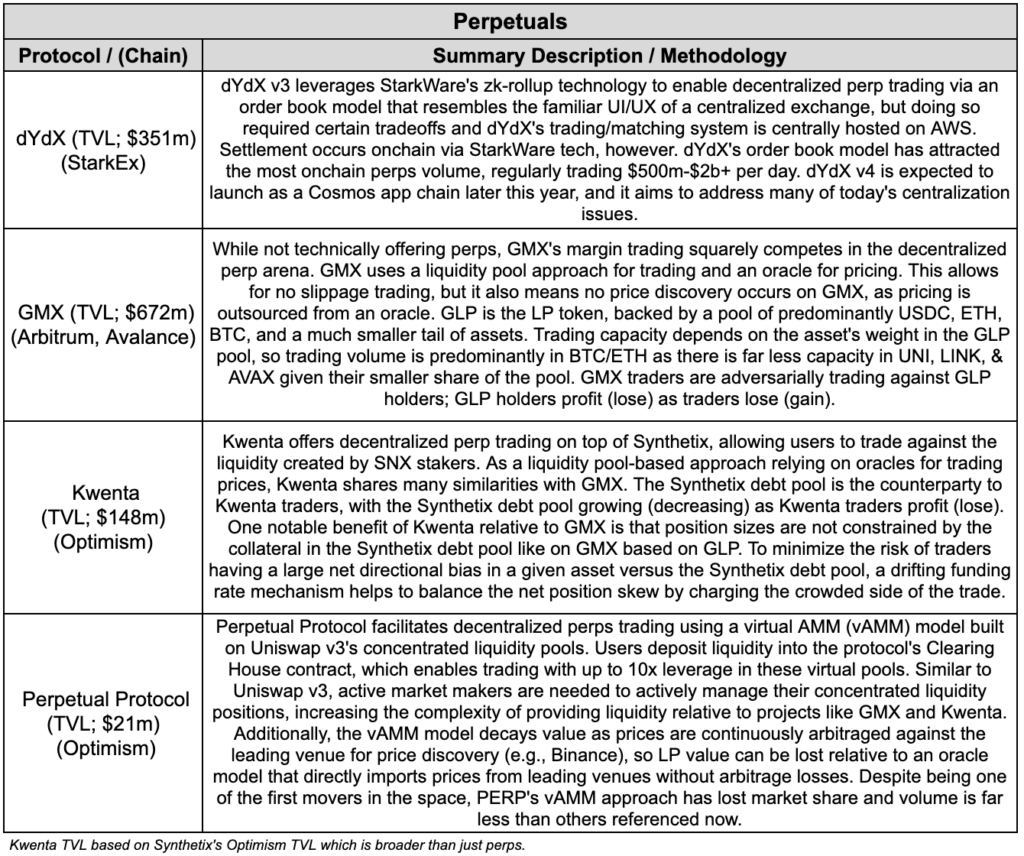

In addition to CLOB-based centralized derivative exchanges, there are also decentralized exchanges that facilitate permissionless perp trading. Though derivative DEXs represent just 1-2% of centralized futures volume today, they may gain share with centralization risks recently elucidated by FTX and several others. dYdX is the most established derivative DEX, with regular trading volume of $15 to $30 billion per month over the past year. It remains comparatively early in the life cycle for derivative DEXs, with the launch of dYdX coming nearly four years after BitMEX first introduced perps in 2016. Despite the low market share, new entrants continue to innovate rapidly, and there are many interesting derivative DEXs in operation today with solid daily volumes. For example, GMX launched in Q3 2021, and it regularly trades hundreds of millions of dollars each day, while volumes on Kwenta reached a new daily record of nearly $500m in mid-March. We expand upon derivative DEX applications and common approaches more thoroughly in Appendix B.

Rolling 30-Day Perpetuals Volume by Derivative DEX ($b)

Source: Laevitas, Kwenta, GSR. Data as of May 10, 2023. Kwenta data manually included beginning mid-February as volume grew ~10x.

Crypto Options Landscape

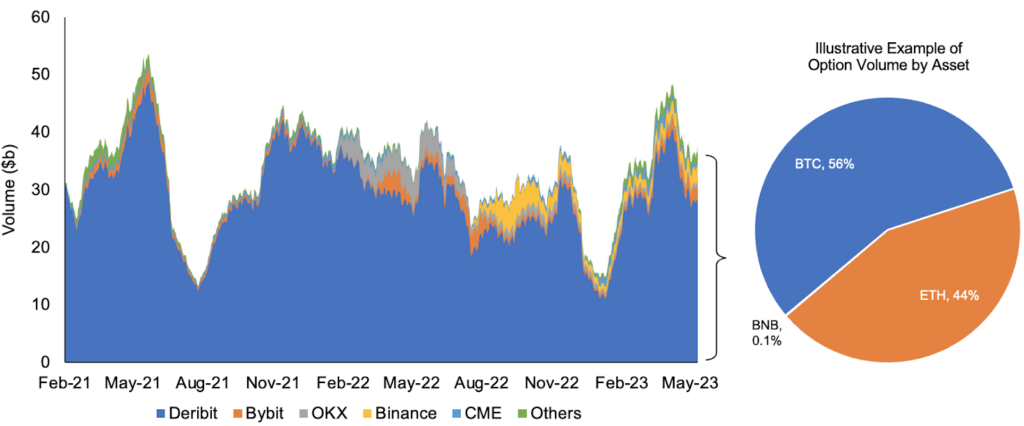

While the crypto options market continues to develop with many new exchanges and DeFi protocols entering the space, overall adoption of crypto options has been muted relative to perps. Centralized options exchanges typically trade around $30 billion in volume per month, closely rivaling the volume of decentralized perps but amounting to just 1-2% of all futures volume. Additionally, liquid options markets have failed to materialize on centralized venues for assets beyond BTC and ETH, so the breadth of listed solutions is far narrower than for perps that trade on hundreds of assets10. Complexity may contribute to the relative lack of adoption, with market participants favoring the simpler pricing dynamics of linear derivatives thus far. Another impediment may be the sheer challenge of bootstrapping liquidity into a new market that is fragmented by so many variables. Perps solved this problem in the futures market by consolidating liquidity into one contract per asset, reducing the fragmentation of the traditional futures market by concentrating the liquidity that’s normally spread among various expiries. Options are even more fragmented though, and calls and puts each require various listed strike prices across multiple expiration dates.

Due to headwinds stemming from complexity and liquidity fragmentation, building a crypto options exchange is notoriously difficult, and the industry has converged toward a monopoly with 80-90% of volume flowing through the offshore centralized derivatives exchange, Deribit. Adding to complexity challenges, the contracts listed on Deribit are structurally distinct from those listed in traditional financial markets. While components of Deribit’s contracts may appear familiar as they are cash-settled European contracts with common expiries, they also have some less typical features. Since Deribit does not support fiat currencies and it has not historically supported spot trading of stablecoins, users were unable to post dollars for margin, and Deribit was unable to settle payoffs in dollars despite listing BTC-USD and ETH-USD options. Deribit has therefore listed inverse options for this reason, meaning the option’s payoff is calculated in dollars but settled in the equivalent dollar value of BTC or ETH. This approach requires an extra layer of hedging via perps for investors that seek to minimize changes in the value of their collateral and/or option profit in dollar terms. Deribit may be able to mitigate these challenges in the future as they recently added support for spot trading of BTC, ETH, and USDC, enabling a path for direct options to be listed moving forward.

Rolling 30-Day Options Volume by CEX ($b) / Illustrative Decomp of Listed Options

Source: Laevitas, GSR. Data as of May 10, 2023. Note: The pie chart is an illustrative snapshot only meant to illustrate the number of assets that have listed options.

Due to the various onboarding requirements and user experience challenges today, activity in the options market is predominantly driven by sophisticated institutional actors. Paradigm’s institutional liquidity network plays a crucial role in the ecosystem, accounting for about 30% to 35% of Deribit’s monthly trading volume. Paradigm is an OTC communication network that allows institutions to privately negotiate pricing (i.e., RFQ) and atomically execute multi-leg trades, leveraging a chosen venue’s infrastructure for clearing and settlement while bypassing its order book. In essence, Paradigm provides a simple interface to request pricing and seamlessly execute trades across institutional counterparties. However, since all Paradigm transactions must settle on a supported venue, its scope is confined to the instruments listed on those venues (e.g., BTC & ETH options), and it cannot support the breadth of bespoke solutions in the OTC market that lack standardized terms.

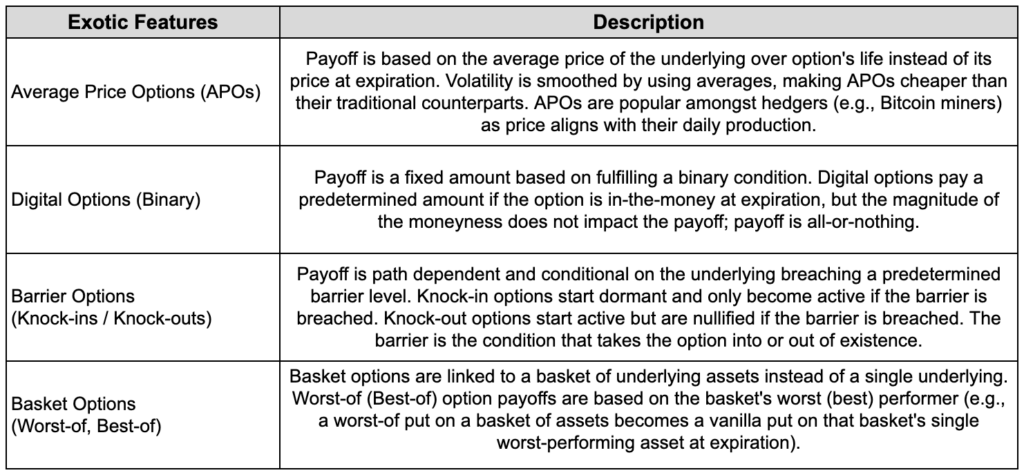

Principal trading desks like GSR provide the increased flexibility to service this demand, facilitating bespoke client trades bilaterally despite the absence of a listed market in many cases, such as with altcoin options. In this example, GSR would face the client directly and become the counterparty to their trade, allowing GSR clients to trade options on a broad suite of altcoins with flexibility around trade size and maturity date. It also allows for flexibility on the strike price, collateral, settlement type, exercise style, and other exotic features such as average price options, digitals, barriers, and baskets.

Exotic Option Features Accessible via OTC Desks

Source: GSR.

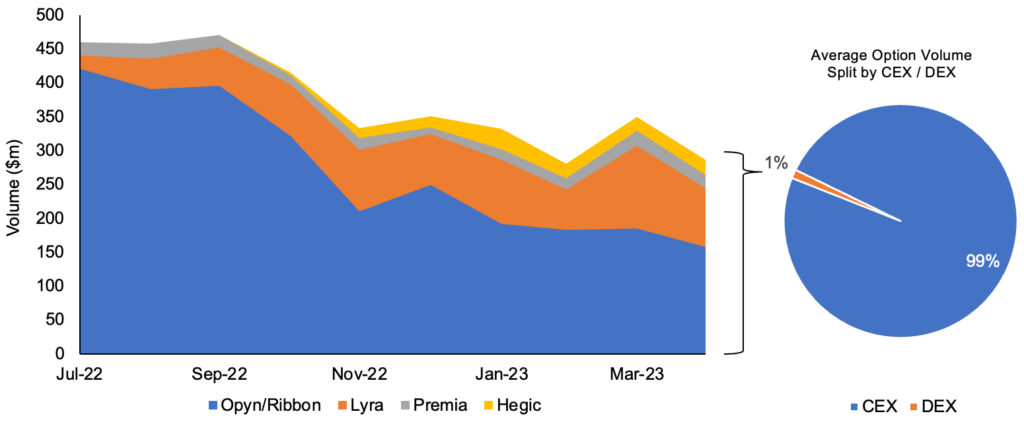

In addition to the volume from centralized exchanges and OTC desks, a small portion of options volume occurs onchain via decentralized option protocols. Option DEXs allow users to mint and trade vanilla options onchain, and they typically trade using an AMM, a liquidity pool with a pricing oracle, or an order book. The majority of activity has congregated on AMM/liquidity pool-based option DEXs like Lyra and Dopex so far. With order books requiring greater transaction throughput, the majority of these protocols were built on Solana and have seen diminished activity in the wake of FTX. Despite Ethereum’s Opyn v2 deprecating its 0x-powered onchain order book, Opyn is still a top option protocol by TVL due to its use as an infrastructure layer to mint options onchain. With its order book deprecated, price discovery no longer occurs onchain, but Opyn’s infrastructure still allows options to be minted and sold onchain at a negotiated price via Paradigm or directly with a market maker. Due to throughput limitations, order book-based option DEXs have not seen tremendous success in facilitating onchain options trading thus far, but early implementations successfully delivered the infrastructure that powers many of the onchain structured product protocols that have been relatively more successful and are covered in the next section. All told, onchain option DEX volume represents just ~1% of centralized option volume today. See Appendix B for more protocol-specific coverage.

Monthly Options Volume by DEX

Source: DeFi Llama, Frank Maseo Dune, GSR. Data as of Apr 30, 2023. Note: Opyn’s option volume is proxied using the total volume across all Ribbon vaults. Aevo has begun doing > $1m / day in May on average despite access being permissioned by a whitelist.

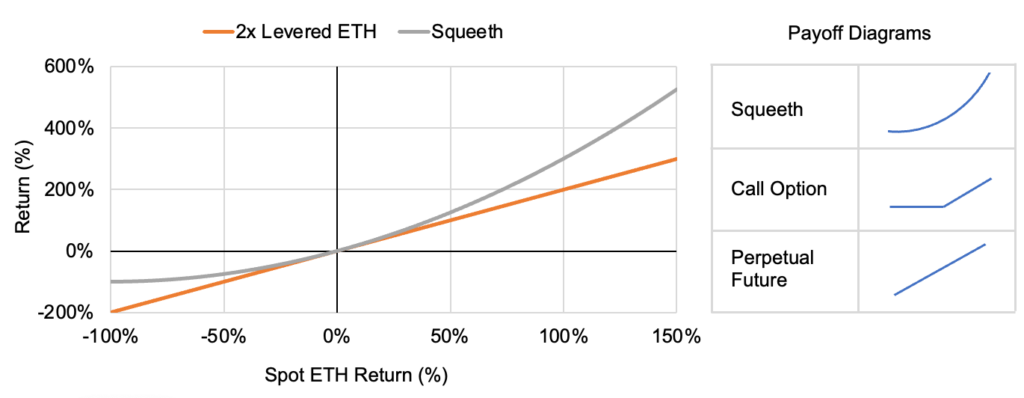

Many have attempted to build a perpetual future equivalent for options that would mitigate fragmentation and consolidate liquidity. Paradigm first released a paper titled Everlasting Options that incorporated a funding mechanism to consolidate liquidity across expirations, but this design still left the market fragmented by strike price. Power Perpetuals extended this idea further, creating an instrument that provides option-like exposure without fragmenting liquidity by strike or expiry. Power Perpetuals, in fact, are a specific type of perpetual future where the underlying asset is raised to a power, most commonly two, providing nonlinear exposure that’s more akin to an option than a future. The most prominent example is Opyn’s Squeeth, a perpetual future on ETH squared. Long Squeeth behaves like an everlasting call option that’s always at the money, providing a constant gamma (convexity) exposure that outperforms an equivalent linear exposure in both bull and bear markets (i.e., optionality is constant and doesn’t dissipate as the price of the underlying fluctuates)11. Resultantly, funding is different than in a typical perp, and longs pay funding to shorts in normal circumstances to compensate them for assuming short gamma risk. While these instruments display some promising use cases for advanced traders (e.g., hedging options or LP positions), the market is still developing and has yet to produce meaningful volume.

Squeeth Payoff Diagram Illustrated Versus Traditional Derivative Instruments

Source: Opyn, GSR. Note: The distance between the gray line and orange lines displays the payoff attributed to Squeeth’s constant gamma profile (convexity).

Crypto Structured Products Landscape

Structured products are a broad category of investment products in traditional finance that package multiple financial instruments (e.g., equities, bonds, commodities, currencies, options, and/or other derivatives) into a single investment product that delivers a return stream linked to some underlying asset or basket of assets over a defined time horizon. By adding, subtracting, or leveraging the return streams of various financial instruments, structured products enable highly bespoke payoff profiles catered to a specific set of risk and return objectives to be simplified into a single investment product; they essentially abstract away the complexity of managing the various underlying positions in exchange for a fee. Structured products come in many different flavors and serve various purposes, but common uses include generating yield, minimizing risk, or structuring payoffs that benefit from the fruition of a particular view or thesis. Crypto structured products have predominantly found success in volatility-selling yield enhancement strategies thus far, but the ecosystem is developing quickly and a wider set of strategies is beginning to emerge.

Crypto structured products are sold across various centralized and decentralized venues today. Binance’s Dual Investment platform is one prominent centralized provider that facilitates the trading of covered calls and cash collateralized puts across 16 different coins, in addition to a limited set of other structured products like straddles. Competing derivatives exchanges OKX and Bybit have similar structured product offerings as well.

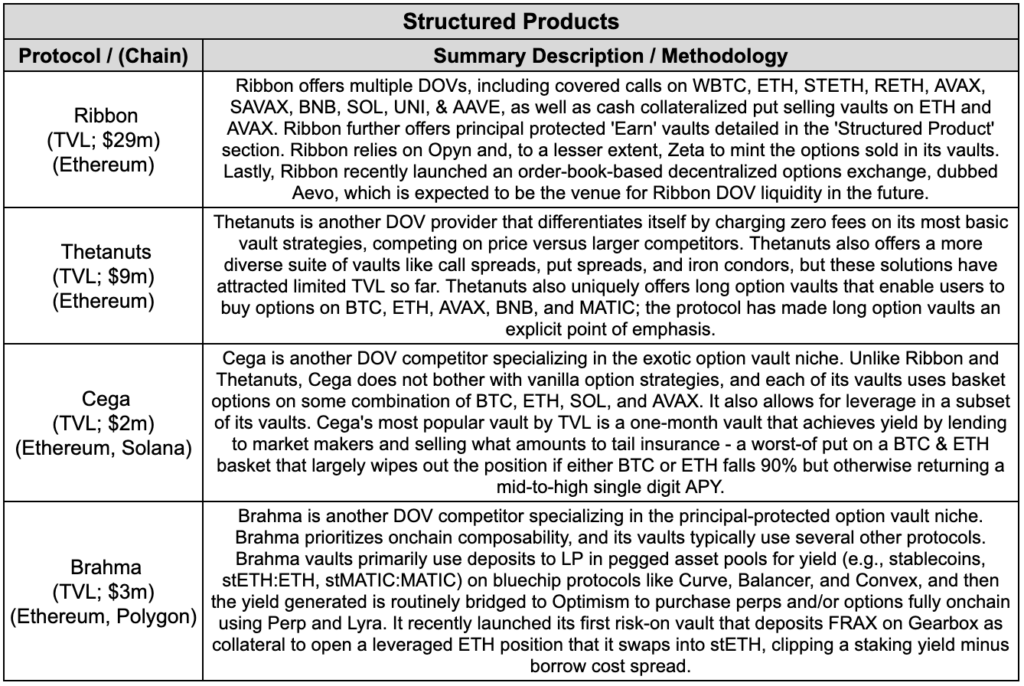

Decentralized structured products shine as a relative bright spot in the decentralized derivatives ecosystem, commanding a larger percentage of market share than other decentralized solutions in the crypto futures and option markets12. Protocols like Ribbon and Thetanuts have found success in the simplicity of their DeFi Option Vaults (DOVs). Unlike trading options directly, DOVs enable users to gain short option exposure without having to choose amongst expiration dates or strike prices. DOVs allow users to deposit collateral in a smart contract that provides a structured option payoff (e.g., covered call, etc.), typically for a fixed period of time, such as a week or a month, and users can choose to withdraw their collateral and any profits or losses at expiration or simply do nothing and maintain their exposure through the next expiry. The implementation approaches vary across DOVs, but in many cases, vaults obtain their short option exposure by minting options via a protocol like Opyn and selling them to market makers via an auction process like Paradigm’s.

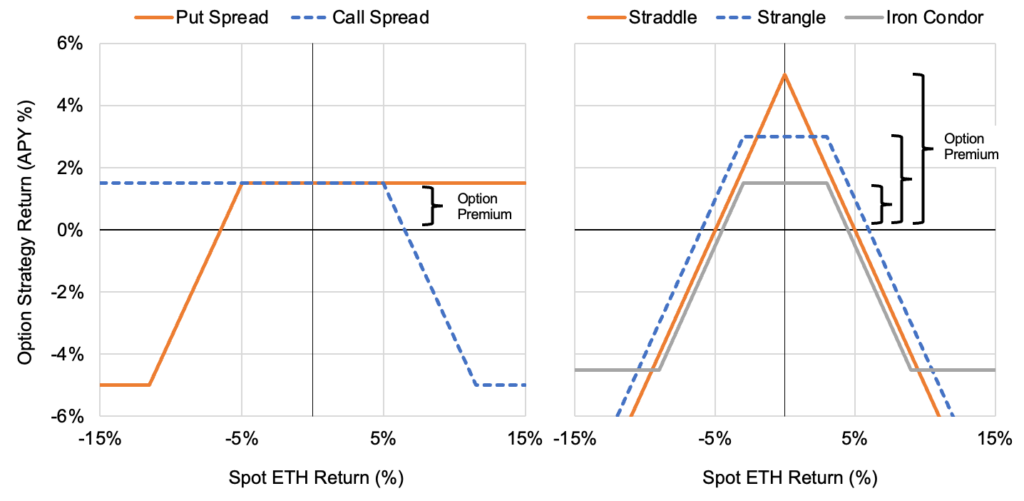

Covered call vaults and cash collateralized puts vaults are the most common structures, and there are active vaults on ~20 of the largest tokens today despite the dearth of assets listed on option CEXs. ETH vaults also exist for multi-leg short-option strategies, like call-and-put spreads, straddles, strangles, and iron condors. Cega’s exotic option vaults go further on the complexity spectrum, deploying a portfolio of knock-in/knock-out basket options that generate yield in exchange for bearing tail risk. Lastly, we would be remiss if we failed to mention the various other yield enhancement structured product strategies that do not explicitly sell options at all. For example, Opyn’s Crab Strategy vault is similar to a straddle, but it generates yield via funding by pairing a short Squeeth position versus long ETH in a delta-neutral fashion. Other examples include levered staking vaults, vaults that manage concentrated liquidity positions on Uniswap V3, and other yield-based strategies. See Appendix C for DOV alternatives.

Illustrative Payoff of Short Spreads, Straddles, Strangles, and Iron Condors

Source: GSR. Note: Short call spreads are a bearish strategy (negative delta), short put spreads are a bullish strategy (positive delta), and short straddles, strangles, and iron condors are short volatility bets that take less directional risk (delta neutral or close to it). Put/call spreads and Iron Condors are defined loss strategies, while straddles and strangles have uncapped loss potential.

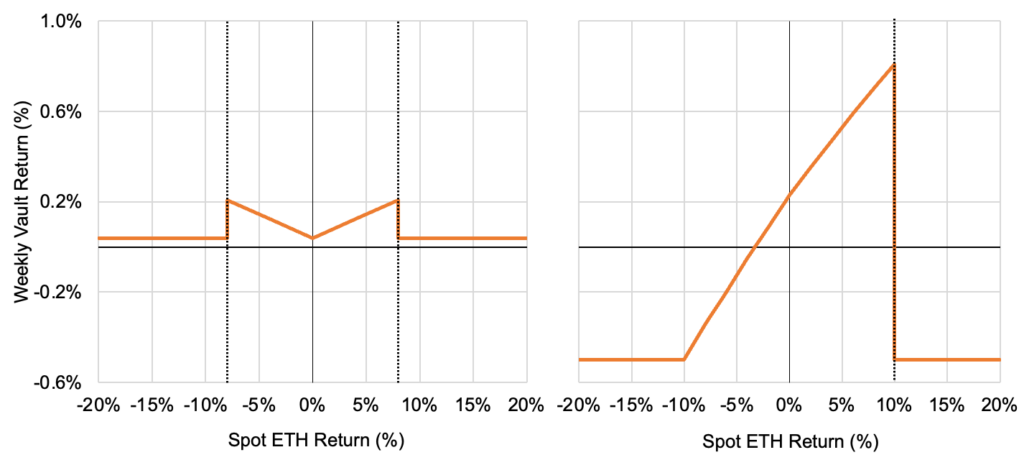

While short option vaults were the first mover and remain the clear TVL leader today, long option vaults with principal protection catering to more risk-averse investors have come to fruition in recent months. Ribbon unveiled two new vaults under its Ribbon Earn branding that strive to protect invested capital while retaining a degree of upside participation. Principal-protected vaults typically achieve this goal by lending the deposited capital for a yield, usually onchain via an AMM or directly to a trusted market-making counterparty, and then using all or a portion of this yield to finance long optionality.

As an example, Ribbon’s Twin Win v1 vault initially took USDC deposits and lent them to Wintermute for a yield that financed the purchase of a weekly at-the-money knock-out straddle; the vault generated a minimum 2% APY, but yields grew from there as long as ETH did not rise or fall by more than 8% in a week. The Twin Win vault was recently restructured into a new v2 iteration, and the vault removed its earlier dependence on a centralized lending counterparty by purchasing tokenized T-Bills for onchain yield13. Ribbon’s other Earn vault alternatively uses ETH staking yield (plus 0.5% of deposits) as the source of financing to purchase a weekly in-the-money knock-out call option (90% strike); this vault risks less than 50 bps per week but fares better than the previous vault when ETH is flat or up less than 10%. Additionally, smaller DOV competitors like Brahma and Vovo offer alternative principal-protected vaults, and Thetanuts recently raised capital to develop new long option vaults. While long option strategies only represent a small share of the market today, we expect the diversity of strategies offered by DOVs to increase beyond the predominantly one-sided short option vaults flourishing today.

Ribbon’s Principal-Protected Vault Payoffs [Twin Win (left); Dolphin (right)]

Source: Ribbon, GSR. Note: Returns are weekly percentage gains; they are not annualized. Dotted lines are knock-out barriers that introduce path dependency. Data is based on illustrative snapshots, but lending yields, staking yields, and option prices will change over time. As of the time of writing, the Twin Win v1 strategy is expected to generate ~4 bps/week (~2% APY) even when the options expire worthless (i.e., it doesn’t spend all of the yield it earns from lending on option premiums). Conversely, the Dolphin strategy pays 50 bps each week plus most of its staking yield to acquire options, so it is not fully principal protected and will lose slightly less than 50 bps per week if the option expires worthless.

Lastly, it’s important to note that the ‘principal-protected’ label commonly used refers to protection from market risk, but users still bear various forms of other risks. For example, lending to a centralized counterparty bears credit risk while gaining yield via staking or AMM-based lending adds additional smart contract risks. Moreover, the ‘principal-protected’ label may be loosely applied to vaults that still retain some degree of market risk, like Ribbon’s Dolphin strategy, which isn’t truly ‘principal-protected’ but is marketed as such, given its small, defined max loss. All in all, a comprehensive evaluation of risks should be done on a vault-by-vault basis for all strategies.

Conclusion

The crypto derivatives market is a rapidly evolving sector that’s begun to flourish in recent years. And like in traditional finance, derivatives play a crucial role in crypto, accounting for the majority of all crypto trading volume globally. Perpetual futures comprise the lion’s share of derivatives volume today, with calendar futures, options, and various other crypto-specific derivatives accounting for the remainder. Perpetual futures have found mass adoption across retail and institutions due to their highly efficient design and simple linear payoff, and perps are now the industry’s most liquid instrument as a result. Nonlinear instruments like options have conversely failed to attract a similar degree of appeal with retail users thus far, and most direct options trading activity is institutional today. Conversely, structured products like DOVs offer simplified access to the options market indirectly, helping to democratize and expand retail participation by shielding users from potentially overbearing strike/expiry selection decisions and position management responsibilities. Looking ahead, we anticipate options will comprise a growing share of crypto volume as the industry continues to mature, growing from relatively anemic levels compared to spot and perps. We share this view for derivative DEXs, whose current market share amounts to less than a quarter of that captured by their spot market analogs. And while we admit it will be a challenge for decentralized derivative volumes to rival that of their centralized counterparts over the near term, we expect the volume differential to decrease as blockchain scalability improves and better derivative DEX mechanisms are designed.

Appendix A: Option Payoffs & The Greeks

Profit/Loss by Derivative Instrument at Expiration

Source: GSR. Note: The illustration assumes a market price of $14, with the call and put struck at-the-money ($14) for a $1.50 premium. Payoffs denoted from the perspective of the purchaser.

An Illustration of Volatility’s Impact on Option Payoffs

Source: GSR. Note: Each bar on the x-axis assumes an equal 50% chance of realizing a positive return or a negative return, but as you move along the x-axis volatility grows and the magnitude of returns grows in absolute value terms. The expected spot return is zero in all scenarios, but the expected option payoff grows with volatility due to its asymmetry.

The Greeks are a collection of metrics commonly used to measure an option’s sensitivity to its prominent risk factors. For the calculus inclined, these are partial derivatives of the Black-Scholes option pricing formula and represent the expected change in one variable for a small/instantaneous change in another variable. We use ATM, ITM, and OTM to denote the option’s moneyness – at-the-money, in-the-money, or out-of-the-money.

Options Greeks

Source: GSR.

Appendix B: Decentralized Derivative Protocol Highlights

Though we are still in the early stages of derivative DEX development, several approaches are used to facilitate the decentralized trading of options and perps via smart contracts. We anticipate the end-game for decentralized derivatives is likely to converge back towards the CLOBs of traditional finance. AMM/vAMM-type approaches constantly decay LP value as they are arbitraged against the leading centralized venues for price discovery (e.g., Binance). Oracle-based approaches help mitigate arbitrage losses accrued by AMMs, allowing for no-slippage trading as they import prices from leading third-party venues, but this approach is inherently capacity constrained and could never be the leading venue for liquidity. If this reasoning is not immediately apparent, imagine a scenario where an oracle-based DEX imports prices from a less liquid venue, then one could theoretically profit by taking a large position on the oracle-based DEX while using a smaller amount of capital to manipulate the less liquid venue’s price and resultantly its oracle that determines the PnL of the larger position. Given Ethereum’s Layer 1 throughput constraints, we expect future developments are most likely to occur on general-purpose Layer 2s (e.g., Arbitrum, Optimism, Starknet, etc.) or bespoke app-specific environments. The latter seems to be an increasingly likely outcome with several prominent projects following this roadmap, including Ribbon’s Aevo exchange launching as an OP Stack chain, dYdX’s upcoming transition to a Cosmos-based appchain, and several other promising projects like Vega and Hyperliquid deploying as appchains.

Decentralized Perp Protocol Examples

Source: GSR.

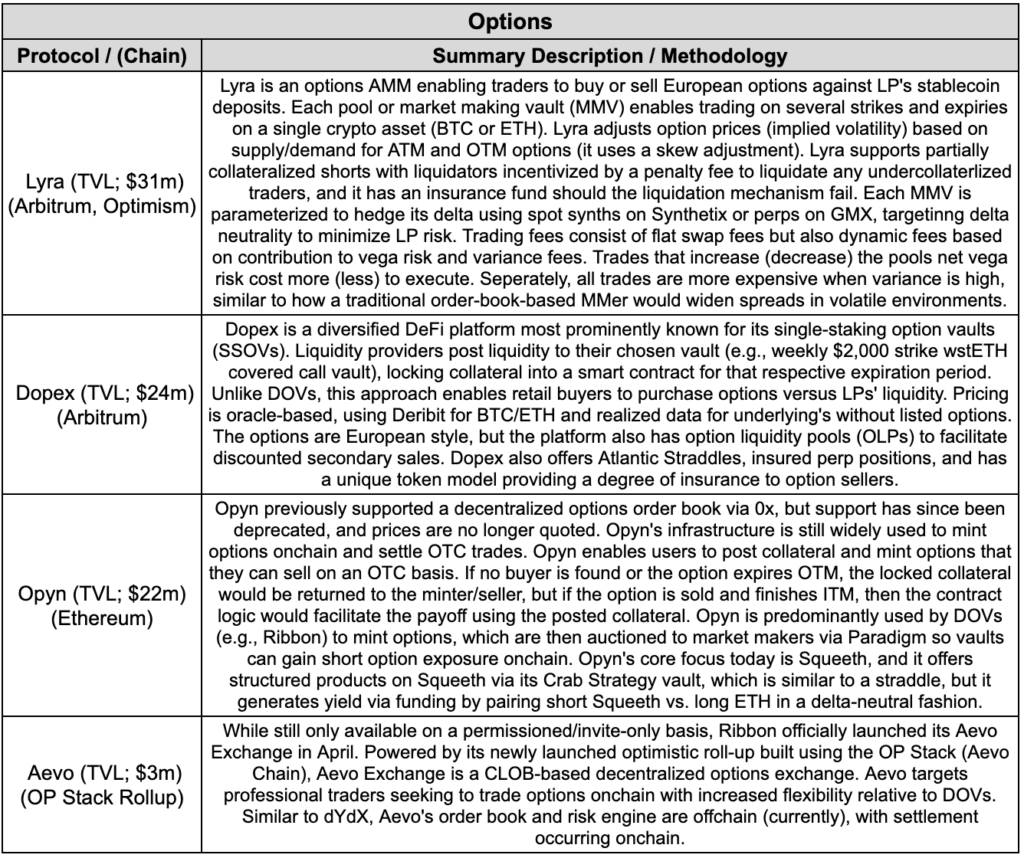

Decentralized Options Protocol Examples

Source: GSR.

Decentralized Structured Products Protocol Examples

Source: GSR.

Appendix C: GSR’s OTC Trading and Managed Solutions Capabilities

GSR’s OTC Trading and Managed Product Capabilities

Source: GSR.

GSR stands by as a trusted derivative ecosystem partner ready to support clients in need of OTC services or managed solutions. Please contact markets@gsr.io to learn more about our OTC services, or contact info@gsrcapital.io for more information about our suite of managed hedge fund solutions. Additionally, for those interested in simply maintaining tabs on the current state of the crypto derivatives market, you can sign-up to receive GSR content via email, where we update various relevant derivative metrics/graphics in our daily market update and provide additional derivatives color in our trading desk commentary. All this material can be similarly accessed via Telegram.

Lastly, we’d note that traditional fund structures can be used as a more developed alternative to DOVs. While DOVs enable permissionless access to managed options strategies via smart contracts, the return streams from options selling can be alternatively packaged in a fund structure with a slightly different set of tradeoffs (e.g., custody, fees, KYC, no smart contract risk, etc.). GSR’s investment advisory arm has researched one such product that seeks to generate a premium in addition to a core bitcoin holding through an actively managed options strategy, selling OTM call options across various strikes and expirations.

Footnotes:

- This is due to principles of no-arbitrage pricing which states that derivatives are priced such that no arbitrage opportunities exist. Since a futures contract is an obligation to purchase an asset at a future date, it becomes no different than the spot asset when that future date arrives, so the price of the future necessarily converges to the spot price on the expiration date or else an arbitrage would exist. Futures contracts are said to be trading in contango (backwardation) when the price of the future is higher (lower) than spot. Thus, if the spot price doesn’t change between one’s purchase of the futures contract and its expiration, contracts in contango will lose money as they converge down to the spot price while contracts in backwardation will profit by converging up to the spot price. The incremental return that a futures contract generates outside of that derived from a change in the underlying’s spot price is known as the carry or roll yield (as the holder rolls up or down the futures curve through time).

- Understanding a contract’s specifications (specs) is incredibly important. The price of oil turning negative at the beginning of Covid was largely attributed to the high cost of storing physical barrels of oil while the contract’s specs required physical delivery at settlement.

- In fact, time and volatility are very closely connected concepts in the pricing of options. Since option buyers are exposed to a positively asymmetric payoff (they are long gamma), they benefit from realized price moves, and prices have more capacity to move when expiration is far away and volatility is high. Increasing (decreasing) an option’s time to expiration generally has a similar impact on an option’s price as increasing (decreasing) its implied volatility. Options lose value everyday due to the passing of time (pay theta).

- Forwards and swaps are the two most common OTC derivatives in traditional finance, but we omitted in-text coverage for brevity due to their similarity with futures and minimal use in crypto. Forwards are virtually identical to futures except that they are not traded on exchanges, so forwards have more flexibility on terms and greater counterparty risk. Swaps are used to exchange one cash flow for another, frequently in a series such as swapping cash flows once per quarter. Swaps are largely used to hedge interest rate risk, currency risk, and credit risk and traditional finance. Swaps may appear more complex at the surface but they are really just a series of multiple forward contracts.

- While the vast majority of crypto derivatives volume occurs on offshore, crypto-native derivative exchanges, crypto derivatives also trade on regulated derivative exchanges in traditional financial markets, like the CME, albeit at a much smaller scale today. The CME offers cash-settled bitcoin and ether futures, as well as options on their crypto futures contracts. In fact, CME crypto futures volume comprises the majority of all calendar futures volume today, and CME crypto options volumes rival competitors like Bybit, OKX, and Binance. Trading crypto derivatives on fully regulated exchanges has become increasingly attractive after FTX’s collapse, particularly for traditional financial institutions. With that said, CME’s footprint is still relatively small after factoring in perps volume and Deribit’s options volume.

- Given the vast number of exchanges in crypto, the term spot price in crypto isn’t as clear as in traditional markets. For this reason the term spot price as it pertains to perps is commonly referred to as the index price, and it’s typically calculated as a volume-weighted average of the spot price across multiple spot exchanges. Perps also have the notion of a mark price, which is calculated using the index price and funding rate, essentially amounting to a smoothed version of the perp’s price for use in unrealized PnL calculations that determine margin requirements/liquidations.

- For those more familiar with the language of traditional finance, positive (negative) funding is analogous to a futures term structure in contango (backwardation). See footnote 1 for further clarity.

- While the details underpinning the calculation of funding rates are relatively complex, the funding rate can essentially be viewed as a perp’s average premium/discount versus the index price over the funding interval. Funding is most commonly paid at the end of every eight hour interval, but Kraken and dYdX notably use one hour intervals so their funding rates must be scaled for uniformity with peers.

- Funding is typically paid/received by traders with open positions at the end of the funding interval. Traders that enter positions and exit them before the end of the funding interval typically do not pay/receive any funding. Prices of the perp should efficiently adjust for this so there isn’t any free lunch entering/exiting positions ahead of the funding cutoff. This is not too dissimilar from a stock’s price dropping as it goes ex-dividend since subsequent buyers will not receive the dividend payment from that point on.

- BNB options are listed on Binance and SOL options were listed on Deribit prior to the collapse of FTX. Still, the overwhelming majority of option volume on centralized venues is in BTC & ETH. More options are available via OTC desks like GSR or via decentralized protocols that rely on OTC desks as their counterparty.

- Squeeth notably has some implementation differences than other centralized perps that we’ve discussed more thoroughly. Squeeth (oSQTH) is an onchain ERC-20 token that functions as a perp on ETH2. It’s mintable by shorts via the Opyn protocol and purchasable by longs on DEXs. Shorts accrue funding for assuming negative gamma exposure, but instead of discrete funding payments, the funding is internalized in the token’s price and the price of oSQTH will constantly decay by the funding should ETH’s price be stable. Long’s cannot be liquidated.

- Structured product volumes are difficult to disentangle as they are not a distinct derivative instrument but a combined package of assets, including derivatives. Additionally, limited information about the volume of centralized structured products is available to our knowledge. With that said, we can get a lower bound for decentralized structured products volume simply from Ribbon, and knowing that most crypto structured products are options-based products and represent a subset of CEX option volume, we estimate that centralized structured products volume must be a subset of (CEX options volume – decentralized structure products volume). With Ribbon alone accounting for more than 50% of all decentralized option trading volume via Opyn, centralized structured products would need to represent nearly all centralized options volume for this argument to be false, which we empirically believe to be quite far from reality.

- In addition to changing the yield generation approach from a centralized lending counterparty to onchain treasuries, the knock-out barriers are also set differently. The up/down barriers were statically set at +/- 8% previously (fixed strike), but now they will be set by targeting 10 delta, allowing the barriers to fluctuate as expectations for volatility shift.

Authors:

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

The authors would like to extend a special thanks to Laevitas for providing the bulk of derivatives market data used throughout this report.

Sources:

Re-evaluating the Decentralized Derivatives Landscape – Delphi, Overview of Option Vaults – Messari, A Lot Of Onchain Option But Few To Exercise – Zee Prime Capital, State of Crypto Derivatives Market – Jump, An Explanation of DeFi Option Vaults – QCP, Crypto Quanto and Inverse Options in a Black-Scholes World, Wade/Squeeth – Twitter, Aevo Launch, DeFi Llama, The Block, Laevitas

Additional sources include protocol docs, websites, and discords for every project referenced herein, as well as centralized exchange websites/docs.

Required Disclosures

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.