Accumulators are a form of financial derivative (or “structured”) product used in the traditional financial markets that are popular in times of high market volatility. This type of financial product requires the investor to buy (or sell) an asset at a predetermined price (the “strike price”), which is settled periodically. The basic idea of an accumulator contract is that the investor speculates the price of an asset will trade between a certain range over a certain time period. The investor is obligated to buy (or sell) the asset at the strike price, and accumulates (or liquidates) a position over the duration of the contract. The bullish or bearish market view of the client can be expressed by choosing the strike prices accordingly, allowing them to take advantage of the market’s volatility.

Miners and Daily Price Risk

GSR has created a first-of-its-kind product explicitly designed for miners who are accumulating digital assets and dealing with daily price risk. The accumulator helps them in offloading their assets without going through the arduous process of manually selling crypto on exchanges. Miners producing digital assets on a continual daily basis are faced with price risk between the time they produced the coin and the time they sell. A simplistic trading strategy of selling immediately at the market price is time-consuming, involves daily deposits, and incurs extensive exchange fees. Alternatively, building up a large inventory and “timing the market” also introduces unnecessary risks.

GSR has developed an over-the-counter structured product that is tailored to the hedging requirements of a miner. It enables the investor to sell inventory on a daily basis at above current market levels, earning them an extra yield on their inventory. The daily amount and price is fixed upfront and there is no upfront premium to be paid.

In Practice

For example, let’s say there is a miner producing 20 BTC every day. If they invested in an accumulator from GSR on 10 BTC, each day they could sell 10 BTC for USD above the market price based on certain predefined conditions, namely the strike prices and the contract duration.

The price that is referenced for the accumulator is a BTC index, such as the CME-CF BRR, and the reference time is preset. Parameters for the accumulator are customizable with the constraint that you cannot sell more than half your expected mined BTC via the accumulator.

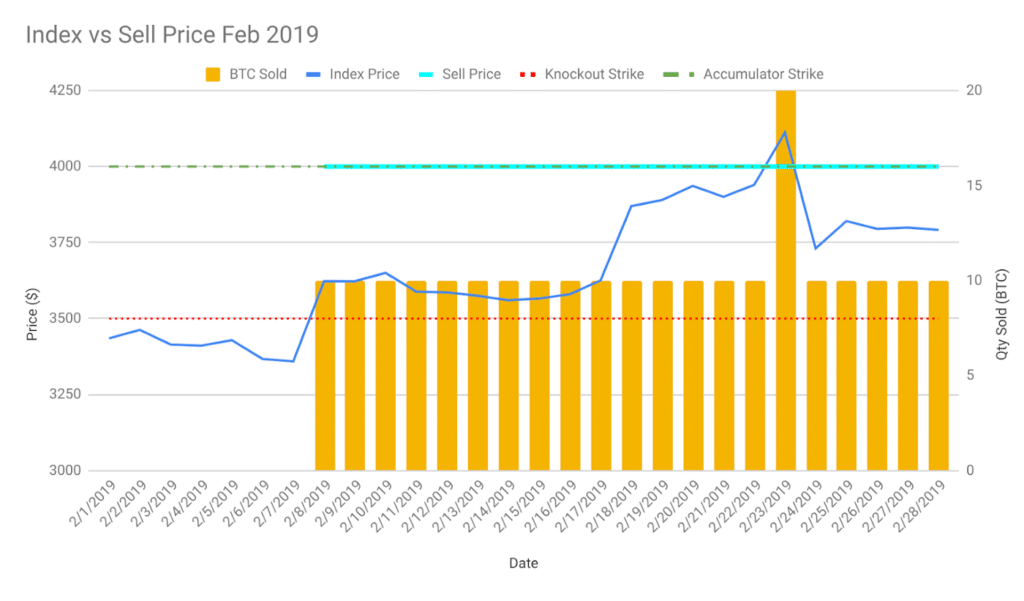

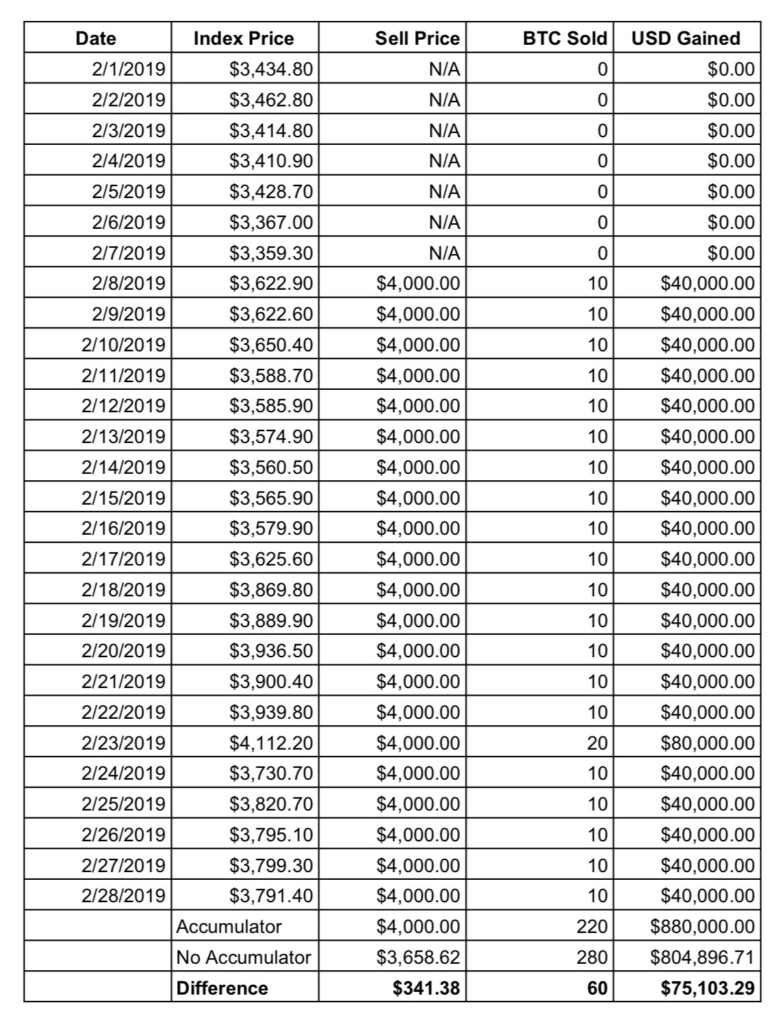

A duration for the accumulator would be chosen, in this case 1 month, ending February 28th 2019.

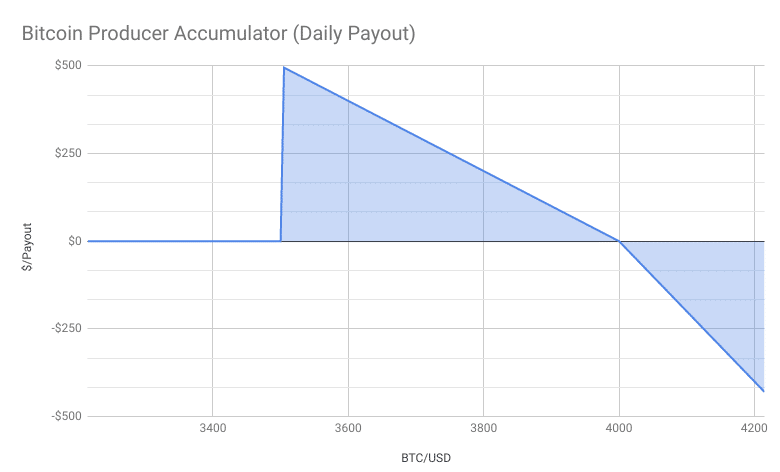

The accumulator strike price (“Accumulator Strike”) is chosen at $4,000, meaning if the market price was above that, then the miner would sell double the contract amount, or in this case 20 BTC. However, there is also a “Knockout Strike” at $3,500, which is the price threshold each day at which below no BTC is sold. In between the Accumulator and Knockout Strikes, the miner sells 10 BTC above the reference price index each day based on the implicit premium in the strikes chosen.

If this accumulator was created on February 1st, it would have expressed a bullish bias by the miner since the price was below $3,500 when it was initiated and no BTC would be sold until 2/8. At this point 10 BTC would be sold each day at the accumulator strike price of $4,000. Then on 2/23 when the price rallied past $4,000, 20 BTC are sold each day at the locked in price of $4,000, until 2/24 when the price dropped back below the Accumulation Strike. Again, 10 BTC are sold at the accumulator price each day until the accumulator expired at the end of the month.

Performance

Compared to simply selling BTC daily each day regardless of the price, the accumulator earned $75,103.29 more having sold an equivalent amount of BTC. The average sells for the accumulator in February would have been on average $341.38 or 9.33% higher than if a straightforward daily liquidation strategy had been performed, not to mention saving the time and effort needed to manually execute the trades.

Advantages & Risks

Simply put, this product means that market prices that occur above the Accumulation Strike will mean selling below the market for that day, and prices below the Knockout Strike will mean nothing is sold for that day. The Accumulator product does come with certain risks, however for miners producing BTC predictably it likely will maximize revenue while reducing their workload. The Accumulator parameters are also highly customizable to fit expected production levels and align with hedge amounts. By referencing an index price for liquidations, miners have a transparent and liquid means of monetizing their BTC while avoiding slippage. Also, by settling at the end of the accumulator period and avoiding daily liquidations, withdrawal and trading fees are eliminated. The risk to miners is that they sell below the market for the day when price rallies above the Accumulation Strike, generally still a net positive for miners. As already outlined, the risk is that no BTC is sold when the price is below the Knockout Strike. However, in both cases, the Accumulator can be unwound or restructured before maturity if strikes become deep in- or out-of-the-money. Furthermore, miners still have the ability to express bullish or bearish views on the market depending on the strike prices chosen.

Summary

In summary, taking advantage of structured products such as accumulators is a way of maximizing potential revenue from BTC mining while reducing overall price risk and isolating risks to mining specific variables like electricity and hardware costs. GSR has extensive experience designing tailored products to fit any unique set of revenue targets and risk profiles.

About GSR

Founded in 2013, GSR is one of the original leaders in algorithmic digital asset trading. We have traded billions of dollars of digital assets utilizing our proprietary software suite, capable of satisfying all liquidity needs, from basic execution services to highly complex solutions. We have a deep understanding of crypto liquidity and microstructure, having integrated into over 35 trading venues. Our team leverages decades of experience from Goldman Sachs, Two Sigma, Nomura International, Oracle, Circle and IBM across trading, quantitative investments, and trading technology. GSR’s algorithmic platform has been trusted by many of the top players in the space, including miners, protocols, ICOs, exchanges, custodians, and banks.

If you would like to learn more about this type of structured product, contact markets@gsr.io