Bitcoin and Ethereum

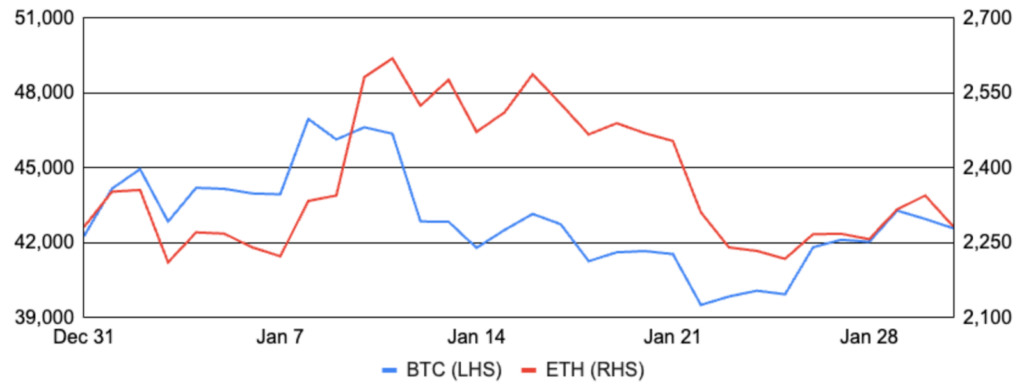

Bitcoin gained ~1% during January after entering the month around $42,300 and finishing at ~$42,600. Bitcoin rallied into the approval of spot Bitcoin ETFs on January 10th, but price topped out around ~$48,500 the next morning before dwindling lower for most of the month due to GBTC outflows. Bitcoin bottomed beneath ~$39,000 on the 23rd, resumed its uptrend into month-end, and realized a small positive gain, with much of the intra-month volatility stemming from the ETF launches, discussed more below. It was also an eventful month for Bitcoin miners, headlined by Core Scientific’s emergence from bankruptcy and relisting on the Nasdaq, while Swan Bitcoin also unveiled a new mining unit and Cipher announced a purchase of ~16.7k Canaan mining rigs. Elsewhere, German law enforcement seized ~50k bitcoin that was reportedly earned through a pirated movie distribution service; Taproot Wizards unveiled its Quantum Cats Ordinals collection and the genesis cat sold for a staggering ~$254k via Sotheby’s but the broader mint was been riddled with challenges; an unidentified address sent ~27 bitcoin to Satoshi’s genesis wallet and sparked a flurry of speculation; and, the Crypto Open Patent Alliance (COPA) declined a settlement offer from Craig Wright and is now seeking a declaration from the UK High Court that Craig Wright does not have legal rights over the Bitcoin name.

Ethereum finished January unchanged around $2,300 despite facing even greater volatility than bitcoin. ETH underperformed early in the month leading into the ETF approval decision, but outperformed sharply on the Bitcoin ETF approval news as bitcoin faded into the rearview mirror and the narrative transitioned to ETH as the next potential ETF beneficiary. On the development front, the Dencun hard fork was successfully implemented on the Sepolia testnet and developers plan to execute the final testnet fork on Holesky on Wednesday (today) before an anticipated mainnet fork later likely in March. In addition, a renewed focus on the tail risk of Ethereum staking was arguably the most notable development after bugs plagued Ethereum’s Besu and Nethermind clients during the month. Leaving the minutiae to our prior work, the key takeaway is that these minor bugs would have caused billions in staker losses if they emerged in the Geth client that’s currently used by the supermajority of Ethereum validators. While there have been many efforts to reduce Ethereum’s dependence on Geth historically, the efforts lacked meaningful progress until Nethermind served as the canary in the coal mine sparking an eruption of social pressure against the largest node operators to diversify. Allnodes and P2P Validator have led the early diversification wave, but even larger operators like Coinbase and Kiln have signaled that client diversity improvements are likely to come in short order, presenting a viable path towards finally ending Geth’s supermajority reign.

BTC and ETH

Source: Santiment, GSR.

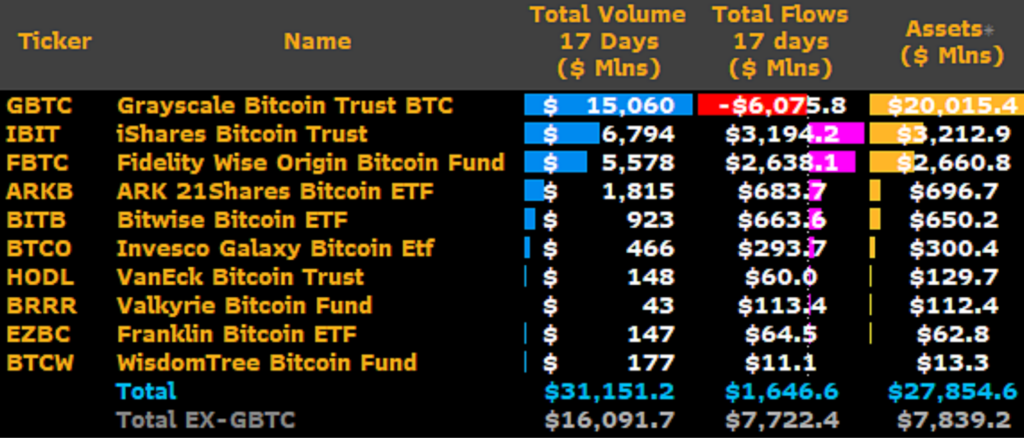

Spot Bitcoin ETFs Approved in the US

After a decade-long wait, the SEC issued an omnibus approval for spot Bitcoin ETFs in January, allowing the Grayscale Bitcoin Trust (GBTC) to convert to an ETF alongside nine newly launched competitors. Bitcoin rallied briefly following the approval, but sentiment quickly soured and bitcoin suffered a ~20% peak-to-trough slide over the following ~12 days. While early demand has been incredibly strong relative to any traditional ETF launch, more than $6.0b has exited from GBTC and the infamous Grayscale widowmaker trade, offsetting the majority of the ~$7.7b of inflows into the nine other products. Moreover, it’s likely that many of the net inflows were likely funded in part from existing bitcoin exposures, such as from spot bitcoin, bitcoin futures, non-US bitcoin ETFs, etc. While the market’s response indicates the initial demand underwhelmed the immense expectations, the approvals remain an enormous win for retail investors. The discount on shares of GBTC has evaporated and unlocked billions of dollars of value, and investors can now access passive bitcoin exposure for a 0.19% annual fee, which is less than half of the cost of making a single trade on Coinbase. BlackRock and Fidelity have separated themselves as the early AUM leaders at ~$3.2b and ~$2.6b, respectively, but Ark and Bitwise have each raised a commendable $650m+ as well.

Crypto ETF attention will now shift to Ethereum, which is the only other cryptoasset with a shot of being granted approval in the US for the foreseeable future. The SEC must now approve or deny Van Eck’s application by May 23rd, 2024. We are optimistic that approval will come in May, but it’s by no means a sure thing, and prediction market odds have trended sharply lower, currently indicating a ~42% chance of approval.

Spot Bitcoin ETF Applicants’ Tickers, Fees, and Waivers

Source: James Seyffart (Bloomberg Intelligence), GSR. Data as of Feb 6.

Frame(ing) Decentralized Social

Decentralized social networks have long-been a promising use case for blockchains that can return agency to users and reduce entrenchment by lowering switching costs/vendor lock-in. And while bootstrapping a new social network is particularly challenging (e.g., cold start problem), notable improvements around censorship resistance, social graph ownership, and algorithm selection (i.e., selecting an open-sourced algorithm to interact with instead of being forced into a closed-source algo from incumbents) may be enough to eventually flip today’s centralized paradigm. We are still in the very early days of decentralized social development, and the two largest blockchain-based decentralized social networks still require whitelisted access (e.g., Lens) or just recently opened access (e.g., Farcaster). However, decentralized social networks made a big splash in January despite their nascency, and Farcaster 10x’d its daily active user records after unveiling Frames, its latest and most viral feature implemented to date.

Frames allow developers to turn posts on Farcaster’s Twitter-like Warpcast into interactive applications that users can engage with directly from their feed. The first viral example was a free, in-feed NFT mint that users could mint in their Warpcast-connected wallet without ever leaving their feed or even prompting a signature; users only needed to share the post to become eligible and then could mint with a single click. Another notable Frame facilitated the purchase of Girl Scout Cookies, and while this takes a few extra clicks before prompting checkout via Coinbase Commerce, one could envision a one-click future where an address is securely tied to a Farcaster account. In less than a week since Frames were unveiled, we’ve already seen a flurry of Frames-focused hackathons with more than $30k of grassroots bounties posted seeking to stimulate idea generation in a wide-open design space. We’d recommend checking out Not Boring’s coverage for a deeper overview of Farcaster and Frames.

Farcaster Frame to Purchase Girl Scout Cookies

Source: Warpcast, GSR.

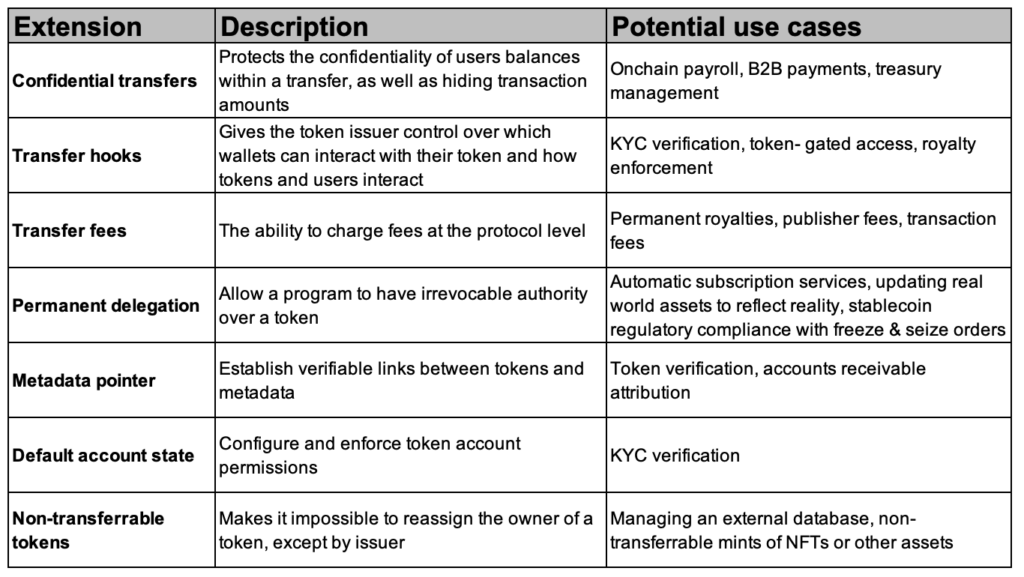

Extending the Enterprise Use Case

Another prominent development during the month was Solana’s announcement of Token Extensions, which is its next generation token program that enables increased token-level functionality in support of enterprise use cases. Token extensions can be viewed as a standardized set of audited token features or modules, and token issuers can optionally incorporate any number of these modules on a plug-and-play basis to add new token functionality that’s natively supported at the protocol level. In simple terms, Token Extensions introduce a standardized framework for issuers to incorporate permissioned features into their tokens without requiring any third-party tooling or bespoke engineering.

Some of the most notable token extensions include confidential transfers, transfer hooks, and permanent delegation. Confidential transfers enable users to transact publicly but use ZK proofs to obfuscate the transfer amount to all but the sender, recipient, and any other prespecified parties (e.g., auditor). Transfer hooks are another powerful token extension that call some arbitrary code whenever a token is transferred, enabling many use cases that require permissioned transfers (e.g., KYC, AML) but also solves the creator royalty enforcement problem that has long-plagued the NFT ecosystem. Lastly, the permanent delegate extension gives token issuers enhanced privileges to burn/transfer tokens on behalf of others (i.e., revocation), and Paxos recently leveraged this extension in deploying its USDP stablecoin on Solana. See here for more details.

Solana Token Extensions

Source: Solana, GSR. This list is non-exhaustive and a more comprehensive list can be found here.

Points Everywhere

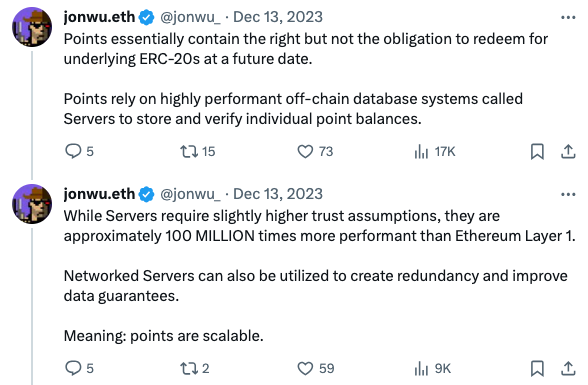

Perhaps one of the most notable trends of the last several months has been that of points, where in lieu of issuing an outright airdrop, many protocols have instituted a points system, awarding points to users for being active on the protocol. Users assume these points will convert to some amount of tokens via an airdrop in the future, though protocols maintain full discretion around points and may not even doll out tokens to points holders at all.

Points started in earnest when Blur, the largest NFT marketplace, effectively used points incentives (and a superior product for professional NFT trading) to unseat OpenSea from its market share lead. Friend.tech also helped popularize points, dropping points each week using an unspecified allocation mechanism that caused users to speculate on what activities would earn the most points. Now, a myriad of protocols use points to incentivize activity, such as Blast, Eigenlayer, many LSTs / LRTs, and even wallets like Rainbow. So popular have points been that The Block estimates there have been over 40 billion points given out to users, though with so much yet to be determined, this is a pretty meaningless number.

Finally, note that points are quite controversial. Proponents argue that points give protocols flexibility and enable experimentation, allowing protocols to tweak incentives to guide user behavior. In addition, some claim they add sybil protection against airdrop farmers by inserting an additional step / layer prior to an airdrop. Lastly, many believe points offer greater legal and regulatory protections, and dapps may, for example, feel more comfortable handing out points to US users that it can convert into an airdrop once there is more legal and regulatory clarity. Opponents of points, however, argue that points are kept in offchain, centralized databases, and are therefore a step back versus onchain constructs. Points systems are also quite opaque, can be changed, and offer no assured benefits for users who often jump through hoops to get them. And, with a lack of clear end dates and likely future examples of protocols not ultimately rewarding tokens to points holders, it remains to be seen whether the usage of points will subside or proliferate.

Tongue in Cheek Twitter Thread Explainer on Points

Source: Twitter, GSR.

GSR in the News

Coindesk – Crypto Market Maker GSR Appoints Former JPMorgan Executive as Head of Trading

Business Wire – GSR Boosts Executive Leadership with Head of Trading Hire

Bloomberg Law – JPMorgan’s Koukorinis to Head Trading at Crypto Firm GSR

Blockworks – Former JPMorgan executive appointed as head of trading at crypto firm GSR

Finance Feeds – GSR Hire JP Morgan Andreas Koukorinis to Enhance Crypto Trading and Execution

The Block – GSR hires former JPMorgan executive Andreas Koukorinis as new trading head

Coingape – Former JPMorgan Head Koukorinis Moves to GSR for Crypto Push

The Crypto Times – GSR Appoints Former JPMorgan Executive as Head of Trading

Bloomberg – Traders Look to Bitcoin ETFs to Patch ‘Alameda Gap’ in Crypto Market

Global Digital Finance Annual Report – Scaling for Success

The Block – Hybrid crypto exchange Cube reaches $100 million valuation in new funding round

TechCrunch – Masa Finance gets $3.5M pre-seed to build its decentralized credit protocol

The Block – Crypto experts predict whether a spot Ethereum ETF will get approved in 2024

Bloomberg – EDX Plans Asia Crypto Exchange With Funding From Sequoia and Pantera Capital

The Block – Kiln raises $17 million in latest funding round to expand crypto staking platform

Coindesk – Grayscale’s GBTC Discount Closes to Zero for First Time Since February 2021

Blockworks – How analysts, executives are reacting to spot bitcoin ETF approval

The Block – (Spaces) Spot Bitcoin ETFs with VanEck, Valkyrie, GSR & Fox

The Block – (Spaces) Spot Bitcoin ETFs with Bloomberg, VanEck, GSR & Fox

Cointelegraph – DeFi lending service raises $6.1M to improve capital efficiency

Fortune – Predictions from top investors on cybersecurity, crypto, and fintech for 2024

Authors:

Brian Rudick, Senior Strategist | Twitter, Telegram, LinkedIn

Matt Kunke, Research Analyst | Twitter, Telegram, LinkedIn

View January 2024 Market Update

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.