The likely imminent approval of spot exchange-traded funds for bitcoin could be a game-changing moment for the digital assets industry.

Originally Seen in CoinDesk’s Trading Week

Bitcoin is the non-sovereign reserve currency of the digital world, and from an investment management perspective, it can uniquely and inexpensively diversify well-balanced portfolios to improve total risk-adjusted returns. However, while there have been many ways to gain exposure to crypto’s apex asset, there has long been one glaring hole, the holy grail of access if you will: a US spot bitcoin ETF.

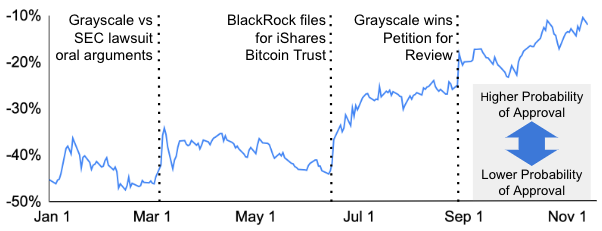

The road to a US spot bitcoin ETF has been long and arduous, with the SEC rejecting all 33 applications across more than a dozen filers since the Winklevoss twins first sought approval over a decade ago; however, from BlackRock, with its $9T in AUM and impeccable application track record, entering the fray in June to Grayscale’s resounding court victory over the SEC vacating its previous application denial to the recent approvals of a levered bitcoin futures ETF and Ethereum futures ETFs, it appears as if we are closer than ever before. Indeed, noted industry analysts now peg the chance of approval by early January to be 90%, Grayscale’s discount to NAV has narrowed from 45% at the beginning of the year to 12% indicating a higher market-implied probability of approval/conversion, and bitcoin is up a resounding 120% year-to-date due at least in part to spot ETF hopes. So what’s the big deal?

GBTC Discount to NAV, %

Source: Grayscale, GSR. Note: GBTC shares trade at a discount to its NAV due to the absence of a redemption mechanism for shares. However, if Grayscale converted GBTC to an ETF, authorized participants (APs) could redeem shares for the underlying bitcoin and the price should converge to NAV (holders get NAV minus bid/ask spread).

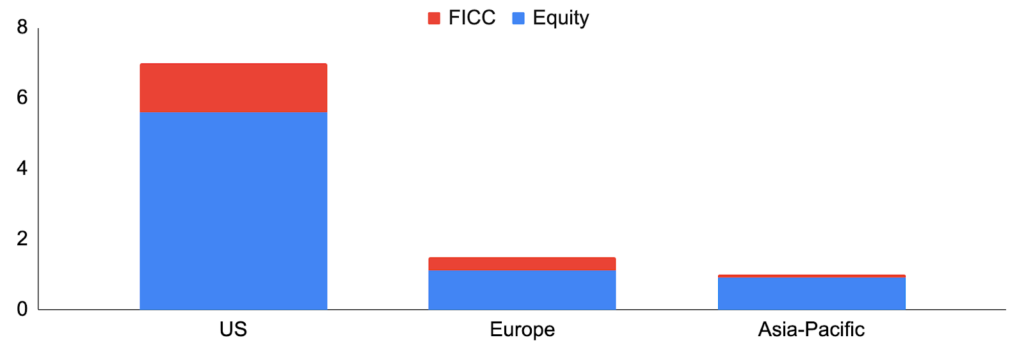

A US spot bitcoin ETF is a massive opportunity because of the sheer size of the US capital markets. In fact, SIFMA estimates that the US accounts for a full 40% of total global fixed income assets and equity market cap. Moreover, ETFs in the US represent a greater percentage of total assets than in other jurisdictions, coming in at 7% of equity and fixed income assets versus 4% in Europe and 2% in Asia-Pacific. All in, that amounts to a $7.0T US ETF market, which is multiples the size of Europe’s $1.5T market and Asia-Pacific’s $1.0T market. Looked at another way, assets managed by broker dealers, banks, and RIAs in the US total nearly $50T, so it would take just a tiny percentage of managed and brokerage assets migrating into a spot bitcoin ETF to move the needle. And crypto adoption in the US is high with the US ranked fourth in Chainalysis’s Global Crypto Adoption Index, portending well for adoption translating into investment.

ETF Market Size by Geography, $T

Source: BlackRock, GSR.

Another reason a US spot bitcoin ETF is such a big deal is because of its advantages over other vehicles and the resulting increased likelihood of greater adoption. Relative to spot, futures, proxy stocks, OTC-traded trusts, and private funds, ETFs offer a unique and advantaged combination of fees/transaction costs, liquidity, tracking error, and operational complexity, not to mention alleviating the need to figure out custody. And while several Bitcoin futures ETFs have existed since late 2021, there are notable disadvantages to futures-based ETFs such as tracking error, tax inefficiency, and roll costs that will typically lead to material underperformance over time, making them more appropriate for short-term trading than a buy-and-hold strategy that better capitalizes on the benefits bitcoin brings to a portfolio. Put simply, a US spot bitcoin ETF gives bitcoin legitimacy, eliminating regulatory uncertainty (many compliance departments currently don’t allow it), giving credence to crypto as an asset class, and ensuring strong oversight and investor protections, all in a vehicle that investors are very familiar with. Add in a potential offering from the likes of BlackRock, with its sterling reputation among advisors and distribution to nearly every major wealth platform, and it’s easy to see why investment managers and advisors would suddenly take the leap. In fact, only 12% of financial advisors currently recommend bitcoin to clients according to the Digital Asset Council of Financial Professionals, but a full 77% say they plan to do so if and when a US spot bitcoin ETF becomes available.

While predictions around inflows and their resulting impact on price are notoriously difficult when dealing with a new asset class, the introduction of a spot ETF and its impact on the gold market is perhaps the best analogy. Indeed, like bitcoin, gold has a (relatively) fixed supply, and prior to the launch of the first spot ETF, the SPDR Gold Trust (GLD), by State Street Global Advisors in late 2004, it too was difficult to access by investors. However, the SPDR Gold Trust reached $1b in assets in just three days, setting a record at the time, and today sits at roughly $55b. All in, gold ETFs hold over 3,200 tonnes of gold worth ~$200b and equate to 1.5% of the gold supply. And while the analogy isn’t perfect – it was harder to own gold prior to the introduction of an ETF than it is to own bitcoin now, bitcoin is significantly more volatile than gold so investors need less exposure to achieve the same potential return, and gold funds certainly benefited from the macroeconomic environment at the time – the price of gold has increased over 4x since the first spot gold ETF was introduced. To boot (and liquidity issues aside), bitcoin will likely see a larger impact on price for each net new investment dollar it accrues than did gold, as bitcoin’s market cap is just 27% that of gold in 2004. A spot ETF transformed the gold market, and it just may do the same for bitcoin.

ETF Holdings of Gold in Tonnes vs. Gold Price

Source: World Gold Council, GSR.

To be sure, there is still significant uncertainty around ultimate approval, the AUM that spot ETF products may raise, and the resulting impact on price. And whether due to relatively subdued sentiment compared to the bull markets of yesteryear, the run-up in price in anticipation of an approval or portended by the lackluster debut of ether futures ETFs, it’s entirely possible and perhaps probable that short-term inflows will disappoint. However, given the size of the US market, the superiority of a spot ETF product, and the impact spot ETFs had on gold, the world is perhaps at the precipice of a truly game-changing moment for bitcoin and digital assets as a whole.

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.