MACRO + CRYPTO SUMMARY

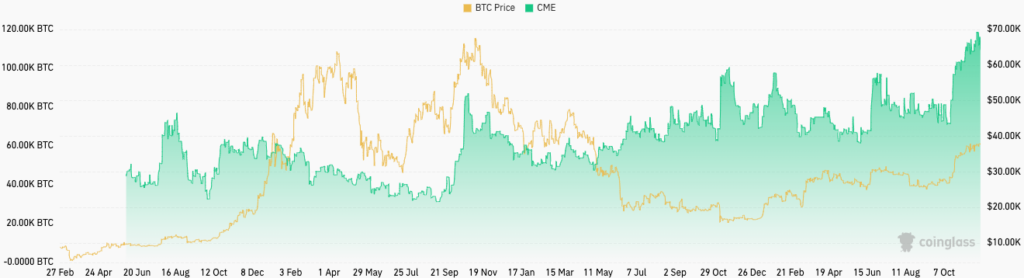

Digital asset markets have been strong in November as incremental news flow continues to point to the imminent approval of a spot Bitcoin ETF in the United States. In anticipation of this, traditional finance participants have drastically increased their bullish Bitcoin bets as evidenced by CME Open Interest pushing to new all-time highs. The CME now represents the single largest venue in terms of Bitcoin OI across regulated and unregulated exchanges.

CME BTC Futures Open Interest

Source: Coinglass, GSR.

Somewhat counterbalancing the buoyant macro inflows, publicly available filings and tracked wallet addresses indicate the FTX estate has begun to methodically liquidate its various token holdings into the market strength, and FTX was additionally given approval to begin selling their Grayscale Bitcoin Trust (GBTC) holdings.

All of the above has led to a fairly balanced market dynamic with leveraged positioning built up in anticipation of a wave of 401k, pension, and retirement flows offset by ready sources of supply.

The backdrop calls to mind prior run ups in speculative positioning into both Bitcoin futures ETF approvals in 2021 and Bitcoin futures approvals in 2017, which marked local tops. As such, it’s possible bitcoin may sell off upon actual spot ETF approval, though the long-term opportunity remains massive.

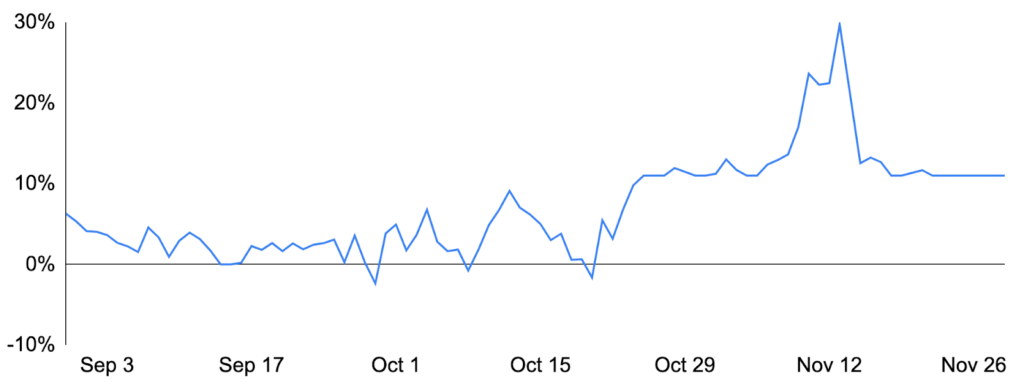

RATES, FUNDING & BASIS

The bullish sentiment over the last few weeks has had a profound effect on the perp funding market, with funding rates hitting their exchange caps and sometimes being let to break through as relentless pressure for leverage hit exchanges. Similar effects have been seen at the CME, the primary derivatives venue for more traditional finance players, where futures basis has consistently remained in the double digits.

24 Hour Rolling Average BTC Funding Rates – Top 2 Exchanges by OI

Source: Binance, Bybit, GSR.

The direct impact of this has been that cash and the opportunity cost of capital has become extremely expensive. Lending rates for stablecoins on exchanges, where driven by supply and demand, shot up from 5-6% to 10%+. Arbitrageurs with cash on hand have sought to buy tokens and sell perps to earn this basis, implying an excess of token supply and putting downward pressure on BTC and ETH lending rates.

The market for RWAs, predominantly tokenized T-bills and money market funds, has continued to flourish as new participants, each with their own niche features, continue to come in and the TVL continues to increase. These new “risk-free” yields becoming accessible onchain has gradually led to rates in other corners of the market going up. Supply rates on Aave and Compound, for instance, have gradually inched higher from 1% earlier this year to north of 4-5% depending upon the market.

Another area that continues to see interest is indices on ETH staking rates. A few different providers have cropped up, each with their own slightly different way of calculating and publishing staking yields. Whether these ultimately become traded via derivatives remains to be seen, but the rates continue to gradually inch lower as more ETH gets staked and rewards are distributed over a wider validator set.

DERIVATIVES

ATM vols in both BTC and ETH spiked after the rally in early November. Since then, the front of the curve has come in strong with longer dated vol holding the higher levels. Skew in ETH has been fairly volatile but range bound, while BTC skew has remained relatively constant.

ETH saw a much more significant selloff in vol post the Thanksgiving holiday and has held higher vol of vol than BTC over the month. Realized volatility has recently dropped below 30d implied volatility, similar to how vols were running in the months leading up to BTC’s rally to $30,000.

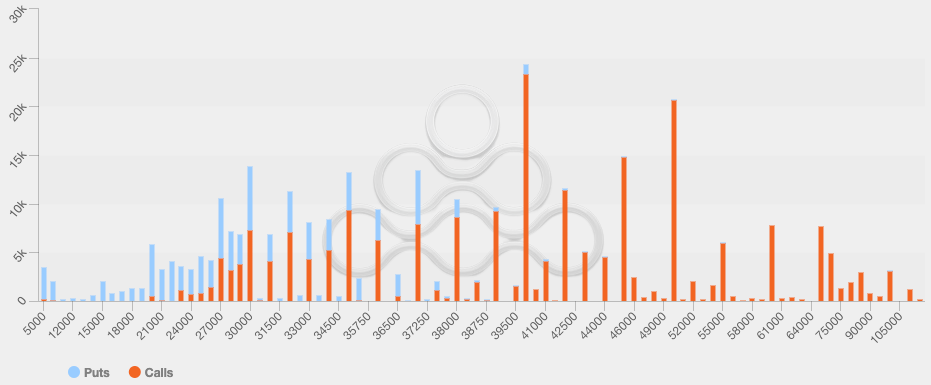

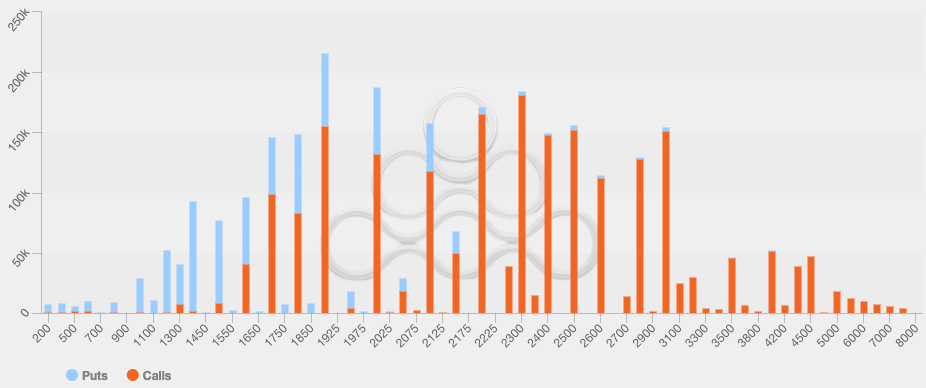

The potential approval of a spot Bitcoin ETF has spurred material activity in upside calls, creating very large OI’s in the $40,000-50,000 range in BTC and in the $2,000-3,000 range in ETH.

BTC Open Interest by Strike

Source: Amberdata, GSR.

ETH Open Interest by Strike

Source: Amberdata, GSR.

Following the new margin rules on short vol on Deribit, it is more costly to hold short vol positions. This could result in significant vol squeezes if we see BTC and ETH take another leg higher.

FLOWS & LIQUIDATIONS

BTC and ETH futures OI increased sharply at the end of October, and this has continued to slowly climb above levels seen in August. Options OI has also increased over this time frame. Notably, CME futures have begun to lead the market on specific US headlines, indicating that large institutional flows are joining the market.

Outside of BTC and ETH, alts have begun to outperform as some believe that a new alt season may be near. We have seen mixed flows with this rally, as some participants look to buy tokens to get in on the market, while others sell off portions to take advantage of the higher prices.

Authors:

Spencer Hallarn – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding & Basis

Embert Lin – Derivatives

Mitch Galer – Flows & Liquidations

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material. GSR is not authorised or regulated in the UK by the Financial Conduct Authority. The protections provided by the UK regulatory system will not be available to you. Specifically, information provided herein is intended for institutional persons only and is not suitable for retail persons in the United Kingdom, and no solicitation or recommendation is being made to you in regards to any products or services. This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.