Author: Brian Rudick, Senior Strategist

We review market making basics, liquidity provisioning on centralized and decentralized exchanges, and ponder what the future of market making may hold in this week’s Chart of the Week.

- Market Making Basics: Market making is the act of providing two-sided quotes – bids and asks – along with the quote sizes for an asset on an exchange. Doing so increases liquidity for buyers and sellers, where they otherwise may have seen worse pricing and less market depth. In theory, market makers earn the bid-ask spread – for example, buying an asset for $100 and selling it for $101 – in return for taking on price risk. In practice, however, crypto assets are volatile and there is often limited two-sided flow, making the bid-ask spread difficult to capture. As such, market makers typically seek to meet KPIs around bid-ask spread, percentage of the time the market maker is the best bid and best offer (known as top of book), and uptime to earn fees while keeping risk low. Market makers use proprietary software, often referred to as an engine or bot, to show two-sided quotes to the market, with the engines constantly adjusting bids and asks up and down based on market price movements. The quality of market making services varies significantly by market maker, with key differentiators including liquidity provided and adherence to KPIs, technology and software, history and experience, transparency and reporting, reputation and support of fair markets, exchange integrations, liquidity provisioning across both centralized and decentralized venues, and value-added services such as treasury services, OTC trading, strategic investment, and industry network, knowledge, and advisory. The benefits of market making are vast – greater liquidity and market depth, reduced price volatility, improved price discovery, and dramatically reduced slippage to name a few. But perhaps most importantly, market making is vital to the technology, as tokens are what makes the protocols work.

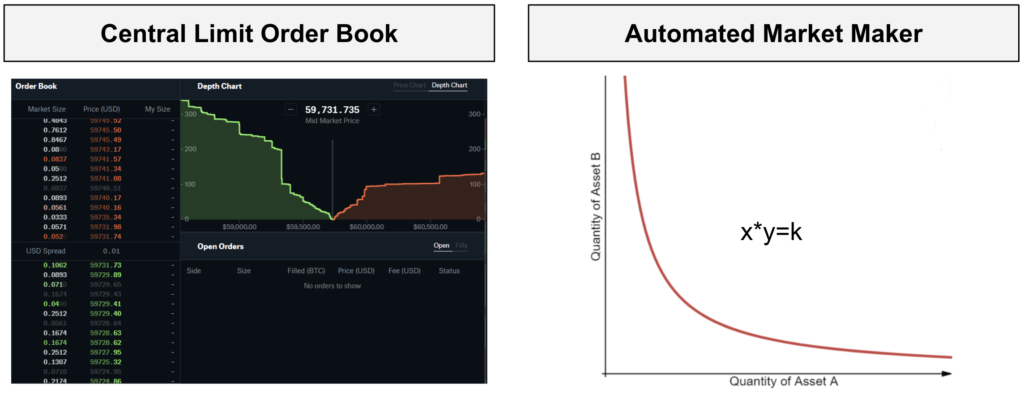

- CEXs vs. DEXs: Market making by professional firms has traditionally taken place on centralized exchanges, though is increasingly occurring on decentralized exchanges as well. The differences are:

- Centralized Exchanges: Centralized exchanges are intermediary platforms connecting buyers and sellers, and examples include Binance and Coinbase. Assets on a centralized exchange have a bid price, defined as the maximum amount anyone on the exchange is willing to pay for an asset, and an ask price, defined as the minimum amount anyone on the exchange is willing to sell the asset for. The difference between the bid and the ask price is the spread. Note that there are two main types of orders, maker orders and taker orders. Maker orders are where the buyer or seller places the order with a defined price limit at which they’re willing to buy or sell at. Taker orders, by contrast, are orders that are executed immediately at the best bid or offer. Importantly, maker orders add liquidity to the exchange, while taker orders remove liquidity, and as such, many exchanges charge a lower fee or even no fee at all for maker orders. Bids and asks are then encompassed in an exchange’s central limit order book, which matches customer orders on a price time priority. Taker orders are executed at the highest bid order and the lowest ask order. Market participants can also see order book depth, i.e. bids and asks beyond the highest bid order and lowest ask order, called top of book. Market makers connect their trading engines to automatically provide bids and asks on a certain cross, and are constantly sending bid and ask orders to exchanges.

- Decentralized Exchanges: Some market makers are starting to extend services to decentralized venues as well. Central limit order books used at centralized exchanges may be difficult to use on a decentralized exchange, as the cost and speed limitations of many layer ones make the millions of orders placed per day by market makers impractical. As such, many decentralized exchanges use a deterministic pricing algorithm called an automated market maker, which utilizes pools of tokens locked in smart contracts called liquidity pools. AMMs work by allowing liquidity providers to deposit tokens, usually in equal amounts, into a liquidity pool. The price of the tokens in the liquidity pool then follows a formula, such as the constant product market maker algorithm x*y = k, where x and y are the amounts of the two tokens in the pool and k is a constant. This results in the ratio of tokens in the pool dictating the price, ensures that a pool can always provide liquidity regardless of the trade size, and that the amount of slippage is determined by the size of the trade compared to the size of the pool. As the price in the liquidity pool deviates from the global market price, arbitrageurs will come in and push the price back to the global market price. Various protocols iterate on this basic AMM model or introduce new models to offer improved performance for things like highly correlated tokens (Curve), many-asset liquidity pools (Balancer), and concentrated liquidity (Uniswap V3), as well as extend to derivatives such as with virtual AMMs for DeFi perpetuals protocols. Note that with the progress of layer two solutions, several DEXs follow a more traditional central limit order book model, or offer both an AMM and a CLOB. Liquidity providers in a liquidity pool receive trading fees in proportion to the liquidity they provided to that pool. In addition, protocols often incentivize the provisioning of liquidity by giving liquidity providers protocol tokens, in what’s called liquidity mining. Liquidity providers are exposed to impermanent loss, which is where one of the two assets provided to the pool moves materially differently than the other, causing the liquidity provider to have been better off by simply holding the two assets outright rather than providing the liquidity.

- State of the Market: The cryptocurrency market has many unique characteristics, leading to various challenges when providing liquidity. For example, crypto markets are open 24/7/365, offer the ability to self-custody, has retail interact directly with the exchange (exchanges play the role of broker, exchange, and custodian), offer instant “settlement” of virtual balances at CEXs and fast settlement of on-chain trades at DEXs compared to T+2 traditional finance settlement, and use stablecoins to facilitate trading, given BTC volatility and still-clunky fiat to crypto conversion. In addition, the crypto markets are still largely unregulated, leading to the potential for price manipulation, and continue to be highly fragmented, with liquidity bifurcated across many on and off-chain venues. In addition, trading venue technology is still evolving, as exchanges have varying quality of API connectivity and periodically go down during times of high market activity. Lastly, the crypto derivatives market is still evolving, with derivatives being much smaller relative to spot when compared with traditional financial markets. These characteristics have led to various challenges when it comes to providing liquidity, including market fragmentation/interoperability, poor capital efficiency, regulatory uncertainty, and still-improving exchange technology/connectivity.

- The Future of Market Making: Cryptocurrency continues to evolve at a breakneck pace, and crypto market making is no exception. We see the following current and potential future trends:

- Institutionalization: The crypto market is becoming more institutional by the day. The importance of liquidity providers will only increase as institutional demand grows.

- Interoperability: Interoperability should improve, particularly in DeFi as cross-chain bridging solutions improve and composability comes to the fore. We see a multi-chain world, but where this is fully abstracted away from the user, including liquidity providers. One potential solution is layer two middleware providers, which can trustlessly interact with different chains to find the most efficient trading routes across many liquidity sources, but without the fees, settlement delays, and liquidity mining wars of the current system.

- Capital Efficiency: Liquidity providers on centralized venues have to fully fund their order books at each exchange, given fragmented markets and an inability to cross-margin. In the future, greater credit extension through the use of crypto prime brokerages or a more formalized repo market could improve capital efficiency. Within decentralized exchanges, continued progress on concentrated liquidity provisioning, sub-100% collateralized credit extension, efforts to unlock staked assets, and cross-protocol margining given tokenization/composability should improve capital efficiency in DeFi. And advances in settlement speeds should improve capital efficiency at both.

- DeFi Derivatives: Given the prevalence of derivatives in traditional financial markets, DeFi derivatives volumes, and thus DeFi derivatives market making, are likely to grow faster than spot DeFi volumes.

- DeFi Fights Back: DeFi protocols often incentivize liquidity provisioning through liquidity mining, where it gives its native token to users in exchange for depositing assets into its liquidity pools. Such liquidity, however, is often short-lived and leaves once the liquidity mining incentives run out. A host of new projects dubbed DeFi 2.0 such as OlympusDAO are experimenting with protocol-controlled liquidity, where the projects themselves acquire funds to support their protocols rather than utilize users’ funds by incentivizing them with liquidity mining rewards. Through these innovative mechanisms, liquidity provisioning in DeFi may be moving from user-contributed to protocol-controlled.

- DeFi vs. Cefi: DeFi is likely to grow faster than CeFi, given faster innovation from being earlier its life cycle, higher yields given system capital needs and liquidity mining rewards, improvement in its current limitations such lower gas fees, MEV-resistance, greater insurance options, and its many benefits including openness, permissionlessness, self-custody, financial inclusion, immutable recordkeeping, and provenance, etc. Regulation, however, is likely to be a key determinant, with its ability to slow DeFi adoption should regulators attack the more centralized components of DeFi, or spur growth, should clear but sensible guardrails be instituted that encourage greater institutional participation.

- CeDeFi: The lines between CeFi and DeFi are likely to merge, including for liquidity provisioning. Already various exchange protocols such as Unizen are integrating quotes from both centralized and decentralized venues, while others like Qredo are providing a brethren of services to bring institutions into the mix, including advanced compliance solutions. And some market makers are providing liquidity across both centralized and decentralized realms, with the best liquidity providers agnostic as to whether price discovery occurs on or off-chain.

Exhibit 1: Centralized vs. Decentralized Liquidity Mechanism

Source: Coinbase, Chainlink, GSR

To download this article as a PDF, click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.