Two weeks ago, the TerraUSD (UST) stablecoin depegged from $1.00, bringing down the Terra blockchain and destroying over $40b in value from UST and LUNA alone. We review what happened in this week’s Chart of the Week.

A Brief Review of Algorithmic Stablecoins

Before delving into the events of the last few weeks, we provide a brief review of the various types of stablecoins, with a focus on the algorithmic variety. Definitions are blurred, but in general, there are three types of stablecoins:

- Fiat-collateralized: Fiat-collateralized stablecoins are stablecoins where a central party backs each outstanding stablecoin one-to-one, generally with cash in a bank account or short duration government bonds. Fiat-collateralized stablecoins are simple, have the strongest track record of price stability, and will be the first to have a robust regulatory regime in many jurisdictions to usher in greater corporate and institutional usage. However, fiat-collateralized stablecoins introduce centralization into an otherwise often decentralized environment, and require trust that users won’t be blacklisted, reserves are as promised, and governments won’t shut them down. Fiat-collateralized stablecoins are by far the most popular, comprising the vast majority of total stablecoin market cap, and notable examples include Tether (USDT) and USD Coin (USDC).

- Crypto-collateralized: Crypto-collateralized stablecoins are stablecoins that utilize smart contracts and rely on monetary policy, arbitrage, and overcollateralization to maintain their peg. Crypto-collateralized stablecoins can eliminate many of the centralization drawbacks inherent in fiat-collateralized stablecoins, however some have been criticized for utilizing fiat-collateralized stablecoins as collateral which impedes their claim to decentralization. In addition, crypto-collateralized stablecoins are over-collateralization, making them capital inefficient. The most prominent example of a crypto-collateralized stablecoin is Maker’s Dai (DAI).

- Algorithmic: Algorithmic stablecoins are stablecoins that use a stability mechanism to maintain their peg despite not having full collateralization. Algorithmic stablecoins use a variety of stabilization mechanisms intended to absorb the volatility of the stablecoin, including:

- Rebasing: Rebasing mechanisms simply increase or decrease the number of stablecoins in each users’ wallet proportional to their holdings to maintain the peg, effectively exchanging price volatility for supply volatility.

- Seigniorage Style: Seigniorage style algorithmic stablecoins use one or two additional tokens, such as share and bond tokens to change the stablecoin’s supply and maintain the peg.

- Secondary Token: Secondary token models use a minting and redemption mechanism between the stablecoin and a secondary token, controlling the stablecoin’s supply via arbitrage incentives and effectively backing the stablecoin with the secondary token.

Algorithmic stablecoins are decentralized and capital efficient, but they have had a checkered past when it comes to price stability, with failed attempts including Empty Set Dollar, Basis Cash, and Iron Finance, to name a few. Despite this, given the potential benefits of algorithmic stablecoins combined with the enormous addressable market for stablecoins in general, attempts to create a successful algorithmic stablecoin have continued over the years. For a much more thorough review of algorithmic stablecoins, please see our report Solving the Stablecoin Trilemma with Algorithmic Stablecoins.

Terra and TerraUSD

With stablecoin basics covered, we can dive into the Terra blockchain. Terra is a Cosmos SDK-built, delegated proof-of-stake smart contract blockchain developed by Terraform Labs (TFL), offering 200 transactions per second, six second finality, and cheap transactions. In an effort to leverage an existing user base and bootstrap adoption within payments, Terra formed the Terra Alliance, comprising various large Asian e-commerce companies. In addition, Terra realized early on that a stable medium of exchange, store of value, and unit of account was paramount for fostering activity, and as such, integrated a large stablecoin offering directly into the protocol. This offering included its Korean won-pegged TerraKRW (KRT) and its US dollar-pegged TerraUSD (UST), the latter of which was the third largest stablecoin with nearly $19b in market cap prior to its collapse. Terra had also integrated its stablecoins into CHAI, a payments app with over a billion in sales volume.

It was this large stablecoin offering and its integration directly into the protocol that was perhaps the most differentiating feature of Terra relative to competing layer one blockchains. Indeed, while Terra’s native LUNA token was used for staking and submitting/voting on governance proposals, it was also used to absorb demand fluctuations in its stablecoins, algorithmically stabilizing the price through permissionless arbitrage incentives. This was done via its market module, which enabled users to mint one UST by burning $1.00 worth of LUNA and vice versa. For example, if UST was trading at $0.98 in the secondary market, a user would simply buy one UST for $0.98 and burn it in exchange for $1.00 of newly-created LUNA, which could immediately be sold for $1.00, netting a $0.02 profit while at the same time reducing the UST supply and pushing its price back towards peg. Conversely, if UST was trading at $1.02 on the secondary market, a user would acquire $1.00 worth of LUNA and burn it in exchange for one newly-minted UST, which could immediately be sold for $1.02, netting a $0.02 profit and increasing the UST supply to push it back towards $1.00. This mint/burn stability mechanism was lauded for its true decentralization, given its exclusive LUNA backing, and for its unparalleled value capture with LUNA holders benefitting as UST demand grew via a reduced LUNA supply.

In addition to Terra itself, another large driver of its success was Anchor Protocol, a decentralized savings application built on Terra and similarly developed by Terraform Labs. The beauty of Anchor was its simplicity, allowing anyone to deposit UST in exchange for a stable 19.5% yield. In addition, a bevy of protocols started integrating and building on top of Anchor, often levering up Anchor’s 19.5% yield and/or using Anchor’s interest-bearing receipt token aUST as collateral. In the earlier days of DeFi, this yield was not outsized and Anchor’s deposits and borrowings, the latter of which generated revenue for Anchor via interest paid on borrowings and staking rewards on deposited collateral that the protocol kept, were more balanced, allowing Anchor to self-fund the interest expense owed to depositors. However, as DeFi yields fell over time, Anchor’s outsized yield, combined with its simplicity and fixed rate, attracted more and more deposits, propelling UST deposits in Anchor from ~$300m a year ago to over $14b as of May 6, representing 75% of all UST outstanding. Though such strong deposit growth materially outpaced Anchor borrowings and required cash infusions into the Anchor yield reserve to maintain the 19.5% yield, TFL was happy to do so in light of the user growth it brought about, with this expense tantamount to a marketing or customer acquisition cost. Subsequently, a community governance proposal passed that was slated to slowly reduce the 19.5% interest rate to a more sustainable, market-determined rate. This proposal only allowed for a maximum 1.5% adjustment on a monthly basis, so the interest rate was only reduced to 18% by the time of the collapse, but it was expected to move lower over time. At any rate, Anchor was a key component to Terra’s success, bringing countless users into the ecosystem and helping catapult Terra to the second largest blockchain by TVL behind only Ethereum as of just 2.5 weeks ago.

Not without fault, Terra and UST had their fair share of detractors, often revolving around the sustainability of UST’s peg and the mechanics of the stability mechanism. Specifically, criticism centered around Terra’s use of an endogenous asset (LUNA) to maintain the peg, making the system highly reflexive and introducing the potential for a death spiral. This could happen, for example, should market participants question UST and burn their UST for $1.00 worth of newly-created LUNA. This, however, would inflate the LUNA supply and reduce its price, all else equal, and the lower market cap of LUNA, which, as the asset backing UST, might cause additional concern around UST and additional selling of UST that could result in a spiral of both UST and LUNA falling in tandem. Similarly, some worried if UST’s market cap exceeded that of LUNA’s, then not all UST holders would be able to redeem UST for LUNA, which could potentially incentivize UST holders to attempt to exit first, speeding up the death spiral.

Well aware of these risks, Terra created the Luna Foundation Guard (LFG), a non-profit aimed at growing the Terra ecosystem and improving the sustainability and stability of its algorithmic stablecoins. After fulfilling its initial mandate of backstopping the Anchor yield reserve with $450m to maintain the 19.5% deposit interest rate, LFG quickly turned its attention to bootstrapping a bitcoin reserve to further protect the UST peg. This bitcoin reserve was meant to act as a secondary stability mechanism after the primary LUNA mint/burn, and would function as a release valve during volatile periods for UST. Specifically, it was planned to function similarly to an automated market maker, allowing users to trade UST for sub-$1.00 worth of bitcoin when UST was trading below $1.00, and allowing users to sell bitcoin to the reserve for cheap UST when UST was trading above $1, both helping to push UST towards its peg. This bitcoin reserve totaled $3b prior to the market turmoil, and Terra had revealed ambitions to bring this to $10b, possibly through a new UST minting mechanism whereby some of the LUNA required to do so would be diverted to the bitcoin reserve rather than burned (in other words, redirecting some of the seigniorage to the bitcoin reserve). While Terra had not implemented this bitcoin reserve automated market maker prior to its collapse, LFG did have a substantial warchest of $3b worth of bitcoin to defend the UST peg, in addition to smaller amounts of other cryptocurrencies such as AVAX.

Finally, note that concerns around UST had come to fruition in the past, with the stablecoin coming under temporary pressure on several occasions. In May 2021, for example, UST fell as low as $0.93 during a challenging market backdrop that included China’s crypto ban, negative Elon Musk comments, and a dramatic decline in the price of bitcoin. LUNA fared even worse, falling 60% during the month, with Anchor liquidations also adding to the pain. UST recovered, however, and the community responded by tweaking the stability mechanism to make it more durable. In another example, UST moved slightly off $1.00 in January 2022 after a temporary Magic Internet Money (MIM) stablecoin depegging brought on by a loss of confidence in Daniele Sestagalli projects caused worries around UST as over $1b of MIM was collateralized by UST through Abracadabra.Money. Though these events displayed UST’s fallibility, its ultimate resilience during times of high market stress paradoxically added confidence, in our view.

The Great Depegging

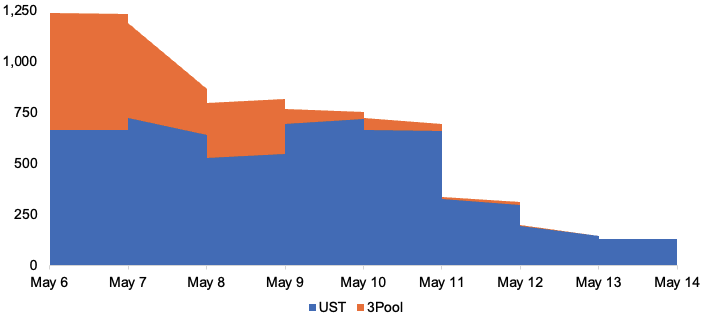

UST initially came under modest pressure on May 7, with its price consistently ranging between $0.99 and $1.00 until it significantly broke downward on May 9th. While the exact reason for the sell pressure is unclear, it appears to have started after $2b of UST was withdrawn from Anchor, and several hundred million dollars worth of UST sales occurred on Curve, a popular automated market maker for stablecoin swaps. These sales, which included an $84m swap of UST for USDC, occurred in Curve’s UST-3pool metapool, and notably did so amidst lower than usual pool liquidity after Terraform Labs had withdrawn UST ahead of its planned 4pool deployment and withdrew additional UST to lessen the pool imbalance. This smaller pool size meant that UST selling had a greater price impact than usual. And while the UST-3pool was temporarily defended by some large actors depositing USDC, USDT, and DAI, they were quickly outpaced by significant outflows that drained the pool of nearly everything but UST over the coming hours.

Exhibit 1: Curve UST-3pool Balances During May 2022, Millions

Source: Dune Analytics, mhonkasalo, GSR. Data sampled every six hours.

As the peg deteriorated, Binance and other centralized exchanges received an influx of UST sell orders as well. Additionally, billions of UST continued to be withdrawn from Anchor each day, indicating that large UST redemptions were coming and that a bank run was likely starting. And all of this occurred during the particularly poor macro backdrop of falling risk asset prices and worries around inflation, central bank policy, and economic growth. Such uncertainty and poor sentiment caused traders to sell faster than they may otherwise would have, for LUNA to have a tougher time absorbing increased supply in the face of rampant minting, and for Terra’s bitcoin reserve to fall in value. As UST’s price continued to wane below peg, LFG loaned market makers $1.5b of BTC and UST, and LFG sold nearly all BTC in its reserve to support UST but to no avail.

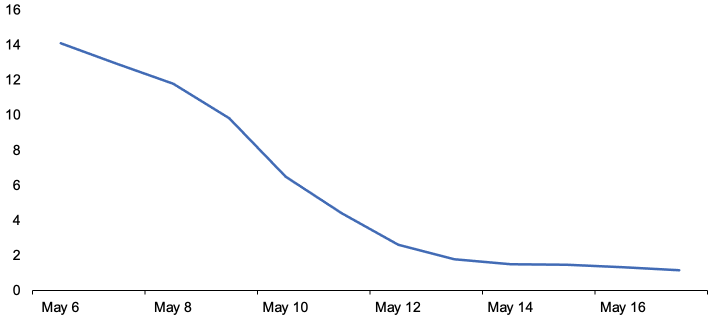

Exhibit 2: Anchor Protocol UST Deposits During May 2022, Billions

Source: Anchor Protocol, GSR. Daily data with the exception of 5/7/22 which was interpolated off the daily balances from 5/6/22 and 5/8/22.

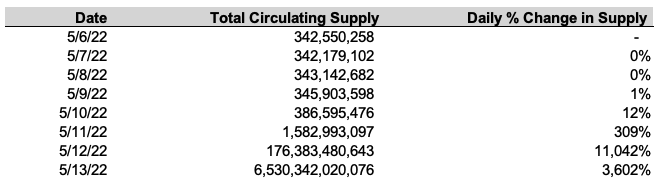

During the crisis, Terra co-founder Do Kwon attempted to raise money to temporarily backstop the peg and restore faith in UST, though was unsuccessful. As UST continued to fall, the hypothesized death spiral came to fruition and investors burned UST for LUNA at increasingly worse prices, hyperinflating the outstanding LUNA supply. In fact, the supply of LUNA increased from less than 350m to over 6.5T in just a few days.

Exhibit 3: LUNA Supply Inflation Per Day

Source: Terrascope, GSR.

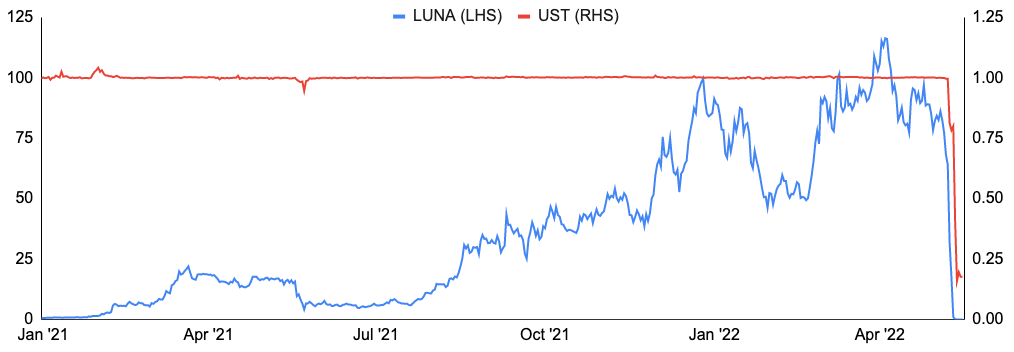

With such drastic increases in supply, the price of LUNA lost nearly all value, while UST dwindled to below $0.10. Network validators even briefly halted the Terra blockchain on May 12th, noting that the severe price deterioration of LUNA had significantly reduced the cost of a governance attack, rendering the network and wrapped tokens that were bridged to it potentially vulnerable (validators later patched the network to disable new delegations in order to minimize this attack surface).

Exhibit 4: Terra (LUNA) and TerraUSD (UST) Prices

Source: Santiment, GSR.

What Went Wrong

While Terra’s mint/burn stability mechanism would seemingly prevent such a de-pegging, its underlying mechanics served to limit its effectiveness. When arbing UST via the on-chain market module, one must pay both a historically-de minimis gas fee as well as a variable spread fee, which can be thought of as the slippage cost of transacting on an AMM and can become quite material during times of stress, lowering the arbitrage incentive. Unlike a traditional AMM, where a trader can swap one token in a two-token pool for the other, Terra’s market module is akin to a virtual AMM, where one token is burned (rather than swapped) to mint the other. Terra’s virtual AMM uses a bonding curve based on a constant product formula to ensure that there is always liquidity between UST and LUNA at some price, though the price of one asset relative to the other can become exorbitant when the size of a trade is large relative to the size of the pool or when the pool composition is not balanced. This slippage/spread fee puts an effective cap on the volume that can be efficiently transacted on-chain, preventing market participants from profitably arbitraging UST back to peg during periods of extremely high arb volume.

While this effective limit on the amount of arb volume may seem counterproductive, it was in place to reduce the potential for oracle manipulation. Ideally, on-chain liquidity would be slightly less than off-chain liquidity to prevent malicious actors from being able to manipulate the price oracle off-chain at a small size while monetizing the manipulated price oracle at a larger size on-chain. Major parameters determining this effective limit on mint/burn arb volume were most recently updated in February to support an estimated minting capacity of ~$293m worth of LUNA. This amount, however, was only a small fraction of the UST that was looking to exit the market based on the Anchor outflows alone, preventing enough UST burning to arb its price back to $1.00 and forcing the majority of UST and LUNA trading volume to bypass the on-chain market module and occur on the secondary market. Moreover, this limit slowed UST’s expected move back towards a dollar, likely contributing to the bank run, as the longer it remained depegged, the more worry and selling that would occur.

Seeking to remedy this arb volume bottleneck, a Terra community member put forward Proposal 1164 on Agora, Terra’s research and governance forum, on May 10. This proposal aimed to quadruple LUNA minting capacity to roughly $1.2b to increase the speed at which UST could be burned to help stabilize the peg. The proposal received Do Kwon’s backing and it generated enough votes to pass in just a few days, but it also required a week-long voting period, far too long to alleviate a panic-induced crisis that required immediate action. Changing the mint/burn arb capacity may not necessarily have prevented a bank run, however, as the arbitrage mechanism is ultimately reliant on value being ascribed to LUNA. Moreover, greater stability mechanism capacity would have also resulted in faster LUNA supply inflation that may have exacerbated worries around UST. Ultimately, a loss of faith in the system, questions on the value of the asset backing UST (LUNA), and a lack of sustainable/practical demand drivers outside of earning yield on Anchor ultimately caused capitulation.

Moving Forward

Do Kwon formally proposed a path forward for Terra via Proposal 1623 on May 16th, and voting began on May 18th. Do’s proposal highlights Terra’s vibrant ecosystem and developer network, and argues for creating a new version of the Terra blockchain without the algorithmic stablecoin component. The new chain would be denoted as Terra (LUNA) while the existing chain would be known as Terra Classic (LUNC). LUNA tokens would be airdropped to LUNC stakers, LUNC holders, UST holders, and essential app developers from Terra Classic. Do further proposed that TFL’s wallet be excluded from the airdrop, making the chain entirely community-owned. While the proposal saw some initial community backlash, voting closed today and the proposal passed.

Final Thoughts

Whether it was an incomplete understanding of the stability mechanism, a simple trust in UST’s strong prior track record and multi-billion dollar market cap, or Anchor’s marketing as a savings (rather than investment) protocol, so many underestimated the risks inherent in Terra. And paradoxically, for as much as Terra was lauded for its mechanism design facilitating unparalleled value capture for LUNA holders, it was exactly this design that made the system so reflexive and ultimately did Terra in. We’d also note that while community governance may one day reimagine power, society, and the economy as we know it, it is still a work in progress with shortcomings such as insufficient speed on display. And while Terra is likely done in its current form, we contend that there was real value creation with its plethora of users, developers, and dapps. Finally, we’d note that crypto is a nascent technology that comes with the potential for high rewards, but also high risks. If nothing more, we’ve learned that the tails are perhaps fatter than we all cared to believe, highlighting the importance of sound risk management. With grand visions to bootstrap a price-stable, decentralized, and capital-efficient money, Terra and UST unfortunately never got the chance to realize its ultimate vision, though provides invaluable lessons as we all build together.

Authors: Brian Rudick, Senior Strategist, Matt Kunke, Junior Strategist

Sources: Terra Documentation, Terra Research Forum, Terra – Twitter, Do Kwon – Twitter, Luna Foundation Guard Website, Luna Foundation Guard Twitter, Bankless – UST: New Paradigm or Ticking Time Bomb? Terra Bear vs. Bull, Bankless – UST Luna Meltdown: What Happened, Unchained Podcast – Did Someone Deliberately Attack Terra/Luna to Kick off a Death Spiral?, CoinDesk – UST’s Bitcoin Reserve Too Late … , Haseeb Qureshi – The Reign of Terra: The Rise and Fall of UST, Hasu – Twitter, Jp12 – Understanding Terra’s Market Module and Redemption Capacity, Kaiko – A Data-Driven Exploration of UST’s Collapse, Mhonkasalo – Navigating the UST Crash

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.