After reviewing the role of miners in the Bitcoin network last week, we explore the components miners use to actually bring bitcoin to fruition – mining rigs, hosting sites, and power inputs – in the latest edition of our multi-part Chart of the Week on Bitcoin mining.

Last week we reviewed the role of miners in the Bitcoin network. Recall that after a transaction is broadcast to the network and nodes have validated it, the transaction will reside in the mempool before miners may select it and add it to a proposed block. Miners will then hash their proposed block, the time stamp, and a random number called a nonce attempting to generate a hash below the current target in order to solve the mining puzzle and be the one selected to add their proposed block to the blockchain and receive the mining reward and transaction fees. To bring this to fruition, miners rely on three main inputs: mining equipment, which for Bitcoin are ASIC machines, mining facilities that house and operate the machines, and power inputs. Each is a vital component of successfully mining bitcoin efficiently and economically. In the below sections we review these key inputs, while subsequent reports will analyze the Bitcoin mining business model, key strategies employed, main public players, and Bitcoin’s impact on the climate.

Bitcoin Mining Equipment

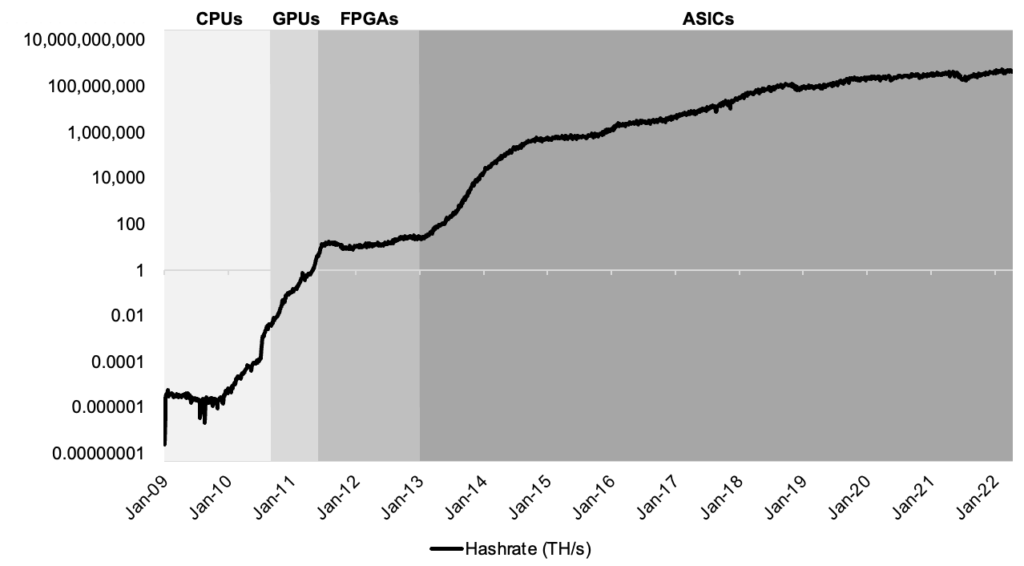

Bitcoin mining takes place on specialized computers called miners or rigs, which produce a certain number of hashes per second at a certain level of efficiency. Hashes for Bitcoin mining rigs are typically measured in terahashes per second (TH/s) which is equal to 1 trillion hashes per second.

A mining rig can refer to various different circuit types such as a CPU, GPU, field-programmable gate array (FPGA), or an application-specific integrated circuit (ASIC). Given that different cryptocurrencies can utilize different cryptographic hash functions in their mining process, there is not a universally optimal rig for mining cryptocurrencies broadly. For example, some cryptocurrencies like Monero use a hashing algorithm that is optimally performed by CPUs to encourage decentralization, as these are the most prevalent and widely accessible chip type. Other algorithms may be optimally performed by GPUs for their superior general processing power, memory bandwidth, and efficiency relative to CPUs. In some algorithms, it may make sense to use specialized chips that are optimized for one particular use as opposed to chips designed for general-purpose computation like CPUs and GPUs. These application-specific integrated circuits, or ASICs, are customized pieces of silicon that in Bitcoin’s case are designed solely to compute SHA-256 hashes as quickly as possible. This feature makes ASICs very inflexible and largely useless outside of mining bitcoin, but they deliver performance that is orders of magnitude higher than top-of-the-line GPUs for this purpose. It took an immense amount of R&D to create ASICs for use in Bitcoin mining, and the first versions weren’t launched until more than four years after Bitcoin’s creation. FPGAs bridged the gap between GPUs and ASICs. An FPGA is an integrated circuit that consists of an array of logic blocks designed to be configured by the customer in the field after manufacturing. These can be repeatedly re-programmed, so they are commonly used to prototype ASICs.

Exhibit 1: Evolution of Bitcoin Mining Hashrate (TH/s) by Hardware Era (log)

Source: Blockchain.com, The Evolution of Bitcoin Hardware, GSR

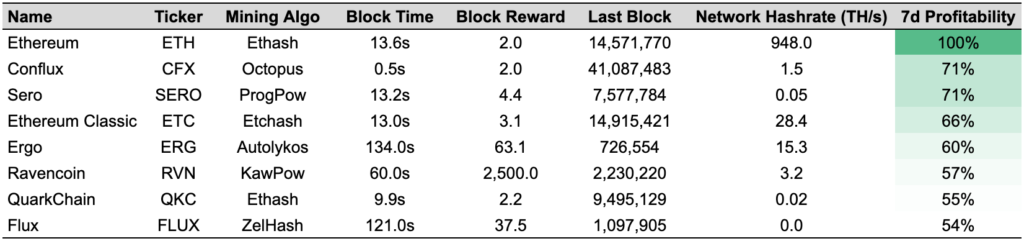

Unlike the ASIC-dominated market for Bitcoin mining, Ethereum prioritized mining decentralization, aiming to utilize an algorithm that was ‘ASIC-resistant’ by incorporating general-purpose computation in the mining process itself, making the creation of an Ethereum ASIC more difficult. Ethereum ASICs first popped up in 2018, but the express intent of making them difficult to produce prevented them from delivering the same efficiency gains that Bitcoin ASICs saw relative to GPUs. Additionally, given Ethereum’s forthcoming transition to proof-of-stake, the value of Ethereum ASICs would be expected to decrease, as they would only be useful for mining small alternative cryptocurrencies that use the Ethash algorithm. Conversely, GPUs could still be used to profitably mine a wide array of cryptocurrencies with different mining algorithms, albeit less profitably than mining ETH. GPUs could be also utilized for an array of non-crypto applications, or they could sell their idle compute power on a hashrate marketplace like NiceHash.

Exhibit 2: GPU Alt Coin Mining Profitability (relative to mining ETH)

Source: whattomine.com, GSR. Data based on a GeForce RTX 3090 GPU at $0.05c/kWh electricity cost. This chart is not an exhaustive list but shows some of the most profitable GPU mining alternatives with market caps >$100m.

Additionally, it’s important to note that network hashrate is a measure of a network’s total hash capacity for a particular mining algorithm, so the metric is not comparable between two networks that use different mining algorithms. Some miners will quote their digital asset production in bitcoin equivalent terms, as they may have fleets of ASICs and GPUs, mining both bitcoin and ether.

ASIC Manufacturers

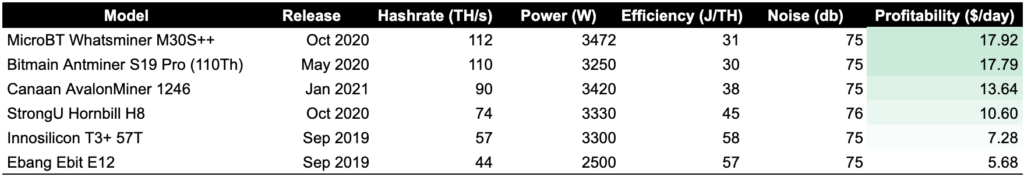

Bitcoin ASIC manufacturing has a high barrier to entry, and it has historically been dominated by a few manufacturers in China. Bitmain is the industry leader, followed by MicroBT, and they effectively operate in a duopoly for the most efficient rigs today. Canaan is another key industry player, and they were the first to introduce a Bitcoin mining ASIC in 2013, but they have lagged behind Bitmain and MicroBT for a number of years now. Other Bitcoin ASIC manufacturers include Ebang and Innosilicon, but their most recent models are a few years dated and their efficiency (measured as joules per terahash) has fallen behind the top players. For example, we do not typically see institutional miners making purchase orders for rigs outside of Bitmain, MicroBT, and to a lesser extent Canaan today. This may change in the future as Intel appears ripe to disrupt this status quo. Intel will be entering the market and releasing their first Bitcoin mining ASIC chip this year with an efficiency that is competitive versus the top incumbents. Additionally, these existing incumbents are fabless manufacturers, meaning they design their chips but outsource the fabrication to a semiconductor foundry (fab) like TSMC, SMIC, or Samsung. Fabless companies focus on R&D and they own the IP of their advanced chip designs, but they rely on third parties to manufacture and test the silicon wafers that are used in their products. Intel is the first vertically integrated manufacturer to enter the market, maintaining full control over the end-to-end production process which may pose some advantages over the field.

Currently, MicroBT’s Whatsminer M30S++ and Bitmain’s Antminer S19 Pro lead the pack and are the two most profitable rigs for mining bitcoin today. Bitmain’s S19 Pro (110TH/s) is theoretically the most efficient rig, consuming 3,250W of power with an efficiency of 29.5 J/TH. Assuming an electricity cost of $0.05c / kWh, the rig is making $21.69 per day with an electricity cost of $3.90, for a daily profit of $17.79. A new S19 Pro, however, is selling for around $10,000, so the payback period is about 18 months long. Additionally, these assumptions are more tailored to the cost structure of an institutional miner, and the economics may look much worse for an individual paying residential electricity prices.

Exhibit 3: Top Bitcoin Mining Rigs (SHA 256) by Manufacturer, $/day

Source: Asicminervalue.com, GSR. Data pulled as of Apr 12, 2022 w/ a BTC price of $39.8k and assumes electricity costs of $0.05c/kWh.

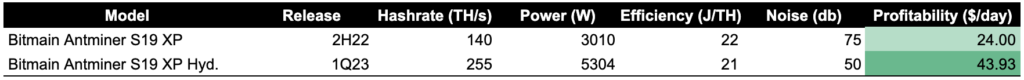

Bitmain, MicroBT, and Canaan have all announced new rigs for release later this year that exceed the specifications of their existing models. Most notably, Bitmain and MicroBT have announced water-cooled versions of these new rigs, substantially boosting performance over their fan-cooled equivalents.

Exhibit 4: Bitmain S19 XP – Air Cooled Versus Water Cooled Versions

Source: Asicminervalue.com, GSR. Data pulled as of Apr 12, 2022 w/ a BTC price of $39.8k and assumes electricity costs of $0.05c/kWh. The Antminer S19 XP Hyd noise output shown is an estimate based on the S19 Pro Hyd specs.

A global chip shortage combined with high demand has made procuring miners difficult, and mining companies often form strategic relationships with equipment manufacturers, ordering miners months in advance and at significant bulk discount rates relative to what a hobby miner may pay. Additionally, large payments are required well in advance of machine delivery so the financing of these purchases can be difficult. As an example, both Riot and Marathon inked deals around the beginning of the year to purchase hundreds of millions of dollars worth of the soon-to-be-released Antminer S19 XPs. While these purchases are expected to be delivered in monthly installments between July and December 2022, the miners were still required to pay 35% at the time of the deal, an incremental 35% of each shipment price six months before the shipment was made, as well as the remaining balance of each shipment one month prior to shipping. All of this is to say that acquiring ASICs is a highly capital-intensive business.

Top ASIC manufacturers also prioritize B2B relationships and sell their newest rigs to institutional miners at scale. This is on display currently with the soon-to-be-released Antminer S19 XP. Institutions can contact Bitmain’s business development team to procure a bulk purchase order at an estimated price of $11,620 per rig, but an individual looking to purchase one of these machines would need to use an intermediary like Compass which is currently charging a ~26% premium on top. This dynamic disadvantages retail miners more deeply than may be readily apparent. Given the Bitcoin network adjusts the difficulty of the mining algorithm based on the total network hashrate, new state-of-the-art rigs are the most profitable before they have saturated the market and they are still difficult to procure. If all miners increase their hashrate by the same percentage amount, their future revenue generation does not change, so the relative advantage is created when miners acquire better rigs before everyone else.

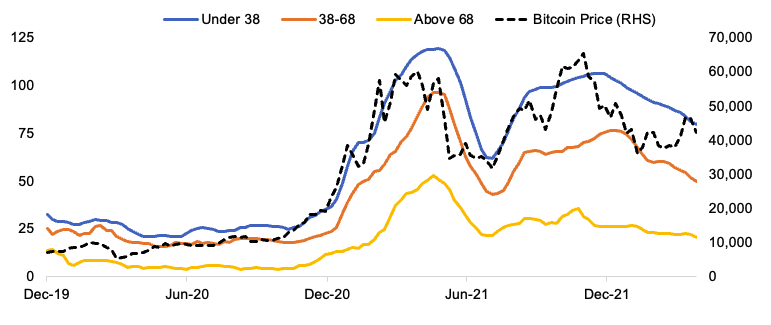

Unsurprisingly, ASIC prices move closely with the price of bitcoin. Manufacturers tend to dynamically price their rigs alongside moves in bitcoin prices. As seen below, the most efficient mining rigs increased nearly 5x in price from June 2020 to May 2021, likely attributable to both the move in bitcoin price as well as the shortage of chips due to COVID-19. Rigs are generally depreciated over three years, though newer miners can last five years or more given the improved quality and improved operating environments. However, the useful life of a rig is difficult to forecast and will depend on one’s power costs, the bitcoin price, as well as the growth of the broader network hashrate.

Exhibit 5: ASIC Price Index ($ Price/TH) Categorized by Rig Efficiency (J/TH)

Source: Hashrateindex.com, GSR

Bitcoin Mining Facilities

Mining is an energy-intensive process that requires operators to secure hosting services with access to a large power supply. Facilities for bitcoin mining are not too dissimilar from traditional data centers, but there are enough distinctions that institutional Bitcoin miners tend to leverage facilities that were optimized for mining bitcoin specifically, hence, you do not tend to see mining rigs hosted next to a traditional server rack.

Two of the key differences between Bitcoin mining data centers and traditional data centers are:

- Resiliency & redundancy: Bitcoin miners operate in a vacuum without any broader business dependencies. A miner losing access to electricity represents an opportunity cost of lost bitcoin, but there are no long-term adverse business implications from a temporary shutdown. Conversely, traditional data centers provide business-critical infrastructure to a wide array of end clients where any downtime may structurally impair their business or reputation. Tailoring data centers to operate most of the time instead of all the time allows Bitcoin mining facilities to save significantly on costs related to redundancy and fault tolerance. This results in Bitcoin mining data centers being much cheaper to construct, as less investment needs to be made in generators, batteries, backup cooling systems, etc. This feature also allows Bitcoin mining facilities to save on security spend.

- Energy use & cooling: ASICs use much more energy than traditional data center hardware, so Bitcoin miners typically require higher density rack space. Additionally, Bitcoin mining data centers are operating at peak capacity 24/7, while traditional data center capacity fluctuates based on client demand, resulting in mining operations producing more heat than traditional data centers. While most Bitcoin mining facilities still rely on typical air cooling today, miners are at the forefront of implementing immersion cooling techniques to further increase miner density and efficiency. Immersion is a more efficient cooling approach as liquids have a higher capacity to transfer heat than air, allowing for an increased hashrate through overclocking. Miners that are utilizing immersion today remove the fans from their machines and place multiple rigs in a large tank of dielectric fluid – an electrically non-conductive liquid that efficiently removes heat from electrical components. It remains to be seen how next-gen rigs with built-in water-based cooling will impact this trend.

Exhibit 6: An Air-Cooled Bitcoin Mining Facility

Source: Michael Gonzalez / The Texas Tribune

Infrastructure strategies vary by mining operators with some preferring to vertically integrate and own their own infrastructure, while others prefer the simplicity and flexibility of deploying their rigs at third-party hosting service providers. The former requires electrical expertise, operational know-how, and large capital investment, but this approach allows the miner to maintain full control over their fleet of rigs and they are able to remove one layer of recurring costs. This approach also provides more flexibility to explore cutting-edge cooling techniques that may improve the performance of one’s existing fleet by as much as 25-50%. Directly owning infrastructure and vertically integrating does come at the cost of reduced nimbleness, however. These miners tend to enter into long-term power purchase agreements (PPAs) with the grid operator, committing to purchase a fixed amount of power for a length of typically five or more years. Many vertically integrated miners diversify their revenues by selling hosting infrastructure services to third-party miners, allowing them to further diversify their revenue stream while securing their own future hosting needs. Proponents of using third-party hosting typically note that they want to retain flexibility to relocate and/or decrease their power consumption if they deemed prudent. Additionally, they believe it is more profitable to procure additional rigs with the money that would have been spent on infrastructure, allowing them to take hashrate market share at a faster pace.

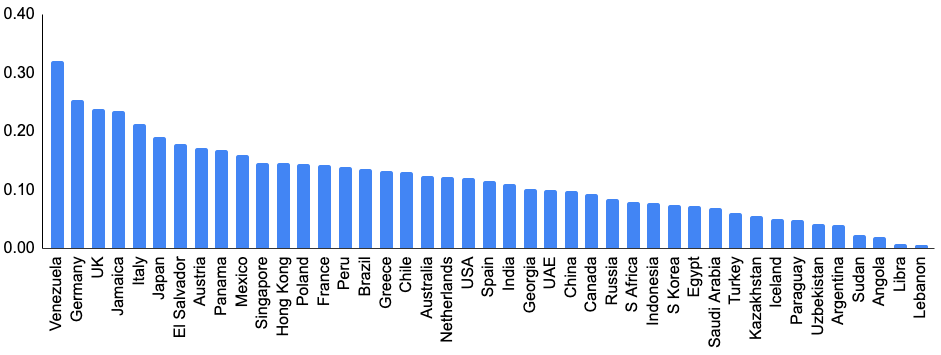

Power is perhaps the most important input into mining bitcoin, as electricity costs tend to comprise 80-90% of a miner’s recurring cost of producing each marginal coin. With a cost structure that’s so heavily dominated by the cost of electricity, the price of power is often the highest priority variable in selecting a facility’s location. While power is a top cost for both miners and traditional data center operators, it’s the simplicity of the mining business that allows miners to be more flexible in selecting their facility locations. Mining notably only requires transportable hardware, a modest internet connection, and a large power source to operate. Given the first two requirements can be moved or accessed virtually anywhere in the world, miners have the unique flexibility to construct their operations in remote locations next to cheap energy assets which may not be palatable for traditional data centers operators that are prioritizing redundancy and fault tolerance. This is simply a prelude to the relationship between miners and power usage which will be explored in a much greater depth in the final part of this series.

Beyond cheap energy assets, miners aim to operate in regions with a stable regulatory environment, a stable electrical grid, and a strong rule of law. The impact of operating in an unstable regulatory environment was prominently on display in 2021 as China quickly enforced a wide-sweeping ban on Bitcoin mining which cut the Bitcoin network hashrate by more than 50%. This effectively transferred the expected future bitcoin production of Chinese miners to other miners around the globe, creating a goldilocks period for miners in more stable regulatory regimes. Additionally, the influx of supply, large tax, import and export duties, as well as the lack of miner hosting infrastructure at the time made the resale value of these rigs crater. The reasons behind China’s ban are still not entirely clear and there is still debate on the drivers of their decision, but it prominently highlights the importance of mining in a pro-Bitcoin regulatory environment with a strong rule of law.

Kazakhstan also highlighted the risks of operating in an environment experiencing political unrest. Kazakhstan was one of the most prominent beneficiaries of the China mining ban, receiving a large inflow of miners alongside the U.S. and Canada. In early 2022, Kazakhstan’s government cracked down on anti-government protests by declaring a country-wide state of emergency and cutting off the country’s access to the internet for nearly a week. Moreover, the country’s energy grid struggled to meet power demand, especially during the winter, which caused the national grid operator KEGOC to cut crypto miners in the country off from electricity supply for some time. Miners in Iran have experienced similar issues and additionally highlight the importance of having access to a robust power source. Iran has routinely struggled with blackouts during periods of high energy demand, leading the country to impose temporary bans on cryptocurrency mining in an attempt to help alleviate the pressure on its power infrastructure. Subsequent to these events, U.S. states like Texas, Georgia, and Kentucky have been increasingly attracting miners for their pro-Bitcoin stance and stable regulatory environment, the strong rule of law, and the relative stability of their grid infrastructure. Weather is another consideration as colder climates can help lower the operating costs of air-cooled facilities, albeit this is of lesser importance than the other considerations previously covered.

Exhibit 7: Electricity Prices by Country, June 2021, kWh, USD

Source: GlobalPetrolPrices.com, GSR

Note: Reflects pricing for businesses.

In the next part, we’ll take a deeper dive into the economics of mining and some of the key operators in space.

Authors: Brian Rudick, Senior Strategist, Matt Kunke, Junior Strategist

Sources: Antonopoulos, Wood: Mastering Ethereum, Ashrae Journal: Cryptocurrency Drives Data Center Innovation, Asic Miner Value, Coin Mining Central, Compass, Construction Dive, Data Centre Magazine, Hash Rate Index, Miner Daily, Taylor: The Evolution of Bitcoin Hardware

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.

This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page