Author: Brian Rudick, Senior Strategist

After a frenzied but brief start to the year, NFTs have come roaring back in recent weeks, with record sales volumes, soaring corporate and venture investment, and a general re-entry into the cultural zeitgeist. We review NFT basics, analyze recent trends, and posit what the future may hold in this week’s Chart of the Week.

NFT Overview: Fungibility is the characteristic of mutual interchangeability, where one is indifferent as to which exact unit one has, and examples include US dollars, gold, and airline points. Non-fungible items, by contrast, are those that are solely unique and therefore not freely interchangeable, such as an original painting, land, and baseball cards. Non-fungible tokens (NFTs) are unique digital assets that are stored on a blockchain (well, technically an ID number in a smart contract that points to the URL of a JSON metadata file is what is stored on the blockchain). As blockchain-based digital representations of ownership, NFTs bear typical cryptocurrency benefits, such as immutability, provable scarcity and provenance, standardization and interoperability, and programmability, and they make digital assets as real and as permanent as objects in the physical world. NFTs can represent ownership in unique items of value like digital art, domain names, intellectual property, and event tickets, can be employed in a variety of use cases like collectibles, gaming, media, music, and finance, and in the future will usher in new paradigms around content, ownership, value, and exchange.

NFT History: Developers first began experimenting with NFTs through colored coins on the Bitcoin network in 2012, followed by Rare Pepe illustrations a few years later. In mid-2017 Larva Labs brought NFTs to the Ethereum blockchain via a collection of 10,000 unique CryptoPunks that are now considered digital antiques. The first mainstream occurrence of NFTs, however, was Dapper Labs’ late-2017 launch of CryptoKitties, which allowed users to collect and breed digital cats based on a cattribute-determining, smart contract-based breeding algorithm. After a quiet period focused on development, NFTs once again entered the limelight in early 2021 after notable events like the $69m sale of Beeple’s Everydays and the popularity of NBA Top Shot’s collectible basketball “moments.” All the while, the NFT ecosystem continued to develop, with advancement in front-end interfaces, marketplaces and value-added services, verticals and applications, and storage solutions and purpose-built scaling solutions and blockchains.

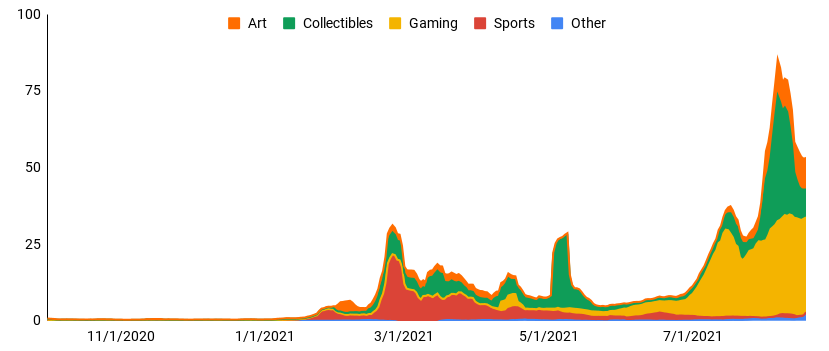

Recent Trends: As shown in Exhibit 1, where we supplement Nonfungible.com’s Ethereum-based sales data with CryptoSlam’s sales data for popular non-Ethereum-based projects, NFT sales volumes have reached new heights this year. Sales activity kicked off in earnest in late February, led by sports NFTs and Dapper Labs’ NBA Top Shots. A few months later, the launch of 3D voxel avatars Meebits gave collectibles volumes a boost. And in July, gaming NFT volumes started to increase as blockchain-based play-to-earn game Axie Infinity, which we cover here in more detail, saw its user count and activity skyrocket after moving to its Ronin sidechain for improved gameplay. And just this month collectibles and art NFT sales have taken off, with the former driven by CryptoPunks and Bored Ape Yacht Club and the latter by Art Block’s programmable and on-demand degenerative artwork. NFT sales growth has been so strong that recent daily sales frequently exceed total sales for all of 2020.

Exhibit 1: Estimated On-Chain NFT Sales Volume by Category, $m

Source: Nonfungible.com, CryptoSlam!, GSR

The Future: While we are a long way off from what NFTs will eventually become and issues around scalability, storage, accessibility, regulation, and the law need to be worked out, the concept of blockchain-based digital representations of ownership brings about endless possibilities. Programmability will increase utility and functionality by making NFTs dynamic, data-driven, and auto-updating, composability will ensure permanence of that which is being built upon leading to greater and faster development, and tokenization will enhance efficiency, transparency, portability, and security. Content creators will break free from the platforms and intermediaries to which they are beholden and utilize NFTs to sell directly to audiences, price along the demand curve, monetize secondary sales, and crowdfund new works prior to creation to maximize creator value capture, better align output to consumer preferences, and reward early supporters. And self-contained, community-owned-and-governed metaverses, enabled by NFTs, will eliminate the boundaries of physical distance, remove barriers to education and opportunity, and enable earning, consumption, and socialization to extend and in some ways supplant the physical world. Years from now a new cyber ideal will emerge, where new paradigms around content, ownership, value, and exchange abound in digital societies built, owned, and operated by their users – all made possible by blockchain technology, cryptocurrency, and NFTs.

To download this article as a pdf click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.