Author: Brian Rudick, Senior Strategist

With the recent launch of Arbitrum and incoming full deployment of Optimism, we review Ethereum scaling solutions and the momentum behind rollups in this week’s Chart of the Week.

An Overview of Scaling: With 70% of DeFi TVL and a rich ecosystem of users, developers, and dApps, Ethereum is the leading smart contract-based blockchain. From time to time, however, the network can be a victim of its own success, with high network congestion causing low throughput and high gas fees, as experienced during the ICO boom/introduction of CryptoKitties in 2017, DeFi Summer in 2020, and recent rise in NFT volumes. While ETH 2.0 efforts are underway to scale the base layer itself through sharding and a transition to proof of stake, another solution is needed, both to improve upon Ethereum’s current 15-45 transactions per second, and post-ETH 2.0 to set the stage for mass adoption. Enter layer two scaling, which scales Ethereum applications by handling transactions off the Ethereum Mainnet (the consensus layer, called layer one), while also relying on the security of Mainnet. There are four main types of scaling solutions:

-

- Sidechains: A sidechain is an independent blockchain attached to its parent blockchain (aka, the main chain) by a two-way bridge. Importantly, sidechains allow for smart contracts on Ethereum to be deployed to the sidechain via EVM-compatibility, and uses include scaling the main chain and allowing developers to test dApps prior to submitting to mainnet. The main drawbacks are that as separate blockchains with their own consensus mechanisms, they have their own security and may not be as open and decentralized as Ethereum itself. While sidechains do offload transactions from the main chain, they are not technically a layer two, as they are not secured by Ethereum’s layer one. Examples of sidechains include xDai, Skale, and POA Network.

-

- State Channels: A state channel is a process where users transact directly with one another outside of Ethereum an unlimited number of times prior to batching and submitting transactions back to the main chain. Channels come in two flavors, state channels and payment channels, and are useful for instances with many state updates (eg. two parties exchanging frequent payments with one another), when the number of participants is known ex ante, and when participants are always available. State channels allow for instant withdrawals/settling, extremely high throughput, and low costs per transaction. Channels, however, are not capital efficient as payment channel funds are locked into a multisig contract, are not open, and don’t support general purpose smart contracts. Examples of state channels include Raiden, Connext, Kchannels, Perun, and statechannels.

-

- Plasma: Plasma uses smart contracts and Merkle trees to enable the creation of a limitless number of separate blockchains called child chains or plasma chains that are essentially copies of the Ethereum mainnet and derive their security via fraud proofs that are used to arbitrate disputes on Ethereum. Child chains are tied to Ethereum via root contracts, which contain the rules guiding each child chain and act as a bridge letting users move assets between the child chains and Ethereum. Plasma offers high throughput at low costs per transaction and is useful for asset transfers, payments, and NFTs. That said, plasma can’t be used to scale general purpose smart contracts, requires a live network, relies on an operator to store and serve data, and has long withdrawal periods. Lastly, note that some break out plasma solutions that use zero knowledge proofs (rather than fraud proofs) as a separate category called validium. Examples of plasmas include OMG Network, Gluon, Gazelle, and LeapDAO.

-

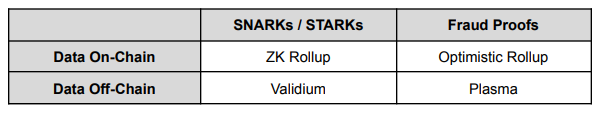

- Rollups: Rollups scale Ethereum by executing transactions on a separate EVM-compatible chain before batching, compressing, and posting to Ethereum Mainnet. Notably, transaction execution occurs off of Ethereum, but transaction data is posted to Ethereum, thus allowing for high throughput and low costs while also inheriting the security properties of Ethereum’s layer one. Rollups come in two varieties: zero knowledge rollups (ZK rollups) and optimistic rollups.

-

- ZK Rollups: ZK rollups bundle transactions off-chain and generate validity proofs known as succinct non-interactive arguments of knowledge (SNARKs) that are posted to Ethereum Mainnet along with the batch. Compared to optimistic rollups, they are faster, more efficient, and allow for instant withdrawals, though are less further along and are harder to migrate smart contracts to.

- Optimistic Rollups: Optimistic rollups assume transactions are valid unless the transaction is challenged, at which point a fraud proof will be run and if the transaction is shown to be invalid, the correct state will be recovered and the submitter of the transaction will see their staked bond slashed. Optimistic rollups have long withdrawal times given the need for a challenge period and require a good actor policing and submitting transaction challenges, though are easier to port existing general purpose smart contracts to and are further along than ZK rollups.

-

- Rollups: Rollups scale Ethereum by executing transactions on a separate EVM-compatible chain before batching, compressing, and posting to Ethereum Mainnet. Notably, transaction execution occurs off of Ethereum, but transaction data is posted to Ethereum, thus allowing for high throughput and low costs while also inheriting the security properties of Ethereum’s layer one. Rollups come in two varieties: zero knowledge rollups (ZK rollups) and optimistic rollups.

Examples of rollups include Arbitrum, Optimism, zkSync, and StarkNet.

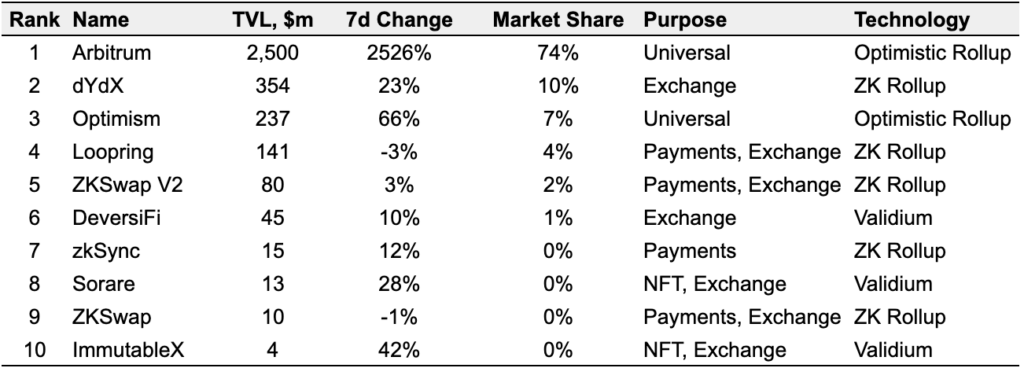

The Players: As shown in Exhibit 1, Arbitrum, which uses optimistic rollups and launched its mainnet a few weeks ago, has already amassed $2.5b in TVL, with the greatest amount in ArbiNYAN, Carbon Finance, and Curve. Decentralized exchange dYdX, which partnered with StarkWare to build a ZK rollup-based layer two protocol to offer lower gas costs and minimum trade sizes, is in second place with $354m in TVL. Optimism, which has been building its optimistic rollup-based scaling solution since mid-2019 and will likely fully deploy to mainnet over the coming months, is in third place with $237m due largely to value locked in Synthetix and Uniswap v3. Note that L2Beat institutes a strict definition for a layer two, requiring solutions to inherit security from Ethereum’s layer one rather than rely on their own validators for security, and as such, notably excludes Polygon from its ranking. Polygon, which aims to be Ethereum’s internet of blockchains with a suite of scaling solutions including sidechains, plasma, ZK rollups, and optimistic rollups easily dwarfs the others with $4.7b in current TVL, per Defi Llama.

A Rollup-Centric Ethereum Roadmap: With the inability of channels and plasmas to scale general purpose applications and sidechains lacking Ethereum’s security properties, the Ethereum community appears to be rallying around rollups as the scaling solution of choice. Indeed, rollups combine the best of both worlds to offer general purpose application scaling without compromising on security. Vitalik Buterin outlined as much in his post arguing for a Rollup-Centric Ethereum Roadmap and his Incomplete Guide to Rollups. We believe that while over the long-term there may be multiple scaling solutions trading off security and functionality with some types more useful for specific applications than others, rollups are likely to lead the pack at least over the short and medium-term. And with development further along, optimistic rollups are likely the key near-term solution du jour, particularly for general purpose applications. Though once EVM-compatibility for ZK rollups is further along, they’ll likely be the solution of choice given better data efficiency, greater scalability, and instant withdrawals. All in, rollups will scale Ethereum from the current 15-45 transactions per second to 1,000-4,000 per second, and when combined with ETH 2.0, could bring Ethereum transactions per second to 100,000, setting the stage for mass adoption.

Exhibit 1: Top Ethereum Layer Two Scaling Solutions by TVL

Source: L2BEAT, GSR

To download this article as a pdf click here.

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report.This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.