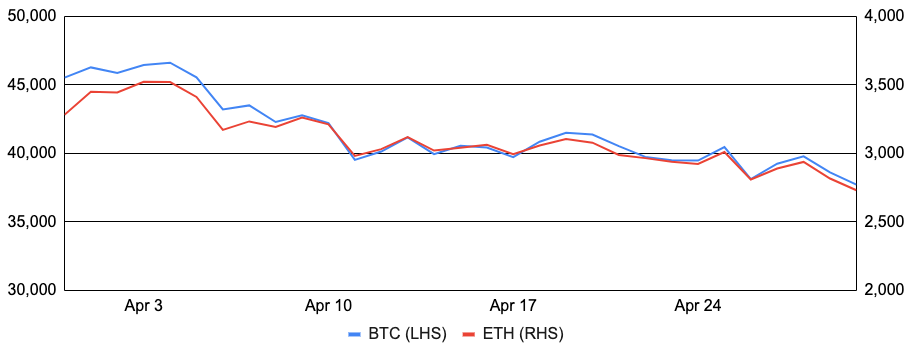

Bitcoin broke its streak of two positive months, falling 17% after entering April around $45,500 and finishing at $37,700. Barring mid-month sideways action, the apex digital asset fell steadily throughout the month alongside broader risk markets. Nevertheless, it was an eventful month that included Bitcoin Miami and plenty of positive announcements throughout. Perhaps most notable were the many integrations with the Lightning Network. Digital payments platform Strike, for example, revealed partnerships with Shopify, Blackhawk, and NCR to give thousands of e-commerce and storefront vendors the ability to accept US dollar payments on Lightning Network rails. In addition, Robinhood, BitPay, and Cash App integrated or announced coming Lightning integrations, with Cash App additionally revealing a paycheck-to-bitcoin conversion feature to help users save in bitcoin. And Lightning Labs announced the development of a new Taproot-powered protocol enabling the issuance and transfer of assets on the Bitcoin network called Taro. Beyond Lightning integrations, increased country-level adoption was another theme during the month. The Central African Republic joined El Salvador becoming just the second country to recognize bitcoin as legal tender. In addition, lawmakers in Panama took a step in this direction legalizing bitcoin and several other cryptocurrencies for paying taxes and private transactions, though the bill, which still requires the President’s signature, does not go as far as making bitcoin legal tender. Local regions in Honduras and Portugal also revealed bitcoin adoption plans. Finally, other notable bitcoin-related news during the month included Fidelity revealing plans to offer bitcoin exposure to 401(k) clients, Goldman Sachs made its first bitcoin-backed loan, Microstrategy and the Luna Foundation Guard both continuing to add to their bitcoin holdings, Direxion and ProShares both filing for short Bitcoin Futures ETFs and Grayscale penning a letter to the SEC arguing for the approval of GBTC’s proposed ETF conversion.

Ethereum posted a similar 17% decline during the month after entering April around $3,300 and ending around $2,700. Most prominently, Ethereum’s merge to proof-of-stake was delayed again, further postponing the transition that was initially slated for 2019. Ethereum core developer Tim Beiko confirmed the incremental delay, noting that Ethereum is “definitely in the final chapter of PoW” and that the merge will likely come a few months after June. Given the delay, Ethereum developers debated if a hardfork was necessary to push back or remove the difficulty bomb, a decision they held off on making in favor of continued shadow fork testing but this will be re-evaluated in the coming weeks. Positively, Ethereum’s first mainnet shadow fork went live during the month with developers deeming it a success. The next steps in the process now include more mainnet shadow forks, followed by forks of existing public testnets. It was also a big month for Ethereum layers 2s. Arbitrum released a major update called Nitro, intended to reduce fees by 50%, speed up transactions, and ease the integration process for Ethereum dapps. The codebase was open-sourced early in the month, they launched a permissionless devnet on Görli, and they ultimately aim to migrate Arbitrum One to the Nitro stack in time. Additionally, Optimism revealed that it will be forming a DAO and airdropping the Optimism (OP) token to early Optimism adopters and active Ethereum users. Unlike many prior airdrops, Optimism is only distributing a portion of the total airdrop supply initially, as it aims to deploy multiple rounds of airdrops in an attempt to incentivize new users to participate in the ecosystem in the future. Other notable headlines included Evmos launching its mainnet blockchain to allow Ethereum smart contracts and assets to be deployed in the Cosmos ecosystem, the Ethereum Foundation diversifying ~19% of its treasury into non-crypto assets, and key Ethereum node service provide Infura suffering an outage.

BTC and ETH

Source: Sansheets, GSR

Otherdeed, Moonbirds, & NFTs

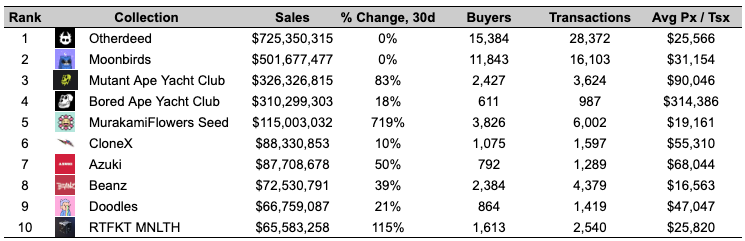

One major highlight of the month was the highly anticipated launch of BAYC-creator Yuga Labs’ Otherdeed for Otherside NFTs. The NFTs represent land in the Otherside virtual world, a metaverse gaming experience developed in partnership with Animoca Brands, Improbable, and others. All 55,000 Otherdeed NFTs quickly sold out and generated a record-breaking $317m in sales. Moreover, as the mint required 305 ApeCoin (APE) to purchase an Otherdeed, this, combined with other positives including OpenSea’s integration of APE and ApeDAO governance votes, helped catapult the APE token +42% during the month and made it the largest metaverse-related token by market cap. Despite the success, the Otherdeed mint did generate controversy, as Yuga failed to utilize a gas-optimized smart contract in the mint process, resulting in network congestion that cost users over $100m in gas (gas fees for failed transactions have since been refunded).

Otherdeeds wasn’t the only star project during the month, as Moonbirds took much of the spotlight earlier in April. Moonbirds is a utility-focused profile picture (PFP) collection of 10,000 pixelated owls. While reminiscent of other PFP releases, Moonbirds aims to provide utility by unlocking exclusive membership access for its holders, as well as additional benefits to holders that lock up their NFTs in a staking-like mechanism known as nesting. Each Moonbird cost 2.5 ETH to mint, but the secondary market floor price immediately jumped ~5x and the floor breached 38.5 ETH at its peak. In addition, Moonbird #2642 sold for a record 350 ETH, or about $1m, within the first week of the project’s launch. Similar to Otherdeeds, the Moonbirds mint also included controversy, with the COO of the project sweeping the floor for ~200 ETH worth of Moonbirds before announcing his departure from the project to start his own NFT venture fund. This caused some community members to allege that he acted on inside information.

While Otherdeeds and Moonbirds certainly stole the show in April, there were plenty of other notable events. These included: OpenSea’s long-anticipated Solana integration went live and the marketplace additionally rolled out direct credit card payments for NFTs through MoonPay; the highly anticipated Akutars NFT contract contained a bug that resulted in ~$34m of ETH being permanently locked; researchers found a security flaw within the Rarible NFT marketplace that could have drained a wallet’s cryptocurrencies and NFTs in a single transaction; a new NFT standard ERC721R adds trustless refunds to NFT smart contracts within a given refund period; 104 cryptopunks were posted as collateral for a record setting $8.3m NFT-backed loan; BAYC’s Instagram and Discord server were hacked, resulting in millions of dollars worth of NFTs being stolen via fraudulent links; a report indicated that 95% of LooksRare NFT trading volume is wash sales; Goldman Sachs revealed that it is exploring real-world tokenization with NFTs; Hedera Hashgraph launched a $250m metaverse fund; KuCoin launched a $100m NFT fund; Index Coop launched an NFT index fund; Coinbase launched the beta version of its NFT marketplace as well as an animated film series inspired by BAYC; Okcoin launched its own NFT marketplace; and, NFT avatar startup Genies raised at a $1bn valuation.

NFT Collection Rankings by Sales Volume, Last 30 Days, $m

Source: CryptoSlam!, GSR

Mining’s Notable Month

It was a busy month for crypto mining, a topic we have covered in depth including the miner’s role in the network, the inputs used to bring bitcoin to fruition, and the bitcoin mining business model. Companies were busy expanding operations during the month, punctuated by Riot’s announcement that it is developing a new one-gigawatt immersion facility in Navarro County to more than double its existing capacity. Hut 8 purchased all hosted rigs at its Medicine Hat facility to focus on self-mining. And Jack Dorsey’s Block partnered with Blockstream to develop a renewable mining facility leveraging Tesla’s solar and battery technology. Even ASIC manufacturers got into the mix with Intel, MicroBT, and Canaan each unveiling their next-generation mining rigs early in the month.

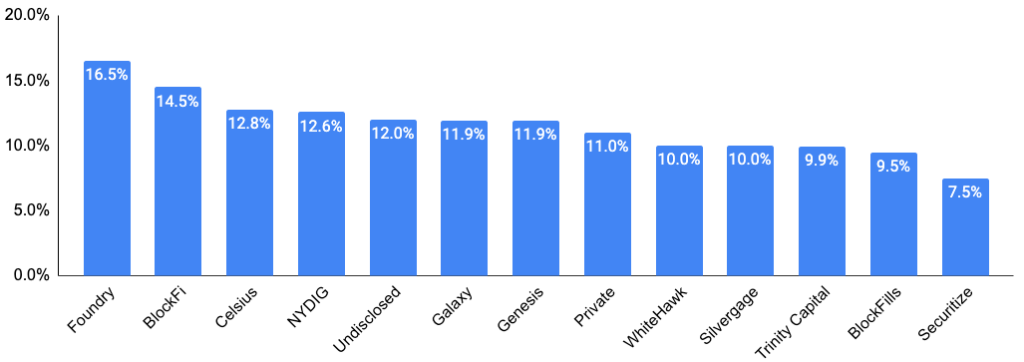

Miner financing continued to evolve throughout the month, with several miners raising capital through bitcoin or ASIC-backed loans. While the industry has traditionally relied on equity financing to expand operations, it appears lenders are more willing than ever to lend using bitcoin and/or rigs as collateral. Both Argo and CleanSpark took out loans during the month to finance the purchase of more ASICs, while Crusoe raised over $500m through a mix of equity and debt. In addition to these debt raises, both Bit Digital and Mawson Infrastructure Group issued shelf registrations providing them the flexibility to sell up to $500m of equity. Applied Blockchain also sold equity during the month as it completed its IPO on Nasdaq and PrimeBlock confirmed plans to go public via a SPAC. Overall, we believe continued progress diversifying funding will not only help miners optimize their capital stacks but also allow them to accelerate revenue growth.

Lastly, there was plenty of regulatory and environmental focus on the miners during the month. Most notably, the New York State Assembly passed a two-year Bitcoin mining moratorium. While the bill still requires approvals from the State Senate and Governor Hochul prior to becoming law, the bill would prevent miners that rely on carbon-based fuels from seeking new permits or renewals while an environmental study is conducted. Additionally, earlier in the month, Representative Huffman alongside other members of US Congress wrote a letter to the EPA requesting them to “evaluate proof-of-work mining facilities’ compliance with environmental statutes”, highlighting many environmental concerns about the mining industry. In early May, a consortium of crypto industry stakeholders wrote a detailed response letter to the EPA, rebutting the letter from Congress on a point-by-point basis.

Loan Yields to Bitcoin Miners by Lender

Source: The Block Research, GSR

Note: Collateral behind the loans is bitcoin, rigs or both; LTVs vary by lender but industry average is 70%.

Stablecoins & 4pool

Do Kwon, the co-founder of Terra, entered April with a bang by introducing the 4pool, a Curve liquidity pool comprised of USDT, USDC, UST, and FRAX. While 3pool is the deepest stablecoin liquidity pool today with ~$3.2b of depth amongst DAI, USDC, and USDT, Kwon revealed aspirations to put 4pool in the top spot. While this is no easy task given that volume typically accrues to pools with the deepest liquidity as this minimizes slippage, Terra formed an alliance with Frax, Redacted, Badger, Olympus, and Tokemak to leverage their Curve voting stake to incentivize liquidity to the newly created 4pool. The group also announced that it will direct emissions to other pools that pair against 4pool and not just 4pool itself, and also has the voting power to stop creation of pools that pair stablecoins versus 3pool. Please see our prior reports on the Curve wars, algorithmic stablecoins, and the Luna Foundation Guard for a deeper dive into these topics.

Finally, it was a busy month for stablecoin news beyond just 4pool, with major headlines including:

- The Neutrino Dollar (USDN), an algorithmic stablecoin pegged to the US dollar backed by the WAVES token, broke its peg

- Tron followed in Terra’s footsteps and revealed plans to launch an algo stablecoin called USDD with a 30% APY

- UST flipped BUSD to become the third-largest stablecoin by market cap

- Abracadabra Money, the protocol behind the Magic Internet Money stablecoin, revealed a new NFT-backed peer-to-peer lending market named AbraNFT

- FXS jumped as terra introduced the 4pool; FXS also went live on fantom

- Frax Finance revealed plans to expand the basket of assets backing its FRAX stablecoin to include other cryptocurrencies and real-world assets

- Volt protocol raised a $2m seed round to build an inflation resistant-stablecoin

- Credit-based algorithmic stablecoin protocol Beanstalk lost $182m in a flashloan attack, causing the token to fall 75% from its $1 peg

- Stripe revealed plans to let clients pay in USDC on Polygon

- USDT launched on Kusama

Authors: Matt Kunke, Junior Strategist, Brian Rudick, Senior Strategist

GSR In the News

- Blockworks – Latest in Crypto Hiring: Binance Recruits Former Regulators

- The Block – LimeWire raises $10 million in a private token sale to grow music-linked NFT platform

- BNN Bloomberg – DeFi Exchange Says It Beat Larger Rivals Binance, Coinbase

- CoinDesk – First Mover Americas: Bitcoin Out of Bullish Trend, Would Fed Backstop Markets Again?

- Nasdaq – This Emerging Markets Fund Could Surprise as Fed Boosts Rates

- Security Magazine – David Cass named President of CISOs Connect

- The Wall Street Journal – Cutting-Edge Crypto Coins Tout Stability. Critics Call Them Dangerous.

- TechCrunch – Masa Finance gets $3.5M pre-seed to build its decentralized credit protocol

- Yahoo! Finance – Bitcoin, Other Crypto Expected to Consolidate More After Fed Meeting

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.