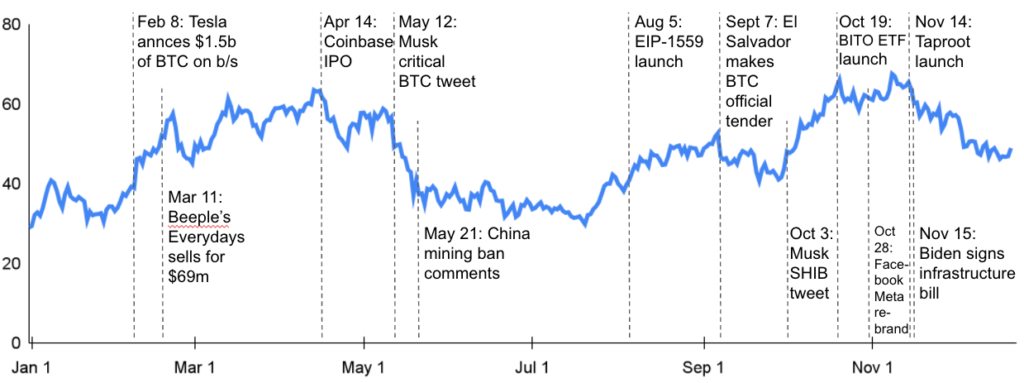

From a wave of institutional and corporate adoption to Bitcoin’s resilience following China’s mining exodus, BTC’s legal tender status in El Salvador, and record crypto trading volumes, NFT sales, DeFi TVL, and stablecoin market cap, 2021 was the year that made crypto impossible to ignore. We review the historic events that thrust crypto to new heights in this week’s Chart of the Week.

What a Year!

Building on foundations set over the years through crypto booms and winters and with continued tailwinds from the pandemic and related government assistance programs, 2021 was a historic year for Bitcoin and cryptocurrency more generally. From Tesla’s addition of BTC to its balance sheet, Beeple’s $69m NFT sale, Coinbase’s IPO, and El Salvador declaring BTC legal tender, cryptocurrencies entered a new level of cultural awareness and one that’s unlikely to reverse. By the numbers, the total crypto market cap has nearly tripled year-to-date, Bitcoin’s hash rate has doubled from its early-July bottom, venture capital crypto investment now totals more than all prior years combined, and crypto spot trading volume is up ~700% this year. In what follows, we highlight many of the largest items that helped to make 2021 perhaps crypto’s biggest year since 2009 when Satoshi mined the very first Bitcoin.

Corporate Adoption

On February 8th, Tesla announced it added $1.5b of BTC to its balance sheet and would accept Bitcoin as payment, an event that brought a new awareness to crypto from retail investors and corporations alike. Indeed, the crescendo of corporates looking to add products and services (and avoid being left behind) steadily grew louder, and included efforts from Mastercard, Visa, Verifone, PayPal, Twitter, State Street, BBVA, Citigroup, Bank of America, and Goldman Sachs, to name a few. Investment and asset management companies also got in on the act, with notable efforts from Robinhood, Revolut, Mass Mutual, Blackrock, Fidelity, Point72, Soros, and Brevan Howard, among many others. Several companies even changed their name partly to further emphasize their crypto focus, such as Square (now Block) and Facebook (now Meta). And with blockchain job postings up 600% since August 2020, per LinkedIn, the general corporate foray into crypto is unlikely to slow anytime soon.

China’s Bitcoin Mining Exodus

China’s Bitcoin mining clampdown began in March when Inner Mongolia published a proposal to ban mining activity to reduce energy consumption. More provincial authorities including in Xinjiang and Sichuan soon instituted restrictive measures, while China’s State Council published a statement calling for a larger ban in May. Notably, the ban in hydro-powered Sichuan suggested the clampdown extended beyond environmental concerns. As more provinces restricted mining and mining companies turned off their rigs, the Bitcoin network hash rate plummeted from 180m TH/s in May to 85m TH/s by the beginning of July, and estimates of China’s global hash rate share moved from over 50% to something closer to zero. By the time China again banned mining in September as part of a larger ban on crypto, miners had already relocated to friendlier geographies with inexpensive energy sources, such as Kazakhstan and the US, helping Bitcoin’s hash rate to steadily climb since its July bottom and hit a new record earlier this month. While a clear negative at the time – the price of BTC fell ~40% from May to July – the ordeal demonstrated the network’s robustness, removed a long-standing overhang, and is net positive for the environment.

BTC as Legal Tender

During the Bitcoin 2021 conference in Miami, El Salvador President Nayib Bukele announced that he would introduce legislation to make Bitcoin legal tender to help the unbanked. The law passed the Legislative Assembly in June, and BTC officially became legal tender in El Salvador on September 7th. Merchants are now required to accept BTC as payment, while citizens can enjoy zero capital gains taxes on BTC and make tax payments in BTC. The government also released its Chivo Bitcoin wallet, issued a Bitcoin bond, revealed plans for volcano-powered mining, and purchased additional BTC to bring its cumulative stash to 1,241 BTC. Other countries may now follow El Salvador’s monumental move, with legislators from Paraguay, Mexico, and Panama throwing their support behind the cryptocurrency.

Key Growth Sectors

Several key sectors within crypto saw record activity and awareness, which was quickly reflected in price. In fact, memecoins were up over 200x this year, per our custom category baskets, while the gaming, NFT, and smart contract categories also saw exceptional performance, up 80x, 37x, and 23x, respectively. Trends were fueled by:

- Meme Coins: Benefiting from Reddit-fueled meme stock trading early in the year as well as tweets from the self-proclaimed Dogefather Elon Musk, Dogecoin hit new heights in January and February, before going parabolic in April and May. In fact, Dogecoin reached an ATH of $0.73 in May in anticipation of Musk’s appearance on Saturday Night Live, after starting off the year at just $0.005. So popular was DOGE that Coinbase listed it in June, and it accounted for over 60% of Robinhood’s 2Q transaction revenue. Shiba Inu was the other standout memecoin, and while it similarly took off in May, it reached new heights in October after Elon Musk tweeted a photo of his Shiba Inu puppy. Dogecoin and Shiba Inu currently rank as the 12th and 13th largest cryptocurrencies by market cap, and their success has caused many other memecoins to rally, including Dogelon Mars, Baby DogeCoin, and Floki Inu, among others.

- GameFi: One of the biggest trends this year has been the rise of blockchain-based gaming, where blockchain technology enables gamers to own assets, expands developer revenue streams, allows for rich incentive schemes, and improves security, transparency, trust, traceability, and composability. Digital pet universe game Axie Infinity first put play-to-earn games in the spotlight in July when its daily user count and revenues broke out after it moved to its Ronin sidechain. Axie is now making upwards of $10m in daily revenue and boasts over 1m daily active users. More recently, other companies are garnering attention such as blockchain gaming platform Gala Games and open-world fantasy battle game Illuvium. Moreover, gaming has led the way for crypto venture investment, and both new corporations and traditional gaming studios are incorporating blockchain technology at a rapid clip.

- NFTs: If it wasn’t for so many other historic events, 2021 could easily have been called the year of the NFT. Indeed, NFT trading volumes are over $23b this year, corporate and venture investment has soared, and NFTs are now firmly planted in the cultural psyche. The first major catalyst for NFTs this year was the rise of NBA Top Shot’s collectible basketball “moments” in February, quickly followed by Beeple’s $69m sale of his Everydays NFT in March. Volumes ebbed and flowed, but reached new heights in August with exceptional sales from crypto antique CryptoPunks, degenerative art studio Art Blocks, member club Bored Ape Yacht Club, and play-to-earn game Axie Infinity. And spurred by Facebook’s rebranding to Meta, NFT metaverse land sales have taken off, as have blockchain domain names. Far beyond simple collectibles, the NFT space is rapidly innovating and is on its way to enabling new paradigms around content, ownership, value, and exchange.

- Layer Ones: Whether Ethereum would be the winner-take-all smart contract blockchain was a genuine question at the beginning of the year, though with activity percolating from Ethereum, the general consensus of a multi-chain world has emerged. Indeed, driven by speed and cost advantages, continued development progress (e.g. Cardano’s Alonzo hard fork, Terra’s Columbus-5 upgrade, Polkadot’s parachain launch), and rich ecosystem incentive programs (e.g. BSC’s $1b, Hedera’s 10.7b HBAR, Fantom’s 370 FTM, etc.), activity on competing chains is buzzing. Competing chains started off the year with just 3% of all DeFi TVL, but non-Ethereum TVL market share now stands at 38% today. The crypto stalwarts did make monumental progress of their own, with Bitcoin improving privacy and efficiency with its November Taproot upgrade and Ethereum overhauling network gas fees and introducing fee burns with its August EIP-1559 launch, but we are clearly headed for a multi-chain world.

- DeFi: DeFi activity has grown at a rapid pace, evidenced by total value locked increasing 14x from the start of the year. Active participants have grown as well, with Metamask monthly active users growing from less than 2m at the start of the year to 21m as of a month ago. And with continued innovations in DeFi, the future looks bright.

- Stablecoins: Despite a long-cemented trade facilitation role, given BTC volatility and clunky fiat to crypto conversion, stablecoin activity and usage really took off this year, with its total supply moving from $29b to over $150b currently. And while Tether still dominates despite questions on its backing, we saw continued adoption of USDC, strong growth from truly decentralized UST, and innovations like PCV-fueled FEI and yield-bearing collateralized MIM.

Regulatory Focus

2021 was also afoot with regulatory activity as governments took different tacks to stomp out crypto altogether or promote innovation. Notable regulatory items include:

- US: In the US, SEC Chair Gary Gensler was quite vocal, hinting that certain tokens may be securities, among many other topics discussed. Additionally, The President’s Working Group released its highly anticipated stablecoin report recommending requiring stablecoin issuers to be insured depository institutions. And in November, President Biden signed the $1.2T bipartisan infrastructure bill that contains controversial crypto transaction tax reporting requirements that some say may stifle innovation. More recently, a congressional hearing was surprisingly constructive, offering hope for the future.

- EU: In Europe, The European Council adopted its position on the Markets in Crypto Assets (MiCA) framework, allowing the Council and the European Parliament to enter into negotiations on the proposal before it is formally adopted as law.

- China: In addition to the mining ban discussed above, the PBOC told major banks and payment platforms to stop providing digital currency trading, clearing, and settlement services in June. In September, regulators banned all crypto transactions and mining activities and vowed to step up enforcement, in what is the most expansive ban yet.

- Other: The Financial Action Task Force updated its 2019 guidance, noting a lack of Travel Rule implementation and pushing for the adoption of crypto regulations around the world. Countries continued to make progress on CBDCs, with nine launched (Nigeria and eight Caribbean countries), 14 countries running pilots, 16 in development, and 40 conducting research. Many companies ran afoul of regulators, though Binance faced the most widespread condemnation with the countries around the world warning against or accusing it of operating illegally before the exchange instituted swift changes to its product offering, policies, and staff. Going forward, several countries are slated to introduce sizable crypto regulation over the near term, including India, Russia, Australia, South Korea, and Pakistan.

Record Investment

With exceptional price action and a general newfound appreciation of its promise, crypto has attracted record levels of investment this year. Case in point is the exceptional VC fundraising totaling over $30b this year alone, more than all prior years combined. This includes $700m-1b mega-rounds from NYDIG, FTX, Revolut, Forte, and DCG, over 60 additional funding rounds above $100m, and a growing herd of newly-minted crypto unicorns. The public markets have not been left out either, from Coinbase’s watershed IPO in April to various miners going public such as Hive and Argo to completed or planned SPACs involving companies such as Bakkt, eToro, Circle, and CompoSecure. And more direct BTC exposure was enabled in October through the historic approval of the first US Bitcoin ETF, with ProShares’ Bitcoin futures-based ETF having a resoundingly successful debut, setting a record for the highest natural first-day trading volume in US ETF history. While another crypto winter is inevitable, this level of awareness and adoption, talent migration, developmental progress, and investment is likely to fuel crypto for some time to come.

Exhibit 1: Major 2021 Cryptocurrency Events vs. BTC Price ($ thousands)

Source: Santiment, GSR

Author: Brian Rudick, Senior Strategist

This material is a product of the GSR Sales and Trading Department. It is not a product of a Research Department, not a research report, and not subject to all of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with your interests. The Firm trades instruments discussed in this material for its own account. The author may have consulted with the Firm’s traders and other personnel, who may have already traded based on the views expressed in this material, may trade contrary to the views expressed in this material, and may have positions in other instruments discussed herein. This material is intended only for institutional investors. Solely for purposes of the CFTC’s rules and to the extent this material discusses derivatives, this material is a solicitation for entering into a derivatives transaction and should not be considered to be a derivatives research report. This material is provided solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or comment (except as noted for CFTC purposes), or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. Information is based on sources considered to be reliable, but not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. GSR will not be liable whatsoever for any direct or consequential loss arising from the use of this Information. Copyright of this Information belongs to GSR. Neither this Information nor any copy thereof may be taken or rented or redistributed, directly or indirectly, without prior written permission of GSR. Not a solicitation to U.S. Entities or individuals for securities in any form. If you are such an entity, you must close this page.